Whoever is elected governor and to the Kansas House of Representatives this fall will face some very serious issues come January.

Kansas Policy Institute does not support or oppose candidates for public office, but we do provide educational information to the public about key economic and education issues facing Kansans. Our 2018 Voter Issue Guide is intended to arm readers with facts and key questions to consider so each reader can be better informed on the issues.

The five issues included were selected for their relative economic and educational importance to the future of Kansas, but are not listed in any particular order:

- Closing a $3.7 billion revenue shortfall over the next four years.

- Improving low student achievement levels.

- Getting schools to spend money more efficiently and effectively.

- Stopping four decades of economic stagnation.

- Amending the constitution to prevent courts from setting school funding levels.

This article provides an abbreviated look at the five issues, and each will be further explored in the coming weeks. The full 2018 Voter Issue Guide can also be downloaded here.

Want a quick look at all five issues?

Get our short, printable version here.

Closing a $3.7 billion revenue shortfall over the next four years

Calculations by Kansas Legislative Research Department show a $3.7 billion revenue shortfall exists over the next four years to pay for approved and proposed school funding increases if no money is taken from the highway fund, pension payments are made as scheduled and legally-required ending balances are maintained.

The shortfall includes a roughly $600 million income tax increase that will occur as a result of federal changes that eliminate personal exemptions and cap deductions for some people who itemize. School funding approved by previous legislatures generate a $2.1 billion shortfall and complying the latest court ruling would create a $940 million shortfall over the next four years.

The shortfall includes a roughly $600 million income tax increase that will occur as a result of federal changes that eliminate personal exemptions and cap deductions for some people who itemize. School funding approved by previous legislatures generate a $2.1 billion shortfall and complying the latest court ruling would create a $940 million shortfall over the next four years.

Legislators’ options to avoid a tax increase include (but are not limited to) ignoring the court’s call for an estimated $365 million additional funding, rolling back some of the planned school funding increases, requiring school districts and universities to use some of their excess cash reserves, reduce costs through the performance-based budgeting system and selling the right to collect future tobacco settlement funds.

Questions to Consider

- Should Kansans be subject to a back-door income tax increase due to federal tax law changes?

- Should any type of tax increase be imposed on Kansans?

- What specific actions should be undertaken to close a $3 billion revenue shortfall over the next four years resulting from school funding increases?

Improving Low Student Achievement Levels

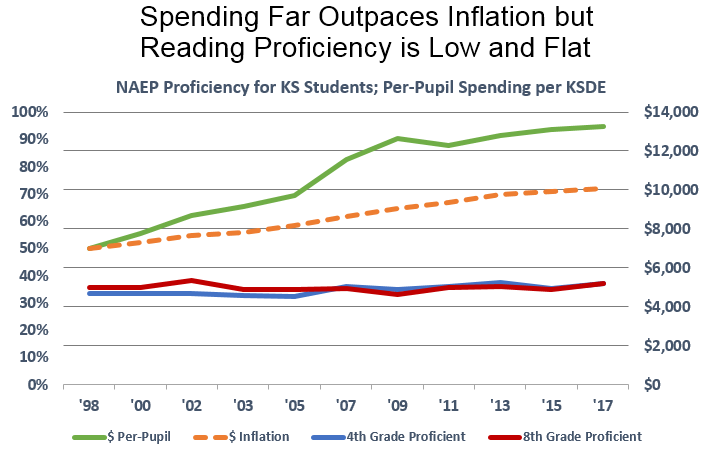

Contrary to claims by education officials, simply spending more money has not produced better achievement in Kansas or anywhere else. Reading proficiency levels on the National Assessment of Educational Progress (NAEP) went from just 35 percent to 37 percent over the last 19 years, while spending is 31 percent above inflation-adjusted levels. Kansas students’ average score on the ACT test is exactly where it was 20 years ago, and only 29 percent of those taking the test last year were considered college-ready in English, Reading, Math, and Science.

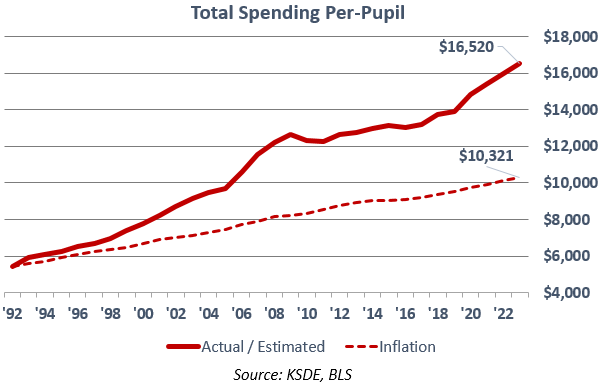

The Kansas Department of Education estimates complying with court rulings will push funding to $16,520 per-pupil in five years, even with no increase in federal aid and minimal gain in local funding; that’s more than $6,000 per-pupil above long-term inflation.

Questions to Consider

Questions to Consider

- Do you believe massive funding increases alone will cause achievement to improve?

- Should there be some student-focused consequence to schools that don’t improve achievement? For example, should low income kids in schools with average scores below grade-level be allowed to take their funding to another school of their choice?

Getting schools to spend money more efficiently and effectively

With 286 school districts averaging about 1,650 students per district, Kansas has a lot of redundancy in accounting, payroll, food service, transportation, human resources, purchasing, etc. The services need to be provided to every district but they could be much more efficiently provided through regional service centers, and the savings could be used to improve instruction and teacher pay.

Getting a larger portion of spending dedicated to Instruction (defined as direct interaction between students and teachers by the Department of Education) is one way of improving effectiveness. In the 2005 school year, local school boards allocated about 54 percent of all spending to Instruction; it declined to 53 percent by the 2017 school year.

Questions to Consider

- A recent survey found 89 percent of voters believe spending on out-of-the-classroom costs (administration, building operations, transportation, etc.) should be provided more efficiently on a regionalized basis, with the savings put into classrooms. Is this a good idea?

- Do you believe school districts should be required to allocate a certain percentage of total funding to Instruction?

Stopping four decades of economic stagnation

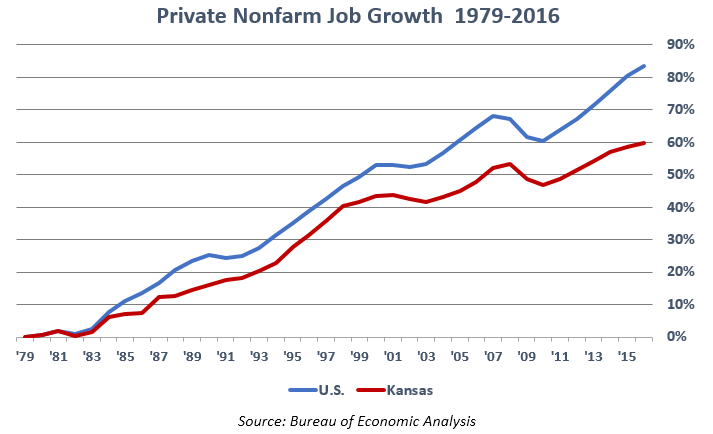

Kansas is in its fourth consecutive decade of economic stagnation and is falling farther behind the nation in jobs and economic growth. Private sector Gross Domestic Product (GDP) began lagging the nation in the late 1980s and the gap rapidly widened in the 2000s.

Private nonfarm job growth has followed a similar pattern. 2017 data has not been published by the Bureau of Economic Analysis at this writing, but preliminary information indicates Kansas fell a little farther behind.

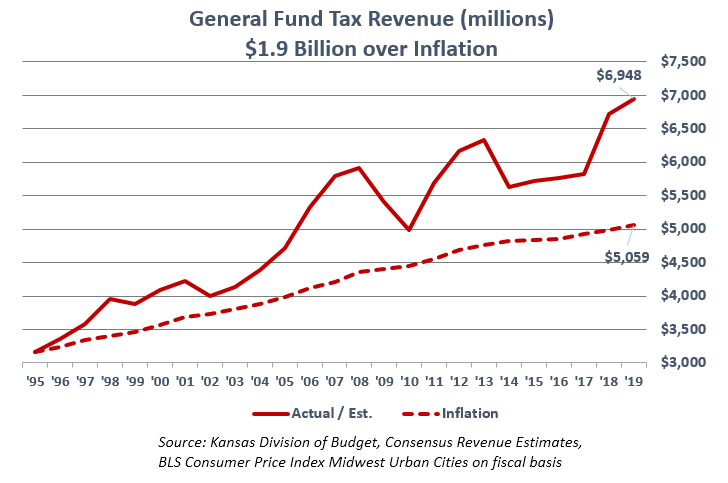

Not coincidentally, state tax collections have far outpaced inflation since 1995. The most current government estimate shows tax collections of $6.95 billion for the current fiscal year will be $1.9 billion higher than the inflation-adjusted level since 1995. That out-sized tax growth was used to pay for spending that’s also running close far above long term inflation, but as explained earlier, there is still a $3.7 billion revenue shortfall over the next four years due to a huge education spending increase.

Not coincidentally, state tax collections have far outpaced inflation since 1995. The most current government estimate shows tax collections of $6.95 billion for the current fiscal year will be $1.9 billion higher than the inflation-adjusted level since 1995. That out-sized tax growth was used to pay for spending that’s also running close far above long term inflation, but as explained earlier, there is still a $3.7 billion revenue shortfall over the next four years due to a huge education spending increase.

Some degree of taxation is necessary but taxes always have a net negative effect on economic growth; like any other cost increase incurred by people and business, a tax increase leaves less money to grow the private sector economy.

Some degree of taxation is necessary but taxes always have a net negative effect on economic growth; like any other cost increase incurred by people and business, a tax increase leaves less money to grow the private sector economy.

Questions to Consider

- Politicians love to call for more ‘investment’ in pet projects, but every dollar ‘invested’ must first be extracted from taxpayers. Should new ‘investments’ be paid for with tax increases, or by reducing other spending?

- Should state and local regulatory restrictions and ‘red tape’ be modified to make it easier to open and operate a business?

Amending the constitution to prevent courts from setting school funding levels

The Kansas Supreme Court’s latest ruling that a six-year, $854-million funding increase is inadequate has renewed talk of amending the constitution. Separation of powers is fundamental to our constitutional republic, and the Kansas Supreme Court itself has made two critical findings that explain why courts cannot set funding levels.

Its 1994 ruling in USD 229 v. State of Kansas declared that “suitable provision for finance” in the Kansas constitution does not refer to a level of funding, but to a system of finance which, as stipulated in the constitution, may not include tuition. “Adequate” isn’t part of the constitutional language on education; that adjective was created by courts.

And in 2015, the court found the Legislature’s attempt to allow local judges to elect their own chief judge unconstitutional. The court said the Legislature violated the court’s constitutional authority and quite emphatically said it is the duty of the judicial, legislative and executive branches “… to abstain from, and to oppose, encroachments… ” on their authority.

Since the Kansas constitution vests authority to spend money solely with the Legislature and the 1994 court said the constitutional meaning of “suitable” doesn’t reference a level of funding, those proposing a constitutional amendment believe they are honoring the system of checks and balances and upholding the rule of law and constitutional intent.

Finally, even if the Legislature adds more money and satisfies the court on adequacy, it’s just a matter of when the next lawsuit is filed. The Legislature’s cost study with its $2 billion recommendation is a ticking time bomb, and school attorneys won’t hesitate to exploit it.

Questions to Consider

- Do you believe courts or elected legislators should establish school funding levels?

- Should the constitution be amended to stipulate that courts have no authority to determine whether school funding is adequate or whether it should be increased?

- Do you believe taxpayer money should be used to sue the state or the legislature for more money?