Note: Since the undertaking of this at-risk project, the school funding formula has changed to what’s commonly referenced as the block grant system. At-risk funding as a distinct pot of money technically has expired although the money still goes to the schools. The block grant approach is scheduled to sunset after the next two years when the legislature rolls out a new funding formula. It is highly likely at-risk funding will re-emerge in some form. This blog describes the at-risk program status immediately prior to the change in the law.

In the first two blogs I detailed what at-risk funding is and the philosophy/research/politics behind the justification for additional funding to adequately educate low-income students. In this blog I will describe the history of at-risk funding in the Sunflower State and how it is we are where we are today.

Although Article 6 of the Kansas constitution gives the responsibility for funding public education to the state legislature, which would include the at-risk program, the force behind the present level of state education funding came from the judicial branch. In particular, two court cases have shaped the current state of the Kansas at-risk program.

Mock v. State of Kansas (1991)

This case challenged the constitutionality of the existing school funding formula – the 1973 School District Equalization Act. Without getting into the depths of the opinion, Judge Terry Bullock’s ruling included a directive to spend more money on those “pupils of low socioeconomic status (who) need compensatory education to offset the natural disadvantages of their environment.” Judge Bullock’s decision spawned at-risk funding as part of the new education finance law in 1992 – the School District Finance and Quality Performance Act (SDFQPA).

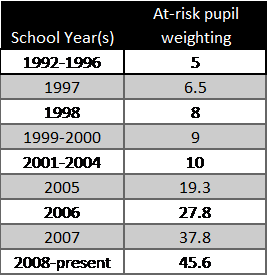

Beginning in 1992 a 5% weighting over and above base state aid per pupil (BSAPP) was provided for each student who qualified for a free lunch under the Department of Agriculture’s National School Lunch Program (NSLP). In the first year of the new law approximately 72,000 (16.8%) Kansas students qualified for at-risk funding, generating just over $13 million. The weighting stayed at 5% until the 1997-98 school year, when it was increased to 6.5%. By the 2001-02 school year, the weighting had increased to 10% (with 1% targeted toward 3rd grade mastery reading). It remained at that level for four years. By the 2004-05 school year, about 135,000 students state-wide (30%) were receiving free lunch which generated about $52 million in at-risk money.

Then came the next court case.

Montoy v. State of Kansas (1999 – 2006)

The SDFQPA faced a legal challenge beginning in 1999 which worked its way through the court system until fully resolved in 2006. Much has been written and discussed about the Montoy decision and the profound impact it has had on education financing in Kansas, including where the state currently stands with regard to at-risk funding.

The starting point of this progression began in 2001. The legislature commissioned the firm of Augenblick & Myers (A&M) to do a cost study analysis of providing an adequate education to the students of Kansas. The study was supposed to be based on efficiency, but A&M deliberately deviated from their methodology to produce inflated numbers. In its final analysis, A&M recommended an increase of a minimum of $773 million to suitably fund public K-12 education.

The legislature attempted to preempt Supreme Court intrusion by expanding the pot by $141.1 million in 2005, which included an increase in the at-risk weighting from .10 to .193. Additionally, the legislature directed Legislative Post Audit (LPA) to “conduct a professional cost study analysis to determine the costs of delivering the kindergarten and grades one through 12 curriculum, related services, and other programs mandated by State statute in accredited schools.” The LPA study, presented in January 2006, recommended an additional $316 million using an input-based approach or an increase of $399 million using an output-based approach. These recommendations notwithstanding, LPA specified the findings were made to help the legislature decide “appropriate funding levels” and that the recommendations weren’t “intended to dictate any specific funding level, and shouldn’t be viewed that way.”

Ultimately, the court used the A&M study and made the unprecedented decision of ordering the legislature to increase school funding by $853 million (adjusting the A&M findings for inflation). Note: former KPI scholar and current Supreme Court Justice Caleb Stegall describes in detail the methodological shortcomings of both the A&M and LPA studies in “Analysis of Montoy vs. State of Kansas.”

Although the Court did not specifically address particular funding categories, such as at-risk, much of its opinion addressed their concerns with the various student weightings, including at-risk. The Court concluded that the current weightings (.193 for at-risk) did not reflect an actual cost basis, but were rather increased merely as a “good faith effort toward compliance.”

The legislature responded to the court order by significantly increasing the at-risk weighting, but there is no evidence it was done on an actual cost basis, as referenced by the Supreme Court. That conclusion is based upon a review of the two cost studies.

Cost basis for at-risk funding – two viewpoints.

Augenblick & Myers. The A&M study included a method to calculate the additional cost of serving at-risk students. It differed from the existing weighting system because A&M considered the size of school a function of the cost, while the current system weighted students the same regardless of school size. A&M created a sliding formula giving the students attending the state’s smallest schools a weighting of .20, while students at the largest schools were weighted at .60, employing an assumption that it is more expensive to educate at-risk students in the larger schools.

Legislative Post Audit (LPA). LPA’s cost model changed the current weighting (2005) from .193 to .484. They also created a new at-risk category called “Urban Poverty” with an additional weighting of .726 to the four districts of Kansas City (USD 500), Kansas City-Turner (USD 202), Topeka (USD 501), and Wichita (USD 259) citing “significantly higher costs incurred in high-poverty, inner-city school districts” that experience “a variety of more serious social problems including drugs and violent crime.”

The legislature’s response.

The legislature complied with the Court, phasing in the directive over a three-year period. Although they satisfied the $853 million order the Court based on the A&M report, the legislature did not utilize the A&M at-risk method. A review of committee meeting minutes and various documents/plans that were proposed to increase at-risk dollars during the 2006 legislative session did not reveal any discussion of using an “A&M-style” sliding scale or any cost-based funding scheme. The legislative compromise forged a new funding formula that included elevating the at-risk weighting to .278 in 2006-07, .378 in 2007-08, and .456 beginning in 2008-09. The legislature also created a compound category called “high-density at-risk” that gave additional weighting to students in some districts based in factoring a high rate of at-risk students and the per-square mile density of the student population. See this pdf for the exact definition. (Also the new law established a small at-risk category for those who were not eligible for free lunch but were not proficient on state assessments. This category was eliminated in 2014.)

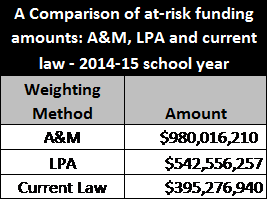

The adjoining table shows how much more it would have cost the state, had the legislature chosen either cost study. This year alone, the A&M approach is almost a half billion dollars more than current level. The LPA method would have cost taxpayers nearly $150 million in increased at-risk spending.

The following table summarizes the at-risk weighting percentages by year since its inception in 1992.

Please note that since 2001, a weighting of 1.0 is dedicated to mastery of 3rd grade reading skills and these weightings since 2006 do not include the high-density category(ies).

So, this is where we are and how we got there.

Up next: A review of how schools districts spend at-risk money.