There are two big reasons that the flat tax proposal is better for taxpayers than Gov. Kelly’s plan.

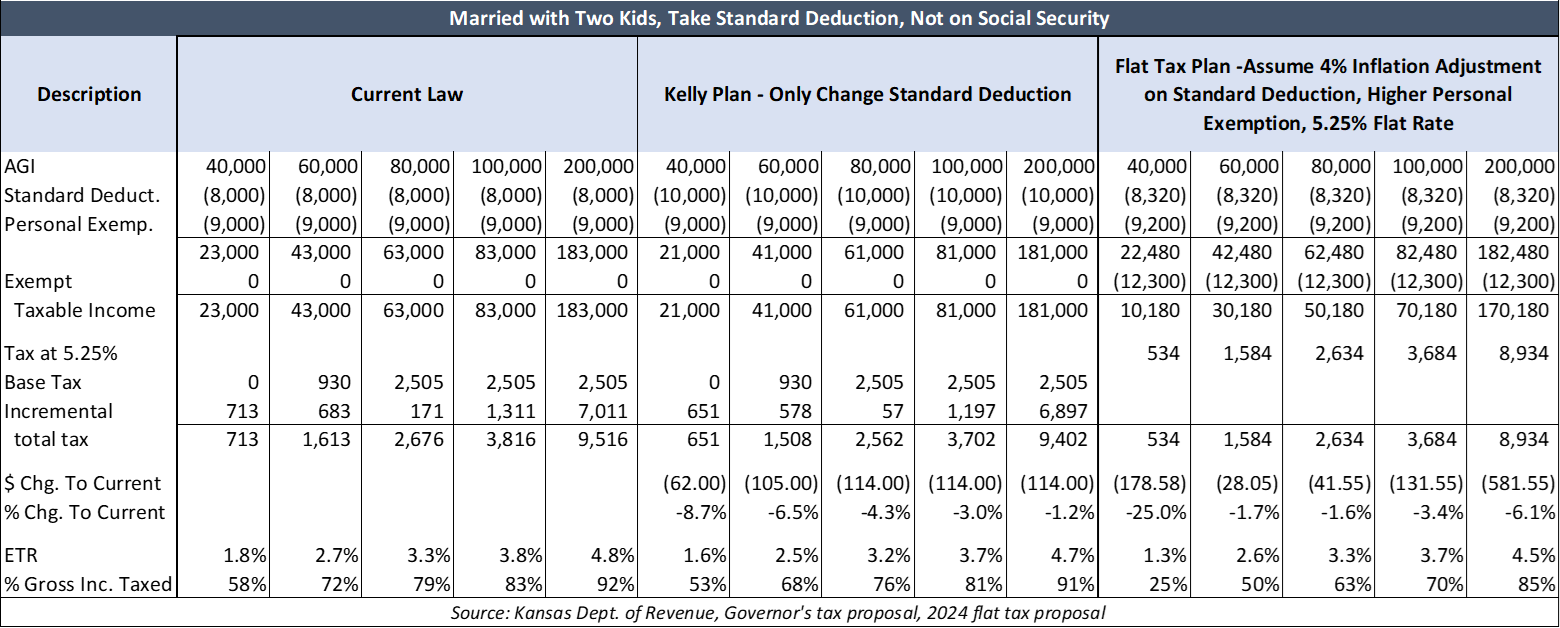

A week into the 2024 Legislative session, the two largest tax relief proposals of the year have been announced. Governor Laura Kelly’s plan increases the standard deduction but keeps the tiered rate system that tops out at 5.7%. The House and Senate Leadership plan doesn’t immediately increase the standard deduction but raises it for inflationary increases, provides a larger personal deduction and exempts the first $6,150 single / $12,300 married from taxation and a flat rate of 5.25% on taxable income.

Both proposals reduce residential property taxes and eliminate the state sales tax on food and the state income tax on Social Security.

The flat tax proposal is better for taxpayers than Kelly’s plan for several reasons:

- Lower-income families save more money.

- Dropping the top rate from 5.7% to 5.25% makes Kansas more competitive with other states.

Also, all taxpayers save money compared to the current system.

Lower-income families save more money

The above table models a married couple with two kids taking the standard deduction and not on Social Security at several income levels Under current law, a couple with an adjusted gross income (AGI) of $40,000 has a taxable income of $23,000 and pays $713 in income taxes. Kelly’s proposal with the standard deduction would save this couple $62. That family saves $179 with the flat tax proposal, however.

The biggest difference comes from exempting the first $12,300 from taxation. That change also means a family of four with AGI of $29,820 would pay no tax, but they would pay $335 under Kelly’s plan.

Kansas is more competitive with a 5.25% flat tax

According to the Tax Foundation, fourteen states have individual income tax rate reductions taking effect in 2024: Arkansas, Connecticut, Georgia, Indiana, Iowa, Kentucky, Mississippi, Missouri, Montana, Nebraska, New Hampshire (interest and dividends income only), North Carolina, Ohio, and South Carolina. Two states—Ohio and Montana—will consolidate some tax brackets, and one state, Georgia, will move to a flat tax.

States with lower income taxes have superior economic growth, and that is desperately needed in Kansas. Private-sector job growth in Kansas was ranked #44 between 1998 and 2022. Last year, jobs grew by just 0.6% through November, which is only one-third of the national average.

Kansas can afford tax the flat tax proposal

Governor Kelly’s claim that the flat tax will result in large budget deficits is not true.

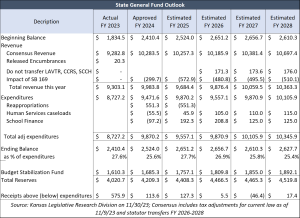

Analysis by Kansas Legislative Research shows the state would still have a $4.5 billion surplus after three years of flat tax Kelly vetoed in Senate Bill 169.

SB 169 was expected to save about $1.5 billion in its first three full years, whereas Gov. Kelly says her plan would save about $1 billion. The cost of the new flat tax plan could be more than the original because of the increase in the standard deduction, but the state would still have a surplus of about $4 billion.

Editor’s note: the original version of this column used the wrong standard deduction under the flat tax plan and, therefore, showed slightly higher tax savings.