Articles Filtered By:

Tax & Spending

High Tax-State Exodus: Kansas Feels the Impact

July 22, 2024

KPI & Show-Me Institute Oppose Stadium Bidding War

June 17, 2024

Economic growth is a marathon, not a sprint

May 28, 2024

2023 Kansas payrolls: $2.48 billion

May 13, 2024

Kelly vetoes tax reform amidst steady budget estimates

April 25, 2024

Kansas Policy Institute welcomes new talent

April 22, 2024

What’s going on with the federal Farm Bill?

April 15, 2024Kansas ranks 41st for private-sector jobs since 1998

April 1, 2024

Kansas has highest rural property taxes

March 25, 2024

New flat tax bill offers relief across all incomes

March 15, 2024

Regulatory sandbox bill would help entrepreneurs succeed

March 11, 2024

What does effective tax relief look like?

March 4, 2024

Integra’s $2.9 billion facility and its taxpayer subsidies

February 26, 2024

Recent revenue estimates shouldn’t deny tax relief

February 19, 2024

KPI Releases 2025 Responsible Kansas Budget

February 5, 2024

Responsible budgeting key to tax reform

January 29, 2024

Legislature should call Governor Kelly’s tax relief bluff

January 15, 2024

Kansas’s short-run GDP growth versus long-run stagnation

January 8, 2024

A snapshot of the 2025 Responsible Kansas Budget

January 2, 2024

Five reasons for tax reform in 2024

December 26, 2023

Property taxes highlight a need to operate effectively

December 15, 2023

Five ways Kansas can responsibly cut taxes

December 11, 2023

The flat tax through the lens of Iowa’s success story

November 21, 2023

Democrats propose 11% property tax hike on farms, other businesses

November 20, 2023Examining four regulations on Kansas’s books

November 13, 2023Integra megaproject shaping up to be another Panasonic flop

November 6, 2023

Kansas flounders as other states shore up their tax climate

October 30, 2023$2.3 billion in 2023 school payrolls available

October 23, 2023

Promoting economic opportunity through regulatory sandboxes

October 13, 2023

What does the Farm Bill’s lapse mean for Kansas?

October 9, 2023

Medicaid expansion is wrong for Kansas

September 26, 2023Kansas still swimming in excess revenue

September 11, 2023

Counties push false narratives in demand for LAVTR tax subsidy

September 11, 2023Steps to vaporize Kansas’s regulatory burden

September 2, 2023

Kansas losing the race for private-sector job growth

August 24, 2023

Kansans’ migration across the state isn’t a one way trip

August 21, 2023

Kansas budget a record $23.8 billion this year

July 21, 2023

Price tag on Kansas’s Panasonic scheme ticks higher

July 17, 2023

Transparency in prices could reduce medical costs

June 26, 2023

Film subsidies are a box office flop

June 15, 2023Over 3,700 KPERS Millionaires in 2022

June 2, 20232022 Kansas Payrolls: $2.36 billion

May 16, 2023Kansas slips into second straight month of job loss

April 28, 2023

Governor Kelly vetoes tax relief amidst budget surplus

April 24, 2023

Bill prohibiting state investment in ESG moves forward

April 14, 2023

Kansas ranks 38th nationwide for earnings growth

April 10, 2023

Kansas conference week round-up

April 7, 2023

3 ways Truth in Taxation empowers taxpayers

March 28, 2023

ESG-related bills stir discussion in Kansas

March 21, 2023

2023 Green Book: Kansas stagnates while others grow

March 6, 2023

Tax relief going forward in the Kansas Legislature

February 27, 2023

Kansas continues to see more out migration than in

February 20, 2023

What is a Flat Tax?

February 13, 2023Small businesses pay for ineffective megasubsidies

February 7, 2023

What does ESG mean for Kansas?

February 6, 2023

Lights, camera, please no action on film subsidies

January 23, 2023

Kelly’s budget a malaise of meager tax cuts and hidden spending

January 16, 2023

The 2024 Responsible Kansas Budget

January 3, 2023

Debunking 6 Myths About a Flat Tax

December 27, 2022

Four Reasons for a Flat Tax

December 12, 2022Declining economic indicators show need for tax relief in Kansas

December 2, 2022Viva la Flat Tax Revolution!

November 23, 2022

Kansas keeps getting duped by economic development schemes

November 9, 2022Inaccurate revenue estimates aren’t a sign for more spending

November 1, 2022

Kansas needs more accurate tax revenue estimates

October 24, 2022

Fewer government workers gives Kansans room to grow

October 21, 2022

Big revenues don’t excuse big government spending

October 4, 2022Stagnation continues in the Kansas economy with tax & spend mentality

September 29, 2022

Miller / Amyx property tax plan busts the budget in its first full year

September 27, 2022

State responses to Biden student loan decision

September 26, 2022

Unspoken reality gets bigger as Kansas jobs shrink

September 16, 2022

Kelly administration has $1.2 billion in unspent ARPA COVID-relief funds

September 12, 2022

What does “dark store theory” debate mean for Kansas property taxes?

September 6, 202225 months of excessive revenue continue decades of stagnation

September 1, 2022

Combating inflation at the state level

August 29, 2022Kansas still 19,500 jobs below pre-pandemic levels

August 19, 2022

Topeka relocation subsidy isn’t working

August 10, 2022

Excess tax collections are not good for taxpayers

August 4, 2022

Saving Billions in Kansas Government Budgets

July 18, 2022Think Long-Term Relief with FY 2022 Tax Revenue

July 6, 2022

Older Residents Leave Kansas For Low-Tax States

June 27, 2022

Cheap, Clean Energy Isn’t An Oxymoron

June 20, 2022

Tracking Kansas ARPA Funds

June 13, 2022

2022 Green Book: Spend Less, Tax Less, Grow More

May 31, 20222021 Kansas Payrolls: $2.26 billion

May 13, 2022

Time’s Not Yet Up for More Kansan Tax Relief

May 11, 2022

Turn Short-Term Surpluses Into Long-Term Tax Relief

April 25, 2022

Kelly’s Tax Council proposes higher taxes, more spending

April 20, 2022

March 2022 Kansas Job Stagnation

April 15, 2022

What Savings Do Kansans Get With HB 2239?

April 7, 2022Simple Tax Reform Goes a Long Way

March 24, 2022

January 2022 Report Shows Job Growth in Kansas

March 11, 2022

Thinking Responsibly About the Kansas Budget

March 10, 2022

Kansas Film Subsidies would be a Blockbuster-Sized Mess

February 28, 2022

What’s Causing Kansas Inflation?

February 21, 2022Rethinking Regulatory Oversight with SCR 1618

February 16, 2022Ideas for ARPA and Kansas Revenue Cash Pile

February 9, 2022

Mega subsidy: budget deficits, no tax cuts for people

February 8, 2022Streamlining State Regulations

February 4, 2022

Tax Revenue Highs Continue into January 2022

February 2, 2022Zoning Reform, Not Subsidies, Reduces Housing Costs

January 31, 2022

SB 347: The Mother of All Subsidies

January 25, 2022Governor Kelly Proposes $2.3 Billion in Budget Changes

January 18, 2022

2022 State of the State…With a Grain of Salt

January 13, 2022

A Responsible Kansas Budget

January 10, 2022Entrepreneurship Resources in Kansas

January 7, 2022

High Tax Revenue Continues into December 2021

January 4, 2022Kansas Needs Long-Term Rate Reductions, Not Election Year Rebates

December 30, 2021

How Free is Kansas in 2021?

December 28, 2021

Oracle’s Acquisition of Cerner Signals Issues with Kansas Subsidies

December 22, 2021

November 2021 Jobs: Slow Pandemic Recovery Continues

December 17, 2021

Reforming Zoning Laws Reduces Housing Costs

December 15, 2021Achievement gaps persist despite KSDE claims

December 13, 2021Subsidies Do Not Equal Economic Growth in Kansas

December 9, 2021

Expanding Broadband Access in Kansas

December 3, 2021

Don’t Expand Government Through November Tax Revenue Surplus

December 1, 2021

Cutting Red Tape in Kansas

November 23, 2021

October 2021 Jobs: Slow Growth Amidst High Inflation

November 19, 2021Don’t Let High Inflation Hurt Taxpayers Through Bracket Creep

November 15, 2021Cut Wasteful Spending to Eliminate the Food Sales Tax

November 10, 2021

Solutions to Kansas’ High Property Taxes

November 8, 2021October Tax Surplus Invites Reform to Prevent Over-Taxation

November 2, 2021What is the government’s fair share of what you earn?

October 29, 2021

Land Banks Fail to Solve Government-Created Living Costs

October 25, 2021

September 2021 Jobs Report: Growth on the Horizon?

October 22, 2021

Use Excess Revenues for Tax Relief, Not More Spending

October 7, 2021

3 things to know about Truth in Taxation

October 1, 2021

August Jobs Numbers Show Slow Growth for Kansas

September 30, 2021

Helping Kansans by Rethinking Taxes Around Remote Work

September 24, 2021

Tax Expenditure Limits Prevent Government’s Balancing Act

September 17, 2021Share COVID Relief Funds with Taxpayers Instead of Expanding Government

September 13, 2021

Tax Ideas for the 2022 Kansas Legislative Session

August 31, 2021

Kansas Businesses Would Thrive in a Regulatory Sandbox

August 23, 2021

Cerner’s Kansas Move Represents the Issues of STAR Bonds

August 13, 2021

2022 Lawrence Budget: Misdirection and Runaway Spending

August 10, 2021

2021 Green Book: Kansas is massively over-governed

June 12, 2021

Kansas lost private-sector jobs in April

June 1, 2021Kelly admin consciously deceived legislators, taxpayers

April 30, 2021

PRO Act is another Biden middle class tax increase

April 30, 2021

Truth in Taxation is a model for legislative change

April 26, 2021KDOR Misleads Lawmakers to Justify Kelly Tax Relief Veto

April 19, 2021

Gov. Kelly signs property tax transparency bill

March 31, 2021Federal taxpayer bailout eclipses local payroll changes

March 29, 2021

Lockdown effect means 57,000 fewer private jobs

March 15, 2021

Localities need belt-tightening, not a bailout

March 5, 2021

COVID pandemic creates opportunities for tax relief

February 28, 2021

The real cost of Government “free stuff”

February 25, 2021

State treasurers deceive Congress on city, state bailouts

February 22, 2021

Kansas RELIEF Act can spur COVID Recovery

February 15, 2021Kansas Labor Dept. over-reports COVID job growth

February 3, 2021

Kelly blames others for poor COVID vaccine strategy

January 25, 2021

Kelly’s budget raises taxes during recession

January 14, 2021

2021 Legislator Briefing Book also has good value for taxpayers

January 14, 2021

Cities, counties keep expanding the property tax honesty gap

January 9, 2021A Kansas Budget for Economic Growth & COVID Protection

January 4, 2021

MoneyWise: Kansas 3rd worst state for taxing retirees

December 17, 2020

An Open Letter to County Commissioners About COVID Mandates

November 23, 2020

Legislature could turn incoming fiscal shortfall into savings

November 18, 2020Reversing years of Kansas fiscal mismanagement

November 9, 2020

Mask mandate made unnecessary as Kansans mask-up voluntarily

October 28, 2020

In one month, 25,000 Kansans quit job hunting

October 21, 2020

Gov. Kelly’s COVID testing strategy won’t end restrictions

October 12, 2020

It’s Official: Lockdown made Kansans poorer

October 7, 2020Kansans’ earnings growth near the worst in the Plains

September 25, 2020August jobs report says no Kansas full recovery until 2021

September 22, 2020

Federal bailouts of state budgets hasten fiscal disaster

September 16, 2020Small businesses re-plummet despite state economic planning

September 8, 2020

Kansas recovery stalls three months after lockdown

September 1, 2020

Wichita’s Key STAR Bonds Didn’t Create New Jobs

August 31, 2020

STAR Bonds redirect jobs, not create them

August 28, 2020Gov. Kelly plays politics with federal unemployment relief

August 24, 2020

KC Star pushes faux ‘science’ to defend Democratic governor

August 14, 2020County Budgets Review: Bringing Savings to Families

August 6, 2020

Unemployed Kansans surpass no-lockdown states

July 28, 2020

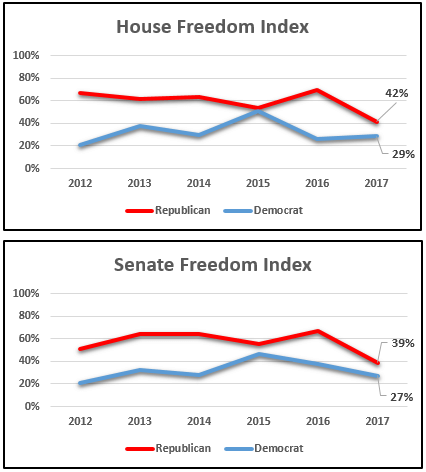

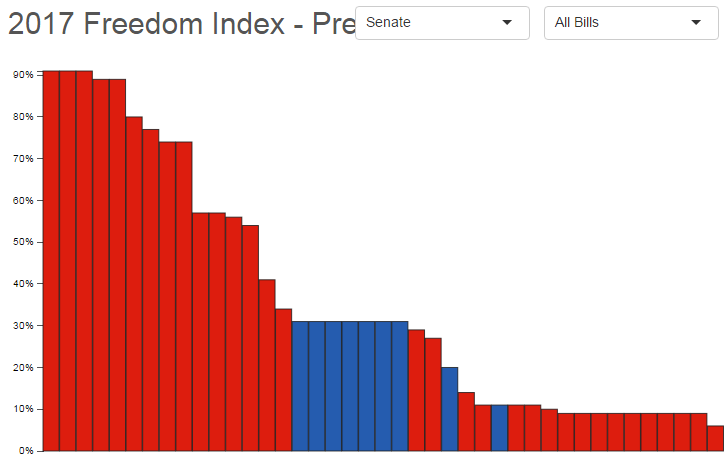

2020 Kansas Freedom Index

June 26, 2020

Use the special session to support taxpayers

June 2, 2020

2019 state payroll: $2.17 billion, up 5%

May 19, 2020

Press Release: Time to help our businesses recover

April 30, 2020

Post-COVID Recovery Plan

April 13, 2020COVID-19: prepare for large state budget deficits

April 9, 2020

COVID-19: local government should cut property taxes

April 6, 2020Government policy Kansans need to combat COVID-19

March 23, 2020

Coronavirus reactions must be balanced, thoughtful

March 23, 2020

It depends on what you choose to see

March 17, 2020Kansas 2019 Private Jobs Grows Slower Than Expected

March 16, 2020

Local government hiked property tax 3X inflation in 2019

March 16, 2020Kansas media spins job growth

March 2, 2020STAR Bonds taint Kansas’s role as a referee

February 20, 2020

Many city and county officials don’t trust taxpayers

February 10, 2020Lawmakers can serve Kansans without Medicaid Expansion

February 10, 2020

5 things you need to know about property taxes in Kansas

February 6, 2020

Gov. Kelly’s 2020 budget: Five things you should know

January 20, 2020Property tax hikes are proof of an honesty gap

January 13, 2020Views of individual Kansans clear in new poll

January 7, 2020County economies among the slowest in the nation

December 30, 2019Gov. Kelly promotes flawed “Three-Legged Stool” tax policy

December 10, 2019Kansas economy ranks 49th as government grows

November 26, 2019

Will thousands more Kansans fall into the 2020 windfall veto trap?

November 18, 2019Income inequality is about choice not “fairness”

October 16, 2019

Kansas deficit-spends into a billion dollar hole

October 10, 2019

Kansas out-migration creates U-Haul shortages

October 2, 2019

Gov. Kelly’s tax council on track to income redistribution

September 26, 2019

The truth about county spending; there’s room to cut

September 23, 2019Will Gov. Kelly’s tax council reward government over families?

September 12, 2019

Local government property tax data shows opportunity for savings

September 10, 2019Poor feel the bite of Gov. Kelly’s windfall veto

September 3, 2019

Budget deficit remains as recession fears grow

August 26, 2019Kansas Tax Increase Unfairly Burdens The Poor

August 12, 2019Three Signs of Kansas Government Growth

July 11, 2019“Hope” Leads to Work & Opportunity

June 24, 2019

$1.2 billion city and county payrolls online

June 9, 2019More State Funding Won’t Stop Tuition Hikes

May 28, 2019New county data underscores struggling Kansas economy

March 25, 2019Solving the Kansas Budget Crisis

March 7, 2019Kansas’s Spending Problem Makes Tax Increases Unavoidable

February 27, 2019It’s Official: Governor’s Budget Sets Up A $1.3 Billion Tax Increase

February 19, 2019Are Kansans Preparing For More Tax Increases?

February 8, 2019No Oversight for Kansas Discretionary Spending

February 5, 2019Medicaid Expansion Attracts Tax & Spend Philosophy

February 4, 2019Will Medicaid expansion save rural hospitals from closing?

January 29, 2019Governor’s Budget is Not Structurally Balanced

January 22, 20192019 Legislator’s Budget Guide: Reversing The Kansas Exodus

January 4, 20192019 Legislator’s Budget Guide: Economic Development Needs Reform

December 19, 2018

Creating a better economy for Kansas

December 17, 2018

What can we expect with new leadership in Kansas?

December 10, 2018

What was Really the Matter with the Kansas Tax Plan?

December 4, 2018November FY 2019: Sales Tax Stalls For Five Straight Months

December 3, 2018

2019 Legislator’s Budget Guide

November 28, 2018Reports of Budget Surplus Ignore Imbalance

November 15, 2018

KPI launches first episode of “Choosing Freedom”

November 5, 2018Taxing Online Sales Isn’t A Kansas Windfall

November 2, 2018October 2018 Report Shows Trend of Sales Tax Struggling

November 1, 2018Kansas Ranked 15th in Economic Freedom

October 30, 2018

Kansas Freedom Index provides legislative transparency

October 22, 2018Reverse long-term economic stagnation

October 8, 2018Politicians are ignoring a $3.7 billion revenue shortfall

September 17, 2018

KPI publishes 2018 Voter Issue Guide

September 10, 2018$3.7 billion tax increase set up by courts and schools

August 1, 2018Lifetime Freedom Index scores set new lows

July 20, 2018Kansas Supreme Court teetering on tyranny

May 31, 2018Kansas legislators might raise taxes again

April 29, 2018

Online sales tax a ruse to grow government

April 29, 2018Kansas #26 in “Rich States, Poor States”

April 29, 20182018 Green Book: Smaller government, more growth

April 22, 2018$2 billion 2017 Kansas payroll online

April 20, 2018School funding plan requires big tax hike

April 5, 2018WestEd cost study has media pushing huge tax hikes

March 17, 2018City and county payrolls jumped in 2017

March 12, 2018

What was Really the Matter with the Kansas Tax Plan

March 1, 2018Medicaid Expansion Crushes State Budgets

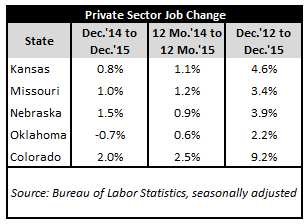

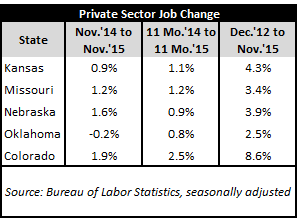

February 6, 2018Kansas Job Growth Rank Improves Post-Tax-Relief

September 28, 2017Tax Cuts and the Kansas Economy

September 23, 2017Pretty Prairie Residents Reject Property Tax Hike

September 21, 2017Are you ready for another tax increase?

September 11, 2017Good News in Kansas City Star

July 26, 2017

Kansas Legislature Broke a Lot of Promises

June 15, 2017$11 Billion School Debt Exceeds State Debt

June 5, 2017IRS data refutes Kansas tax evasion theories

May 17, 2017A tax on your income tax?

May 10, 2017City Property Tax Hikes

May 2, 2017

Pass-Through Exemption Helped Add 18,000 jobs in 2015

April 23, 2017Local Gov’t. Threatens Citizens over Property Tax Lid

April 20, 2017PEAK subsidy costs Kansas $48.5 million annually

April 19, 2017States that Spend Less, Tax Less…and Grow More

April 7, 2017Fake news in Kansas promotes political agenda

March 28, 20172016 State Payroll 3% Above 2013 Level

March 27, 2017City and County Payroll Provides Property Tax Insight

March 22, 2017Property Tax Hikes Continue

March 15, 2017Kansas Private Sector Jobs Grew in 2016

March 13, 2017

Better Together PSA

March 13, 2017Kansas budget can be balanced without tax hikes

February 28, 2017Efficient, Effective Spending Keeps Taxes Low

February 26, 2017

Gov. Brownback Promises Veto of $2.4 Billion Income Tax Increase

February 21, 2017Kansas House passes $2.4 billion income tax increase

February 16, 2017New business filings sets another record in Kansas

February 15, 2017Kansas income tax hike rejected by citizens

February 8, 2017Most Kansas legislators won’t declare their principles

January 30, 2017Kansas job rank improves after tax reform

January 23, 2017Kansas tax proposal endorses government favoritism

January 20, 2017Brownback’s budget proposal pretty good overall

January 12, 2017

State of the State puts students, citizens first

January 12, 2017Tax Change Recap

January 1, 2017Coverage of proposed $820 million tax hike loaded with media bias

December 27, 2016State think tanks lead the fight for freedom

December 19, 2016$820 million tax hike not necessary

December 11, 2016Legislative leadership moving Left in Kansas

December 6, 2016Media’s hypocritical tizzy over fake news

November 29, 2016Government’s Entitlement Mentality – Part 2

November 29, 2016Governing isn’t about granting wishes

November 28, 2016Government’s entitlement mentality – Part 1

November 28, 2016KC Biz Journal misleads on Johnson County property tax

November 21, 2016Oil, farming suppress sales tax collections

November 15, 2016Move Revenue Estimates from April to May

November 15, 2016States That Spend Less Tax Less

November 4, 2016

Pass-through entities drive job growth in Kansas

October 31, 2016KPERS Debt Created under Previous Administrations

October 17, 2016KDOT Spending Higher in 2015 and 2016 than in Prior Years

October 7, 2016Media Ignores Some Good News in August Jobs Numbers

September 23, 2016$1.45 Billion tax hike or broken promises coming in January

September 12, 2016Kansas individual income tax receipts +7% this year

September 9, 2016Media and highway contractors mislead again

August 31, 201619 U.S. Senators promoting tyranny

August 15, 2016Olathe’s real spending increase is higher than explained

August 9, 2016Property tax hikes in the works

July 24, 2016Personal Income Ranking Distorted by Media

July 8, 2016Yellow journalism defines KC Star’s Steve Rose

July 5, 2016Duane Goossen: Do as I say, not as I did

May 25, 2016Why are property taxes so high?

May 11, 2016Option 4: Soak the Poor

May 7, 2016

2015 Property Tax Allocation: 99% Local

March 17, 2016Kansas More Competitive since Tax Reform

March 14, 2016Kansas gains new high-income residents

March 12, 20162015 Property Taxes – The Beat Goes On

March 7, 2016

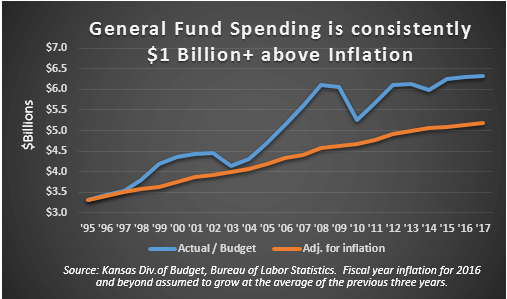

Houston, we have a spending problem

February 20, 2016Scare tactics and false choices: just another Tuesday at KCEG

February 17, 2016Senate Commerce Committee Testimony SB361

February 13, 2016

December Jobs Update

February 1, 2016

Guest Post: A Medicaid Expansion Offer the States Should Refuse

January 22, 2016HB 2023 Eliminating Income Tax Exemption on Pass-Through Income

January 19, 2016

November Jobs Update

January 6, 2016

Kansas Freedom Index now includes lifetime rankings

December 18, 2015CBPP pushes political viewpoint as economic analysis

December 3, 2015

October Jobs Update

November 25, 2015KPI and THF on Obamacare and Kansas

November 2, 2015

September Jobs Update

October 29, 2015

August Jobs Update

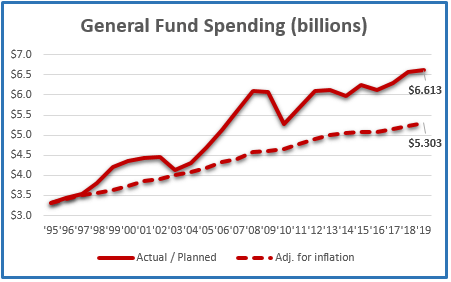

September 24, 2015Kansas General Fund spending sets new records

September 9, 2015

July Jobs Update

August 31, 2015

June Jobs Update

July 31, 2015King v. Burwell Decided: Is It 2015 or 1984?

July 1, 2015

2015 Kansas Budget Wrap-up

June 22, 2015Property tax abuse continues in Kansas counties

June 15, 2015April Jobs Update

May 29, 2015KCEG misleads on job growth – again

May 20, 2015Q1 2015 Jobs Update

May 11, 2015KC Star misleads again on Kansas economic growth

April 26, 2015Political perspective masquerades as ‘documentary’

April 15, 20152014 City and County Payrolls Added to KansasOpenGov.Org

April 13, 2015Kansas beats Missouri in private sector job growth

March 30, 2015Turnpike Payroll Raises Question of Pension Spiking

February 20, 2015December Jobs Update

February 12, 2015

Steve Anderson on Healing the Kansas Budget

February 11, 2015KCEG / ITEP report on tax fairness uses flawed methodology

January 16, 2015November Jobs Update

January 2, 2015

Carve Outs For The Few? Or, Lower Taxes For The Many?

November 25, 2014Responsible journalists don’t choose sides

November 3, 2014Opponents should attempt to persuade instead of simply dismiss

September 23, 2014