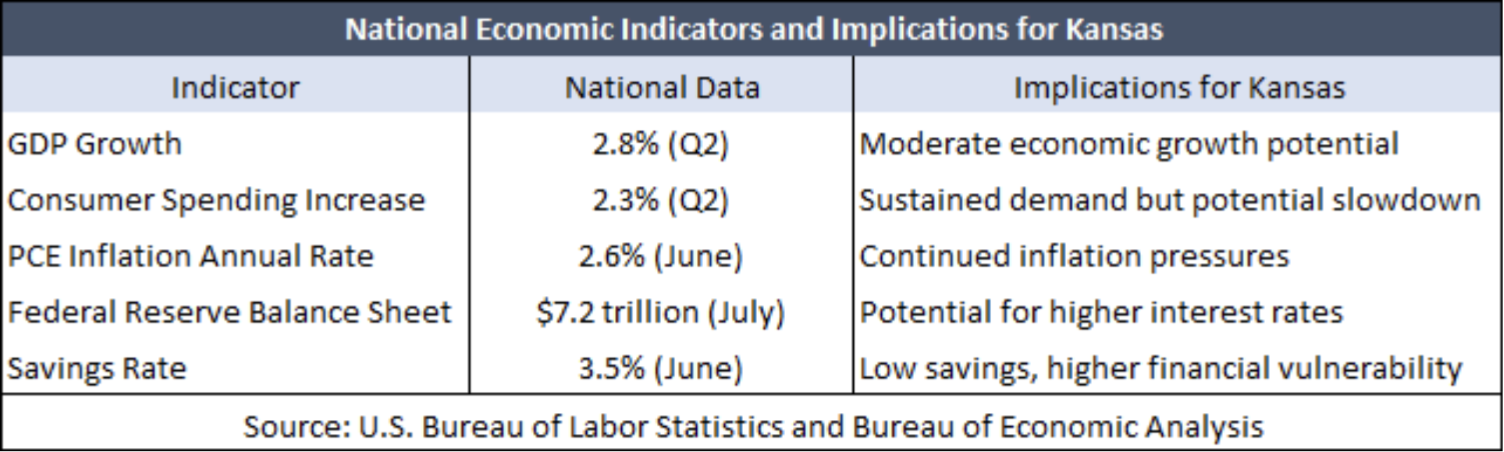

The recent performance of the U.S. economy presents a complex picture for Kansans. The U.S. gross domestic product (GDP) grew at an annualized pace of 2.8% in the second quarter of 2024, fueled largely by consumer spending, which rose by 2.3%. However, this growth masks underlying weaknesses critical for states like Kansas to consider.

The personal consumption expenditures (PCE) index, excluding volatile food and energy prices, increased by 0.2% in June and remained at 2.6% year-over-year, indicating persistent inflation above the Federal Reserve’s target of 2%. The Federal Reserve has tried to curb inflation by reducing its balance sheet from $9 trillion to $7.2 trillion, which includes most U.S. Treasury debt, mortgage-backed securities, and federal agency debt. But its balance sheet remains significantly higher than the pre-pandemic $4 trillion, indicating substantial inflationary pressures remain as too much money is chasing too few goods and services.

Average real weekly earnings adjusted for inflation have been down 1% since January 2021. This decline in inflation-adjusted earnings means consumers are burning their savings at an unsustainable rate, resulting in a historically low savings rate of 3.5% today. The trend is concerning for Kansas as it suggests that consumers have less disposable income, which can slow down economic activity and reduce state revenues from sales taxes.

Excessive deficit spending by Congress further complicates the Federal Reserve’s conundrum of balancing interest rates against inflation. High government spending contributes to upward pressure on interest rates, making it challenging for the Fed to maintain its federal funds rate target of 5.25-5.5% without exacerbating inflation. For Kansas, this federal fiscal policy environment could lead to higher borrowing costs and a constrained economic outlook if interest rates continue to rise.

Kansas can help working families navigate these national economic challenges by focusing on state-level fiscal responsibility and economic freedom. The state can draw lessons from national trends to implement policies that mitigate the impact of federal fiscal and monetary policies. Kansas should adopt a responsible budgeting approach that changes no more than the rate of population growth plus inflation and substantially reduces personal income taxes, eventually to zero.

Reducing regulatory burdens and promoting a business-friendly environment are crucial for fostering innovation and job creation. By emphasizing economic freedom, Kansas can attract new businesses and investments, offsetting some of the negative impacts of national economic weaknesses.

By focusing on fiscal restraint, tax reform, and enhancing economic freedom, Kansas can create a resilient economic environment that supports growth and prosperity despite the headwinds from federal policies and economic conditions. This approach aligns with the Kansas Policy Institute’s pro-growth approach for lower taxes, reduced regulation, and a limited government that fosters an environment where businesses and individuals can prosper.