Like many states, Kansas has a complex economic situation in 2024. The latest Bureau of Labor Statistics (BLS) data provide a blurry picture of the state’s employment situation. While nonfarm employment numbers offer some signs of stability, a closer look at the household employment data reveals potential challenges that warrant careful attention.

Understanding Nonfarm and Household Employment Data

To fully grasp Kansas’s employment trends, it’s essential to differentiate between nonfarm and household employment data.

Nonfarm employment, reported through the Current Employment Statistics (CES) program called the establishment report, tracks payroll jobs in nonfarm establishments, excluding agricultural workers, the self-employed, and private household employees. This measure is a key indicator of jobs in major industries. This BLS survey excludes agriculture and farm jobs because they are difficult to measure due to high volatility and lack of reporting.

On the other hand, household employment data collected via the Current Population Survey (CPS), called the household survey, includes jobs for the self-employed and those in private households but not separated by industry. This latter data set captures shifts in labor force participation and underemployment, often offering a more comprehensive view of economic health.

Historical Employment Trends in Kansas

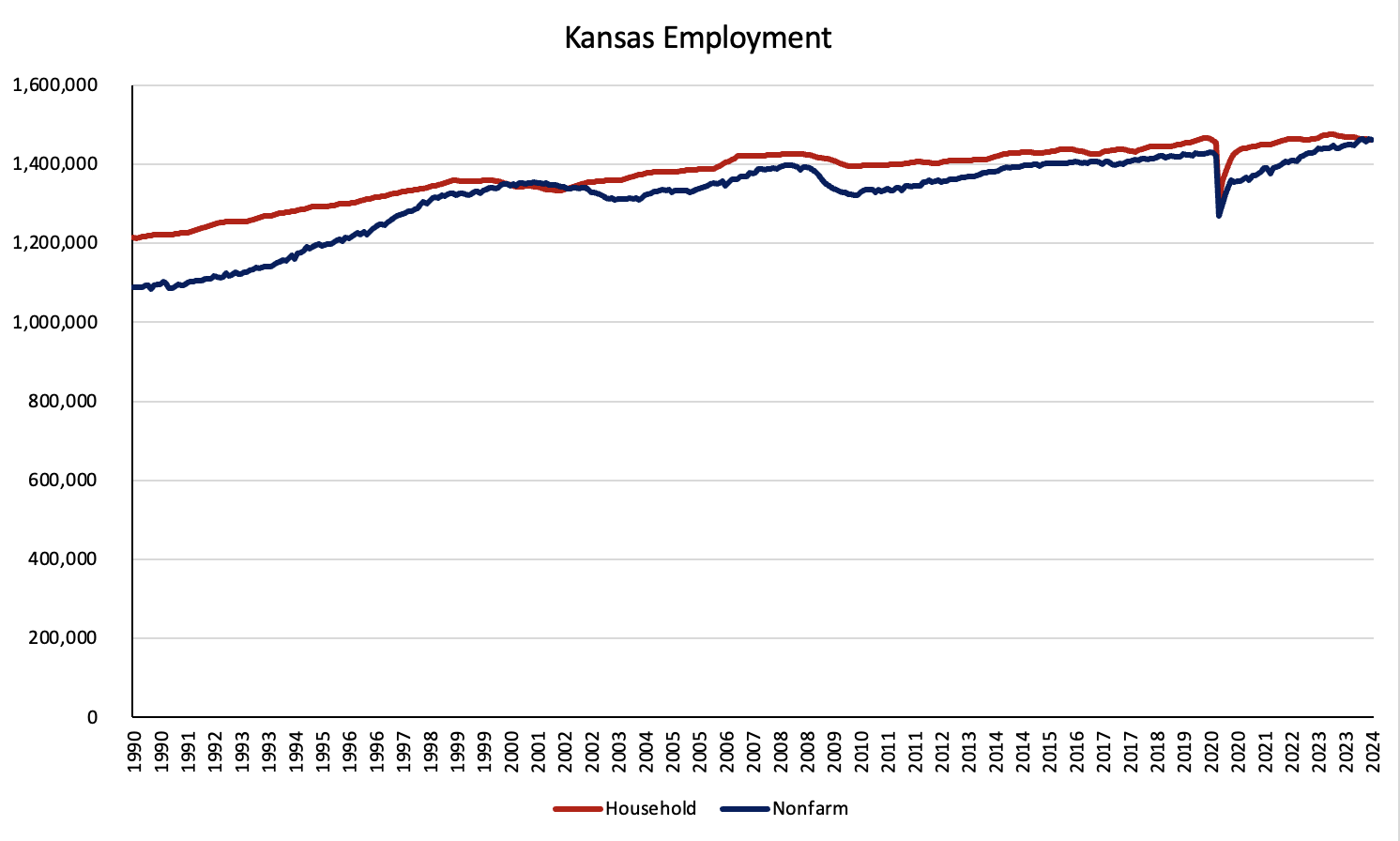

Kansas’s employment trends provide insights into the state’s economic trajectory. Since the 1990s, Kansas has experienced periods of moderate job growth punctuated by significant downturns, such as the early 2000s recession and the Great Recession of 2007-2009.

For example, nonfarm employment grew from 1.08 million in 1990 to 1.12 million by the mid-1990s, reflecting the state’s overall economic growth. However, the early 2000s saw a dip in employment due to the dot-com bubble burst, with a more substantial decline during the Great Recession. Post-recession recovery was slow but steady, with household and nonfarm employment regaining much of their lost ground by 2015.

By 2019, Kansas had reached new employment highs. However, the COVID-19 pandemic disrupted these gains, causing sharp declines in employment across the state. Although there has been a recovery since then, the 2024 employment trends show a divergence that mirrors broader national patterns.

Nonfarm vs. Household Employment: A Comparative Analysis

Since the COVID-19 lockdowns, U.S. employment trends have shown a divergence between household and nonfarm jobs. Initially, household employment rebounded more swiftly as individuals turned to self-employment and gig work to navigate the economic uncertainty. However, nonfarm employment took longer to recover as traditional businesses faced prolonged disruptions and slow rehiring processes. Over the last year, household employment has slowed and remained flat, while nonfarm jobs increased by 2.5 million nationwide.

These trends were similar in Kansas, where household employment bounced back faster than nonfarm jobs in the immediate aftermath of the lockdowns. Since July 2019, household employment has increased by 3,100 jobs, while nonfarm employment has increased by 40,800. Like the national trend, household employment has lost 13,146 jobs over the last year, while nonfarm jobs are up by 21,100.

Household employment has declined in 12 of the last 14 months, with a decline of 14,475 jobs to the lowest level of 1.460 million since January 2022, but nonfarm employment has increased in 10 of those 14 months, increasing by 21,400 jobs to 1.462 million.

In July 2024, Kansas lost 1,700 nonfarm jobs, a slight decline of 0.1%. However, over the past year, the state added 21,100 nonfarm jobs, marking a 1.5% increase, primarily driven by gains in the leisure, hospitality, and professional services sectors. In contrast, household employment declined by 1,200 in July, raising concerns about broader economic well-being.

At the national level, the U.S. added only 114,000 jobs in July 2024, far below expectations and reflective of a broader slowdown in the labor market. This weak performance suggests that Kansas’s challenges are part of a larger national trend.

Unemployment Rates: Kansas and Neighboring States

As of July 2024, Kansas’s unemployment rate is 3.2%, ranking 17th nationally, with the U.S. rate at 4.3%. The state’s unemployment rate reflects a relatively stable labor market, but the losses in household employment that go into the unemployment rate calculations highlight the need for Kansas to remain vigilant in its economic policies to ensure continued competitiveness.

The differences in unemployment rates are notable when comparing Kansas to its neighboring states. For instance, Nebraska boasts one of the lowest unemployment rates in the country at 2.6%, ranking 5th nationally, while Missouri’s unemployment rate is slightly higher at 3.8%, ranking 30th. Iowa is in a better position than Kansas with an unemployment rate of 2.8%, ranking 8th.

These comparisons emphasize that while Kansas performs reasonably well, there is room for improvement, particularly in creating a more dynamic and resilient labor market.

Improving Economic Vitality and Competitiveness

Kansas must prioritize economic freedom and fiscal discipline to enhance its economic competitiveness. Reducing government spending, revamping the tax system, and promoting regulatory reform are essential. By adopting strict spending limits tied to inflation and population growth, Kansas can create a more predictable fiscal environment and attract businesses. Streamlining regulations will encourage entrepreneurial activity and job creation, especially for small businesses and startups.

Kansas’s current economic challenges are not new. The state has faced long-term economic stagnation, with private sector job growth lagging behind national trends since the 1980s.

Addressing these issues requires a concerted effort to reduce government spending and improve the business climate. Embracing reforms that promote economic freedom and pro-growth policies is crucial for ensuring long-term prosperity for all Kansans.