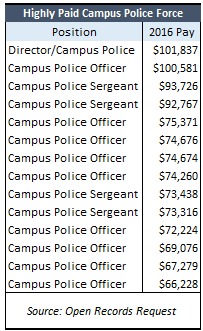

Taxpayers in Leavenworth and Wyandotte counties are on the hook for a highly-paid police force amidst several other highly-paid employees at Kansas City Kansas Community College (KCKCC). This comes according to new payroll records for both FY 14-15 and FY 15-16 that have been added to KansasOpenGov.Org. The table below offers a few examples.

Decisions to pay well above even published city rates to finance the college police force are curious ones given the presumably similar—if not overlapping—duties of officers working for the respective college and city departments.

Decisions to pay well above even published city rates to finance the college police force are curious ones given the presumably similar—if not overlapping—duties of officers working for the respective college and city departments.

These management decisions and others like them come with a higher cost to taxpayers, who are already providing KCKCC with annual tax revenues topping $30.6 million according the college’s latest filings with the Kansas Board of Regents (KBOR). This represents a 10.5% increase in provided revenue during the FY2011-FY2014 period the filings cover.

What’s more, KCKCC’s continued reliance on increased taxpayer support is not likely to end any time soon. Far from trying to keep spending trends in line with enrollment trends, the college increased its All Funds spending by 9.6% from FY2011-FY2014 even as its full-time equivalent (FTE) enrollment dropped by 12.9%.

And KCKCC is just one government entity competing for taxpayer support. No wonder why taxpayers in both Leavenworth and Wyandotte counties have continued to face property taxes that have risen significantly above inflation, population, and mill rate growth since 1997.

Click here to see data for Leavenworth County; click here see to see data for Wyandotte County; and click here for KCKCC’s full payroll listing.