Articles by:

Dave Trabert

K-12 operating cash reserves hit $1.25 billion

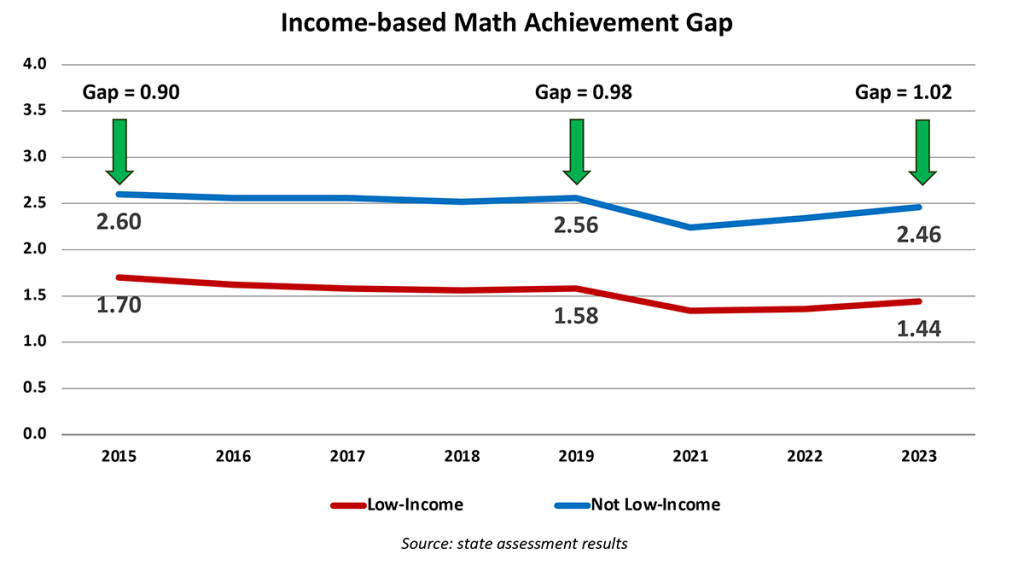

Dave TrabertKASB celebrates low achievement

Dave TrabertAchievement gaps persist despite KSDE claims

Dave Trabert

3 things to know about Truth in Taxation

Dave Trabert

Kansas is #38 in bang for the educational buck

Dave Trabert

Kansas lost private-sector jobs in April

Dave Trabert

Gov. Kelly signs property tax transparency bill

Dave Trabert

5 things you need to know about K-12 education

Dave Trabert

Kansas kids need money-follow-the-child programs

Dave Trabert

Use the special session to support taxpayers

Dave Trabert

2019 state payroll: $2.17 billion, up 5%

Dave Trabert

School budgets: savings opportunities abound

Dave Trabert

School debt sets new records in Kansas

Dave TrabertSchool funding decision doesn’t end litigation

Dave Trabert

$1.2 billion city and county payrolls online

Dave TrabertBusting the Kansas PTA MythBusters

Dave Trabert

KPI acquires The Sentinel

Dave TrabertPer-Pupil funding tops $14,000 in Kansas

Dave TrabertReverse long-term economic stagnation

Dave TrabertImproving Low Student Achievement Levels

Dave Trabert

KPI publishes 2018 Voter Issue Guide

Dave Trabert

2018 Voter Issue Guide

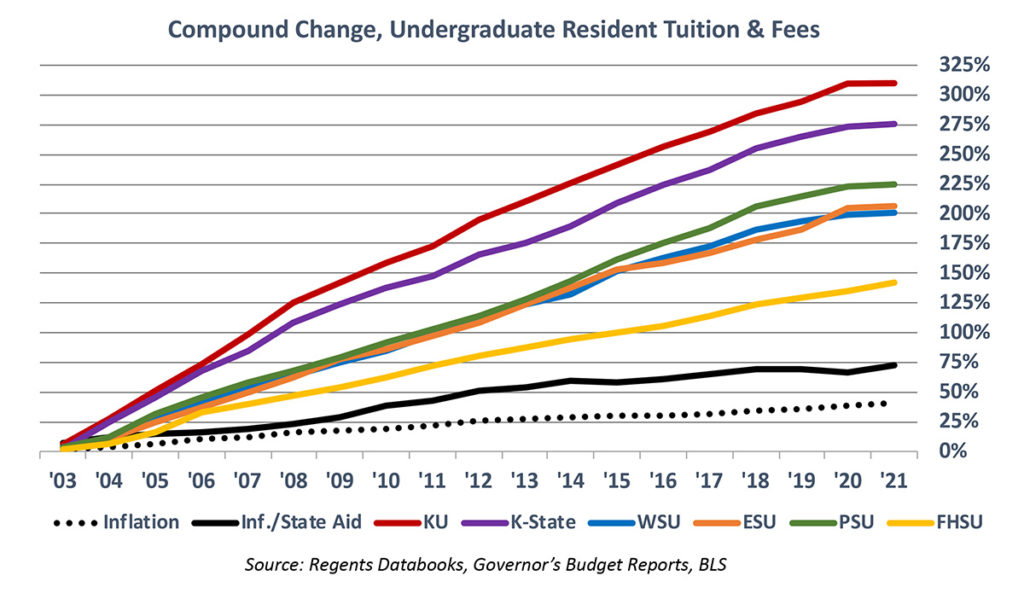

Dave TrabertUniversities use tuition to pad bank balances

Dave TrabertEducators mislead Civil Rights Commission

Dave TrabertKansas school boards skimp on teacher pay

Dave TrabertGannon VI demand for school funding is off base

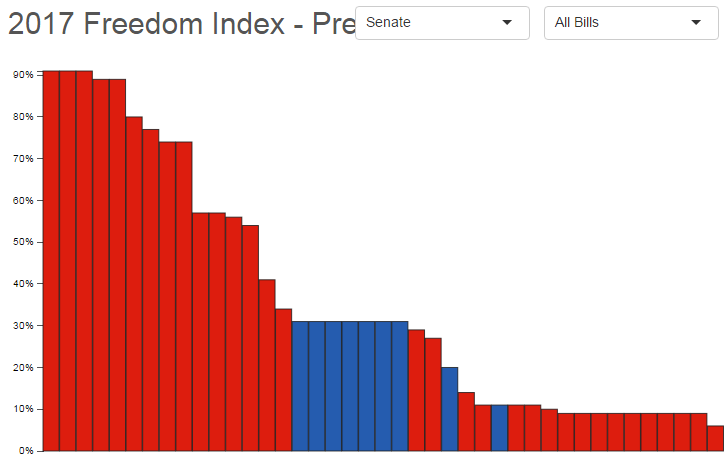

Dave TrabertLifetime Freedom Index scores set new lows

Dave TrabertKansas Supreme Court teetering on tyranny

Dave TrabertKansas legislators might raise taxes again

Dave Trabert

Online sales tax a ruse to grow government

Dave TrabertKansas #26 in “Rich States, Poor States”

Dave Trabert2018 Green Book: Smaller government, more growth

Dave Trabert$2 billion 2017 Kansas payroll online

Dave Trabert2017 NAEP – small gain but long way to go

Dave TrabertSchool funding plan requires big tax hike

Dave TrabertKansas school funding study cuts rural schools

Dave TrabertWhat’s in the House school funding plan?

Dave TrabertSchool lobby pushes money correlation myth

Dave TrabertKNEA deceives teachers on school efficiency

Dave TrabertCity and county payrolls jumped in 2017

Dave TrabertSchool District Debt Exceeds $6 Billion

Dave TrabertMedicaid Expansion Crushes State Budgets

Dave Trabert

2018 State of the State Fails Students

Dave TrabertWill $17K Per-Pupil Make Achievement Acceptable?

Dave TrabertKansans Want Schools Held Accountable

Dave Trabert

Court’s Gannon Ruling Won’t Help Kids

Dave TrabertKansas School Funding Set New Records in 2017

Dave TrabertSchool Districts Plan Large Spending Increases

Dave TrabertSchool District Cash Reserves at Record Highs

Dave TrabertKansas Job Growth Rank Improves Post-Tax-Relief

Dave TrabertTax Cuts and the Kansas Economy

Dave TrabertAre you ready for another tax increase?

Dave TrabertPay Hikes at Johnson County Community College

Dave TrabertKCKCC Pay Jumps 11 Percent

Dave TrabertGood News in Kansas City Star

Dave TrabertSchools Defend Massive Income Tax Hike

Dave TrabertKansas Ranked 6th for State School Funding

Dave TrabertSchool Cash Reserves Hit $203 Billion

Dave Trabert

Kansas Legislature Broke a Lot of Promises

Dave Trabert$11 Billion School Debt Exceeds State Debt

Dave Trabert79 Districts Lost Students, Added Staff

Dave TrabertSchool Debt Sets New Record at $5.56 Billion

Dave TrabertIRS data refutes Kansas tax evasion theories

Dave TrabertA tax on your income tax?

Dave TrabertKansas Budget Deficit overstated by $200 million

Dave TrabertCity Property Tax Hikes

Dave TrabertPEAK subsidy costs Kansas $48.5 million annually

Dave TrabertStates that Spend Less, Tax Less…and Grow More

Dave TrabertFake news in Kansas promotes political agenda

Dave Trabert2016 State Payroll 3% Above 2013 Level

Dave TrabertProperty Tax Hikes Continue

Dave TrabertKansas Private Sector Jobs Grew in 2016

Dave TrabertFalse claims on Kansas school funding

Dave TrabertNew school funding formula required by Court

Dave TrabertKansas budget can be balanced without tax hikes

Dave TrabertEfficient, Effective Spending Keeps Taxes Low

Dave TrabertPrivate Schools Better for Low Income Students

Dave TrabertKansas income tax hike rejected by citizens

Dave TrabertKansas job rank improves after tax reform

Dave TrabertBrownback’s budget proposal pretty good overall

Dave Trabert

State of the State puts students, citizens first

Dave TrabertSchool funding formula must start from scratch

Dave TrabertKC Star scores media bias trifecta

Dave TrabertState think tanks lead the fight for freedom

Dave Trabert$820 million tax hike not necessary

Dave TrabertLegislative leadership moving Left in Kansas

Dave TrabertMedia’s hypocritical tizzy over fake news

Dave TrabertGoverning isn’t about granting wishes

Dave TrabertGovernment’s entitlement mentality – Part 1

Dave TrabertOil, farming suppress sales tax collections

Dave TrabertMove Revenue Estimates from April to May

Dave Trabert

Pass-through entities drive job growth in Kansas

Dave TrabertKMBC-TV perpetuates false school funding claim

Dave TrabertMedia and highway contractors mislead again

Dave TrabertKansas School Pay Raises: Some Big, Some small

Dave Trabert19 U.S. Senators promoting tyranny

Dave TrabertProperty tax hikes in the works

Dave TrabertSometimes, media is wrong without knowing it

Dave TrabertSenator Kelly misleads on school property taxes

Dave TrabertPersonal Income Ranking Distorted by Media

Dave TrabertYellow journalism defines KC Star’s Steve Rose

Dave TrabertLocal control is about citizens, not government

Dave TrabertAmend the Constitution to protect students

Dave TrabertSchool districts load up on debt

Dave TrabertRethinking Education Tomorrow

Dave TrabertDon’t let the courts close schools

Dave TrabertDuane Goossen: Do as I say, not as I did

Dave TrabertOption 4: Soak the Poor

Dave TrabertKansas gains new high-income residents

Dave Trabert2015 Property Taxes – The Beat Goes On

Dave TrabertStudent achievement crisis in Kansas

Dave Trabert

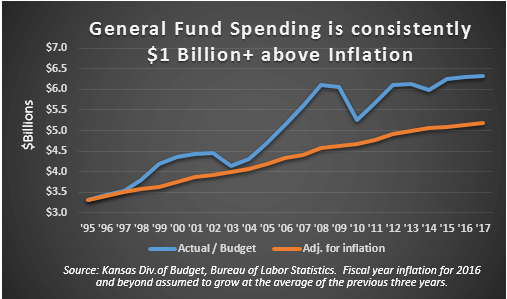

Houston, we have a spending problem

Dave TrabertNo correlation between spending and achievement

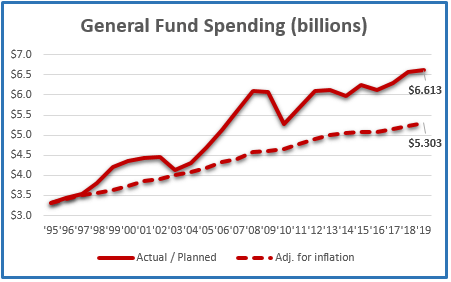

Dave TrabertKansas General Fund spending sets new records

Dave TrabertExtraordinary needs…or wants?

Dave Trabert

2015 Legislative Wrap-up

Dave Trabert

2015 Kansas Budget Wrap-up

Dave TrabertProperty tax abuse continues in Kansas counties

Dave TrabertKCEG misleads on job growth – again

Dave Trabert

Kansas Budget Documentary Short on Facts

Dave Trabert

Kansas K-12 Carryover Reserves

Dave Trabert

Inaugural Podcast with Dave Trabert

Dave TrabertKASB misleads on personal income

Dave Trabert