COVID-19 has presented many challenges for Kansas policymakers. Under unprecedented public health and economic crisis, policymakers must take charge and guide the state to a robust recovery. To do that, they must first tackle the state budget shortfall that lays before them. While it may be daunting, the Kansas Policy Institute has a framework that does not cut quality services but maintains them at a better price, or tax, to Kansans.

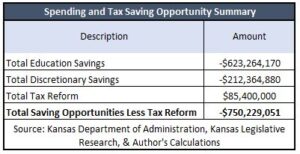

The Kansas shortfall will grow to roughly $721 million by the end of FY 2022 if it follows state law. However, it also creates a great opportunity in the intervening years. Providing for the statutory ending balance, the shortfall turns into a surplus of roughly $600 million in fiscal years 2021 and 2022. Legislators have a vital role in ensuring state spending programs are providing core services efficiently and adequately. This is not a partisan issue; most Kansans want to ensure the government can provide better service at a better price. To improve government services and ensure there is money to pay for them, we need to closely examine how we allocate our resources. We considered education and discretionary savings together, along with the recently studied tax reform package. This framework shows that policymakers can provide relief to Kansans and protect the state budget from the next financial crisis. The table below shows the potential to save taxpayers $835 million and allows for tax reform of $85 million. Ultimately it leaves up to $750 million to shore up the state budget for the potential next emergency. This budget also means no more additional transfers from the highway fund and a maintained schedule for KPERS payments. A more holistic review of state spending would yield further opportunities to save money.

The Kansas shortfall will grow to roughly $721 million by the end of FY 2022 if it follows state law. However, it also creates a great opportunity in the intervening years. Providing for the statutory ending balance, the shortfall turns into a surplus of roughly $600 million in fiscal years 2021 and 2022. Legislators have a vital role in ensuring state spending programs are providing core services efficiently and adequately. This is not a partisan issue; most Kansans want to ensure the government can provide better service at a better price. To improve government services and ensure there is money to pay for them, we need to closely examine how we allocate our resources. We considered education and discretionary savings together, along with the recently studied tax reform package. This framework shows that policymakers can provide relief to Kansans and protect the state budget from the next financial crisis. The table below shows the potential to save taxpayers $835 million and allows for tax reform of $85 million. Ultimately it leaves up to $750 million to shore up the state budget for the potential next emergency. This budget also means no more additional transfers from the highway fund and a maintained schedule for KPERS payments. A more holistic review of state spending would yield further opportunities to save money.

The budget can be balanced by making more effective use of existing resources. No tax increases or reductions in services are necessary. We know this because other states are already doing it. Remember, Kansas spent 40% more per-resident than the states without an income tax in 2018. Those states provided the same essential services as does Kansas. Just as the private industry makes a continuous improvement to its operating processes, so too must state government.