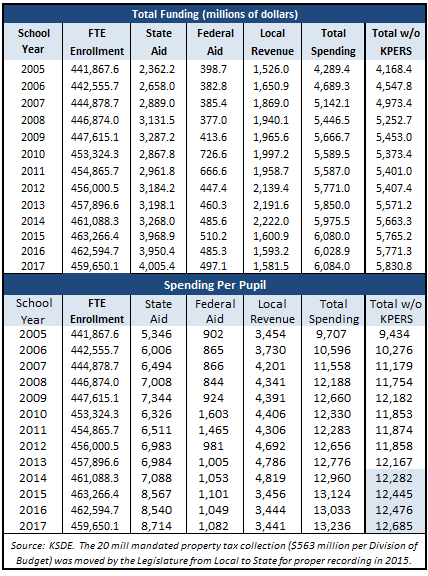

Kansas school funding set more new records in the 2017 school year according to data released by the Kansas Department of Education. Total aid to schools set a new record at $6.084 billion and total aid per-pupil set a record at $13,236. State aid topped $4 billion for the first time, with per-pupil state aid at $8,714. Funding also set new records with KPERS pension payments excluded; total non-KPERS funding was $5.831 billion and per-pupil funding reached $12.685.

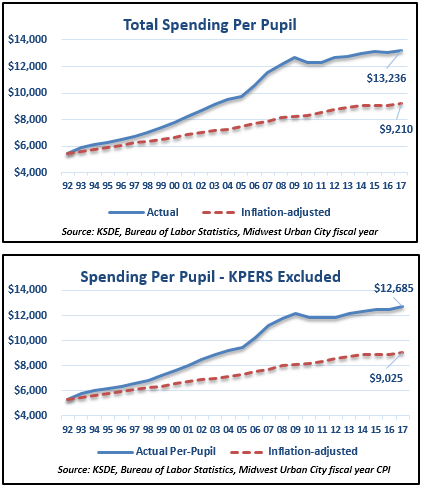

Kansas school funding continues to run far ahead of long-term inflation. Total funding of $13,236 is 44 percent higher than if it had been increased for inflation over the course of the old school funding system, and non-KPERS funding of $12,685 is 41 percent above long term inflation. For perspective, Kansas taxpayers would have spent $1.86 billion less on public education last year if per-pupil funding had just been increased for inflation.

Kansas school funding continues to run far ahead of long-term inflation. Total funding of $13,236 is 44 percent higher than if it had been increased for inflation over the course of the old school funding system, and non-KPERS funding of $12,685 is 41 percent above long term inflation. For perspective, Kansas taxpayers would have spent $1.86 billion less on public education last year if per-pupil funding had just been increased for inflation.

The new school funding record of $6.084 billion doesn’t include new funding approved by the Legislature. An additional $293 million in state aid is scheduled to be added over the current and next school year, but total aid will likely increase even more. The additional state aid allows school districts to increase local property taxes to expand their Local Option Budgets, and that will cause an increase in state equalization aid. KPERS pension payments will also need to be increased based on the amount of new state and local aid spent on employee pay increases and new hires.

But even that is not enough to satisfy the Kansas Supreme Court and the education lobby. The court appears to demand at least $600 million more in addition to the $293 million already added for the 2019 school year and the school lawyers say they are entitled to about $1.4 billion more. Should the Legislature choose to meet just the minimum demand, either state school property taxes would double, the state sales tax would soar to the highest rate in the nation or there would need to be a 20 percent income tax surcharge. Alternatively, General Fund spending on everything else would need to be reduced by about 19 percent to meet the minimum demand.