With the Federal Reserve recently cutting its federal funds rate target by 50 basis points to a range of 4.75% to 5%, Kansas must reassess its economic policies to prepare for the challenges ahead. Lower interest rates may offer short-term relief by reducing borrowing costs, but the continued risk of inflation demands long-term reforms. Kansas can withstand the economic uncertainty created by the Fed by state policymakers taking proactive steps to reform taxes, reduce spending, and deregulate to improve economic freedom and opportunity.

Economic Freedom Ranking and Implications

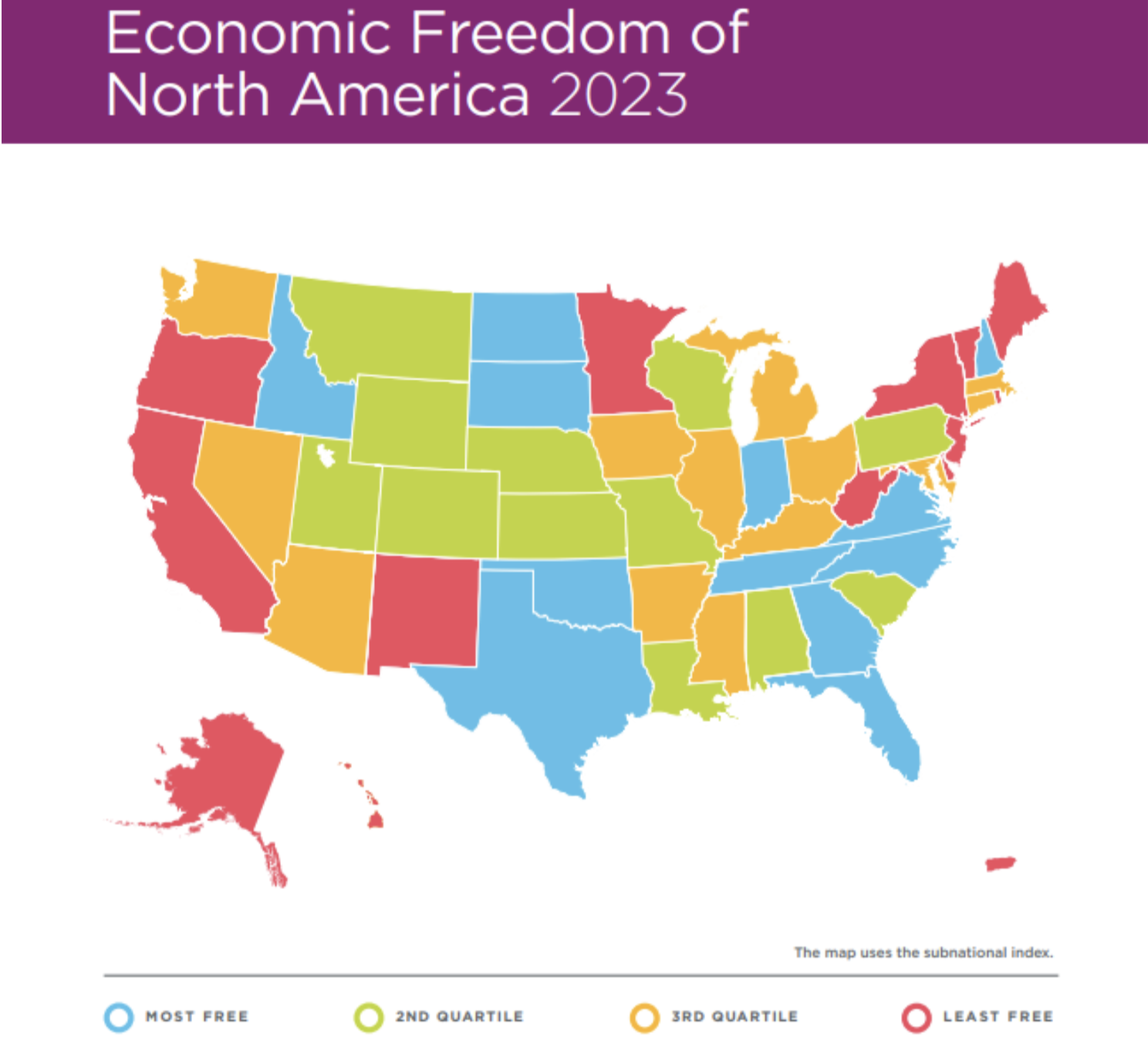

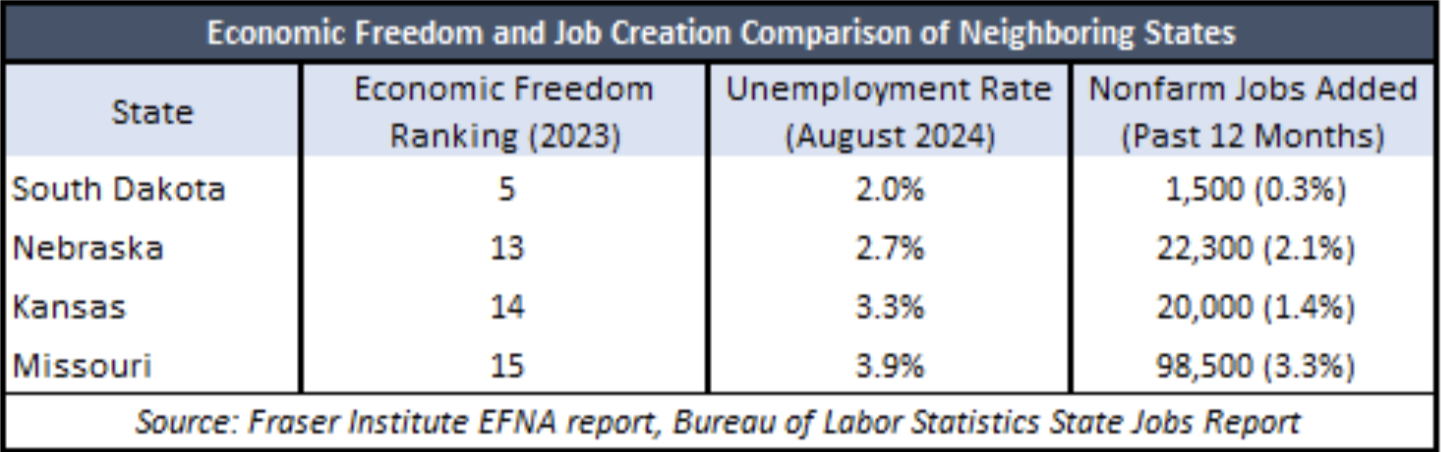

According to the Economic Freedom of North America 2023 report, Kansas, currently ranked 14th in economic freedom, lags behind neighbors like South Dakota (5th), Nebraska (13th), and Missouri (15th). Kansas’s ranking reflects areas needing improvement, including high taxes and government spending.

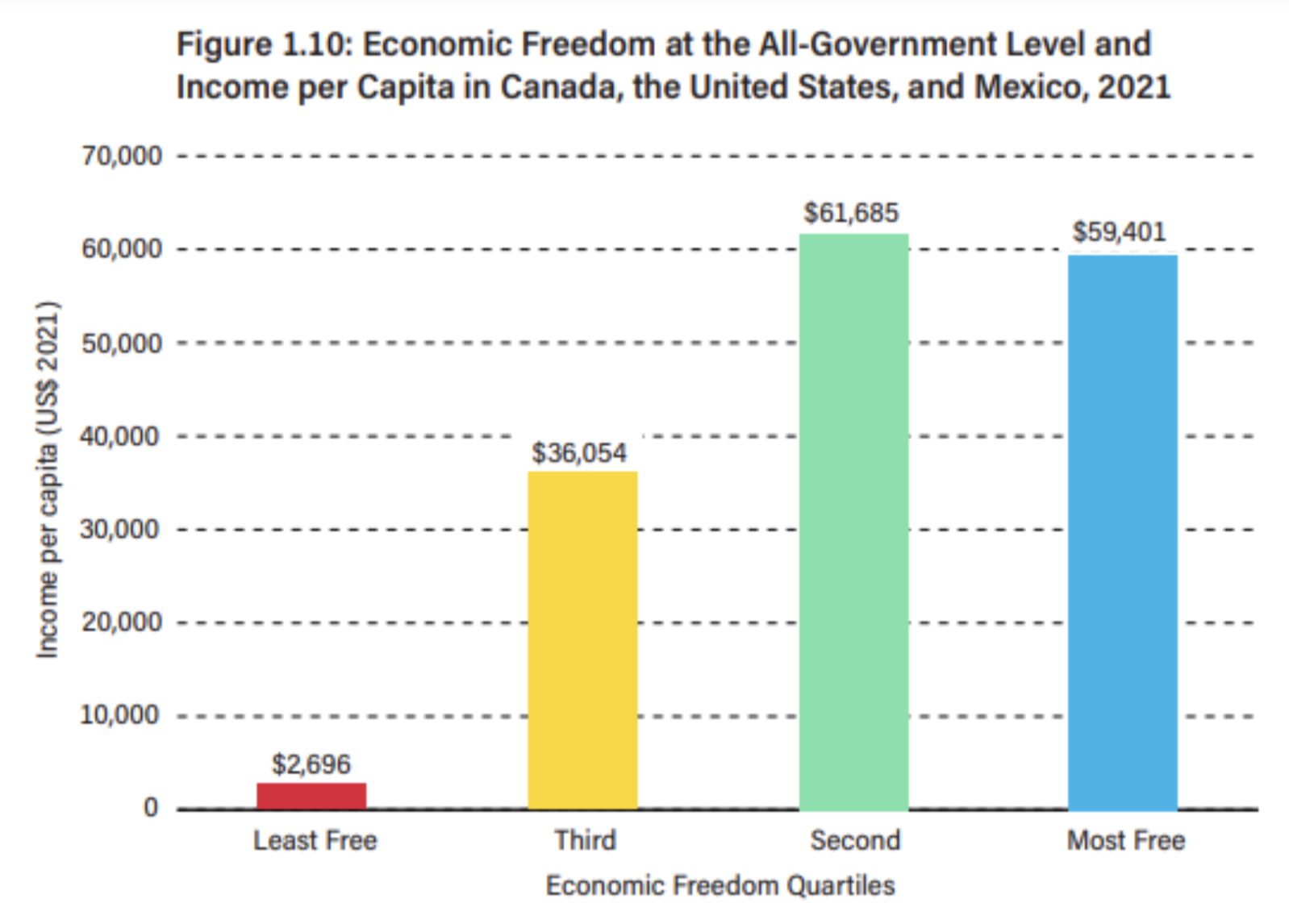

There is abundant evidence that people in countries and states with more economic freedom thrive while those with less don’t. A recent academic study considered information from 54 published articles on relationships between economic freedom and different measures of prosperity and found that “economic freedom is positively related to growth, income, and investment.” This applies with Kansas and other states with higher economic freedom have lower unemployment rates and faster job creation, underscoring the benefits of increasing economic freedom.

The following figure from the report shows the benefits between higher economic freedom and higher income per capita across North America.

Kansas’s tax and regulatory environment has prevented the state from achieving stronger economic outcomes despite its relatively low unemployment rate. To compete with neighboring states and others, Kansas must focus on policies that reduce taxes and remove obstacles to starting a business.

Tax Reform: The Key to Growth

Kansas has made strides in tax reduction, but its personal income tax and high property taxes still pose significant obstacles to business growth and household wealth. States like Texas and Tennessee, which have no personal income tax, consistently rank higher in economic freedom and experience faster population growth and job creation. Phasing out the personal income tax and reducing property taxes would help Kansas attract new businesses and residents. Lower taxes would give businesses more capital to reinvest in jobs and innovation, while making the state more competitive.

Targeted Regulatory Reforms for Small Businesses

Kansas also faces barriers in its regulatory environment, particularly for small businesses. Burdensome regulations, including licensing requirements and other red tape, slow business formation and expansion, hindering economic dynamism. Lawmakers should comprehensively review regulations and focus on removing outdated or excessive rules that stifle small businesses. Streamlining occupational licensing would make it easier for entrepreneurs to start and grow businesses, creating more jobs and opportunities for workers.

Spending Restraint and Fiscal Responsibility

Reducing taxes must go hand-in-hand with controlling government spending. Excessive spending forces higher taxes and crowds out private-sector investment, creating a drag on economic growth. Implementing fiscal rules that limit state spending growth to the maximum rate of population growth plus inflation would ensure that Kansas maintains fiscal discipline. By restraining spending, Kansas can fund critical infrastructure and education without placing additional burdens on taxpayers.

Conclusion: A Path to Greater Freedom and Prosperity

Kansas has the potential to move up the economic freedom rankings, but achieving this requires bold action. By reducing taxes, cutting unnecessary regulations, and controlling government spending, Kansas can build a more vibrant and competitive economy. Following the lead of states like South Dakota and Texas, which prioritize pro-growth policies, Kansas can improve its labor market outcomes, attract investment, and create a more prosperous future for all residents.