The current form of the City of Lawrence budget for the upcoming year could potentially lead to large deficits and more local taxes for many future fiscal years. In mid-July, Lawrence’s City Manager Craig Owens released a 2022 budget proposal which included a deficit of $7.9 million dollars between the projected expenses of $103.4 million and revenue of $95.5 million.

As part of the budget proposal, Lawrence is pursuing new initiatives such as $5 million in pay increases for government employees and 21 new staff positions which are estimated to cost $2.25 million annually. The reasoning for this increased, deficit spending is the belief that the “American Rescue Plan Act (ARPA) and other federal assistance” will close the fiscal gap. While ARPA may work to cover these costs in the short run, cities nationwide only have until the end of 2026 to spend their ARPA funds. The city of Lawrence received $21 million from ARPA ($18.9 million from the Treasury and $2.1 million from the Department of Housing and Urban Development).

If neither Lawrence’s spending nor revenues change, then the ARPA funds would only be able to pay this $8 million deficit for 2022, 2023, and briefly into 2024. So, what about after? Hiring new positions and increasing salaries isn’t a cost that will just disappear when the ARPA funds dry up: the Lawrence budget is putting “the cart before the horse” and establishing spending trends that will eventually require new taxes on Lawrence citizens. The Volcker Alliance and Government Finance Officers Association have described using ARPA funds to establish recurring programs as “an exceedingly dangerous concern.” It’s very likely that Lawrence will be forced to scramble for new revenue sources (most likely, taxation), or cut back spending (which is unlikely given Lawrence’s recent history) in the very near future.

Since 2011, the city’s total expenditures have increased by 68%, while the population in this same time has only grown by 10% and the cumulative rate of inflation has only gone up by 24.6%. Just this week, Lawrence announced it would continue raising the costs of utilities, with the average bill increasing 7.5% since 2015 for an average utility bill exceeding $100. The first step towards providing a fiscally responsible local government is reigning in spending so that citizens don’t have to bear the brunt of future tax increases. Using ARPA funds to pay for permanent positions in Lawrence’s government means that once the funds are gone, the government will need to pay those positions off through new taxes or other revenue sources, thus passing the bill to taxpayers.

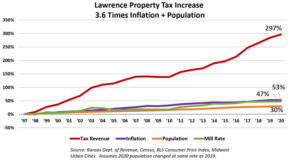

Though the budget’s transmittal memo notes that it is presented “with no property tax or sales tax rate increase” for FY 2022, later on, it clearly states that “some combination of service reductions, increased tax rates, or stronger growth in property values and sales tax or a combination of the above will be required to sustain direction.” This deceptive method of hiding taxes in the near future isn’t a good sign considering Lawrence’s current trajectory with taxation. Since 1997, the city’s revenue from property taxes has quadrupled while other measures of the economy have grown meagerly in comparison, as shown in the graph below.

The ARPA funds allocated to Lawrence should go towards restoring only essential programs, such as one-time infrastructure projects that were delayed due to COVID-19, and which would fit in normally with the Lawrence budget once the economic situation returns to normal. To be specific, ARPA funds are not eligible for general infrastructure spending but can cover water, sewer, and broadband investments. Even with these restrictions, Lawrence could put ARPA qualifying infrastructure projects first that the city may have had plans to do. Then, they could prioritize their other parts of the budget for more general infrastructure. Or, the funds could be returned to the community, and Lawrence could find new ways to invest in the people and local businesses who have struggled over the past year and a half due to the COVID-19 pandemic. This could take the form of offering tax rebates and covering operating deficits resulting from decreased business activity during the COVID-19 pandemic. What the city should not do is rapidly expand its long-term spending, leading to increased costs of living which stifle people’s wellbeing and the city’s economic growth.