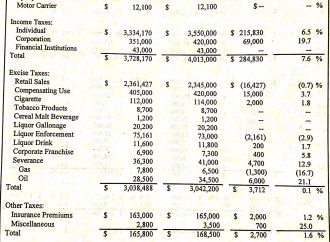

The Consensus Revenue Estimating Group made their November predictions of the income and spending activity of Kansas families and businesses. They believed Kansas families will see incomes grow by a ludicrously high 6.5 percent rate or $216 million on top of what they already guessed for fiscal year 2019. Whether Kansans can support this growth has yet to be seen as the Consensus Revenue Estimates have a history of missing estimates on Kansans’ income and spending habits. A state tax revenue growth prediction beyond what Kansas families and businesses can provide is also a prediction of tax increases. These estimations coming on the heels of Governor-Elect Kelly’s vow for record spending will only make it more difficult for families to make ends meet.

There are three concerns stakeholders should ask of the hamstrung process managed by the Governor’s Budget Office and Kansas Legislature.

There are three concerns stakeholders should ask of the hamstrung process managed by the Governor’s Budget Office and Kansas Legislature.

1. Where did the half a billion dollar miss in income tax come from?

2. Are you guessing how much sales tax Kansas will receive from online shopping? If so, how much sales tax revenue?

3. Where is the Consensus Revenue Estimating Process in implementing the reforms outlined by the previous administration?

While the Kansas economy is improving, Kansas personal income in the past year grew only 2.9%. What makes matters worse is that the group estimates gains in income tax, but a slow sales tax growth below the rate of inflation. What this comes down to is a matter of transparency and whether the state holds itself accountable for making mistakes that ultimately hurt the Kansas economy. The Consensus Revenue Estimating group has played this game of high risk and no reward for Kansas taxpayers for decades. Asking them to be more transparent and to learn from their mistakes is a sensible solution.