There are no pandemic economic models to follow but the economic fallout and state budget deficits from the COVID-19 shutdown will be enormous. Some economists speculate the impact could be even worse than the 2009-10 recession.

Only time will tell if the public health benefits of stay-at-home orders were worth the economic ramifications and related mental health issues; some people may conclude that the economic costs outweighed the health benefit.

Based on the assumption outlined below, Kansas could be looking at deficits between $1.1 billion and $2.1 billion over the next two years. The ‘good’ news is that the state has lots of room to reduce costs, based on comparisons to other states. KPI’s 2012 column in the Wall Street Journal found “states that spend less, tax less…and grow more” and that’s still the case.

In 2018, the states that tax income spent a whopping 55% more per resident than the states without an income tax; Kanas spent 40% more than the states without an income tax, and since spending jumped $1.2 billion higher. Every state provides the same basic services, but some do so at much lower costs and thereby can have lower taxes.

We’re releasing our comprehensive economic recovery plan shortly. Specific recommendations to reduce state and local spending will be included in our plan. But first, it’s important to understand the urgent need to reduce costs by eliminating unnecessary, wasteful spending.

The exact state budget deficits will depend upon the depth and length of the economic shutdown. But two things are certain: (1) there will be significant deficits, and (2) the longer that state and local officials impose shutdowns, the worse the deficits will be.

Scenario 1: less than half the revenue decline in the 2009-10 recession

Income tax collections fell 21% over two years during the 2009-10 recession, and sales/use tax fell 5%. Scenario 1 assumes less than half of that decline, but still shows $1.1 billion in state budget deficits the next two years and leaves just $3.8 million in reserve for FY 2023.

Here are the assumptions used to adjust the budget approved last month:

— 10% decline in income tax receipts for the balance of FY 2020 and all of FY 2021 (10% below estimate for the last quarter of FY 2020 and a 10% drop in actual receipts for FY 2021).

— 3% decline in sales/use tax and all other tax receipts (same period and application as above).

— A 3% increase in all revenue for FY 2022 and FY 2023 (applied as above).

— Spending as approved for FY 2020 and FY 2021, plus caseload estimates for human services and K-12 as provided by Kansas Legislative Research Division.

— Extra costs that could occur but are not counted include but are not limited to, higher KPERS cost due to investment losses, more people qualifying for traditional Medicaid because they lost their job with employer-provided health care and extended unemployment impact on social services and unemployment claims.

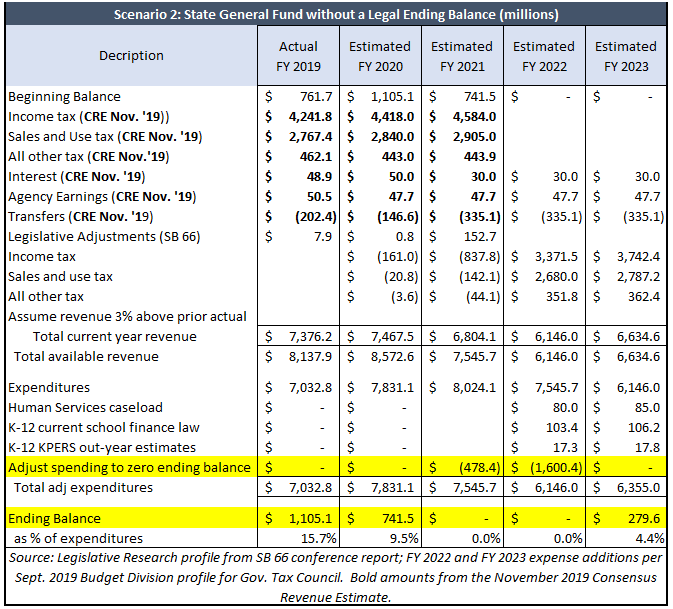

Scenario 2 closely resembles the revenue declines of the 2009-10 recession

Scenario 2 shows $2.1 billion in state budget deficits over the next two years, leaving $279.6 million in reserve by FY 2023. Here are the assumptions used to adjust the budget approved last month:

— Income Tax – 10% below estimate for the last quarter of FY 2020 and actual changes from 2009-10 recession (-12% the first year, -10% the second year, and +11% the third year)

— Sales Tax – 10% below estimate for the last quarter of FY 2020 and actual changes from 2009-10 recession (-2% the first year, -3% the second year, and +4% the third year, which excludes the impact of the sales tax increase in FY 2011)

— All other Tax – 10% below estimate for the last quarter of FY 2020 and actual changes from 2009-10 recession (-9% the first year, -12% the second year, and +3% the third year)

— All other Revenue – interest, agency earnings, and transfers for FY 2022 and FY 2023 the same as FY 2021

— Spending as approved for FY 2020 and FY 2021, plus caseload estimates for human services and K-12 as provided by Kansas Legislative Research Division.

— Extra costs that could occur but are not counted include but are not limited to, higher KPERS cost due to investment losses, more people qualifying for traditional Medicaid because they lost their job with employer-provided health care and extended unemployment impact on social services and unemployment claims.

Conclusion

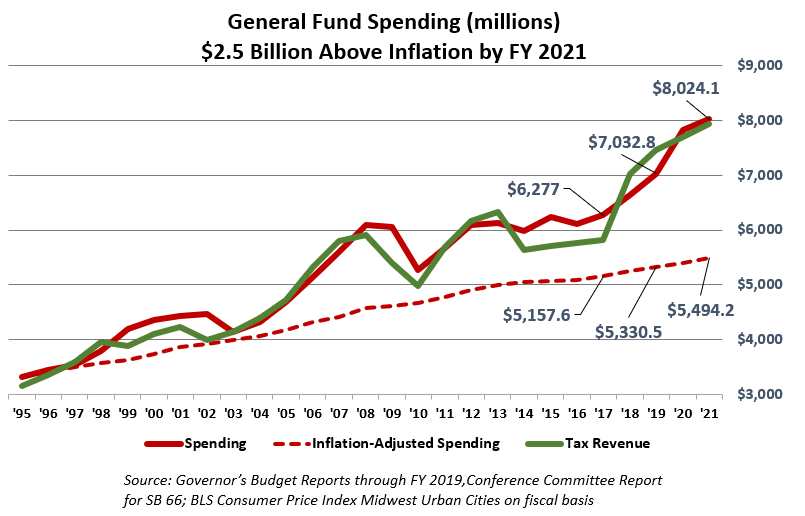

Spending was already higher than projected tax revenue this year and next, largely due to school funding increases. In fact, the budget approved for next year would be $2.5 billion higher than if adjusted for inflation since 1995.

It’s possible to successfully handle the COVID-19 economic challenges, with determination and a collective commitment to make the difficult but necessary decisions (employers and individuals are already doing).

But the longer it takes the Governor and legislators to start cutting waste and other unnecessary spending, the more likely Kansans will be facing their fourth state tax increase since 2017. This was true earlier this year, and the COVID-19 economic fallout is hastening the urgency.