Kansas school officials say the Legislature is falling short of its statutory obligation to fund special education, but it turns out that the formula doesn’t count all the money related to special education. If all the money is counted, the Legislature provided at least $323 million more than required over the last five years.

The formula does not count weightings for at-risk, bilingual, career & tech ed, transportation, and high-density at-risk, even though Deputy Commissioner Craig Neuenswander says special ed students are eligible for those weightings. It also excludes Local Option Budget (LOB) money related to special education funding. (Districts collect over $1 billion in local property tax and state equalization aid to supplement other state aid.) The LOB money related to the regular education funding for special ed students is part of the formula, but Neuenswander doesn’t know why all of the LOB money isn’t counted.

Special education funding generates LOB money based on each district’s LOB rate, which can go as high as 33%. So, a district with a 33% LOB rate that gets $1 million in special education aid also collects $333,000 in LOB money from local taxpayers because of its special education funding.

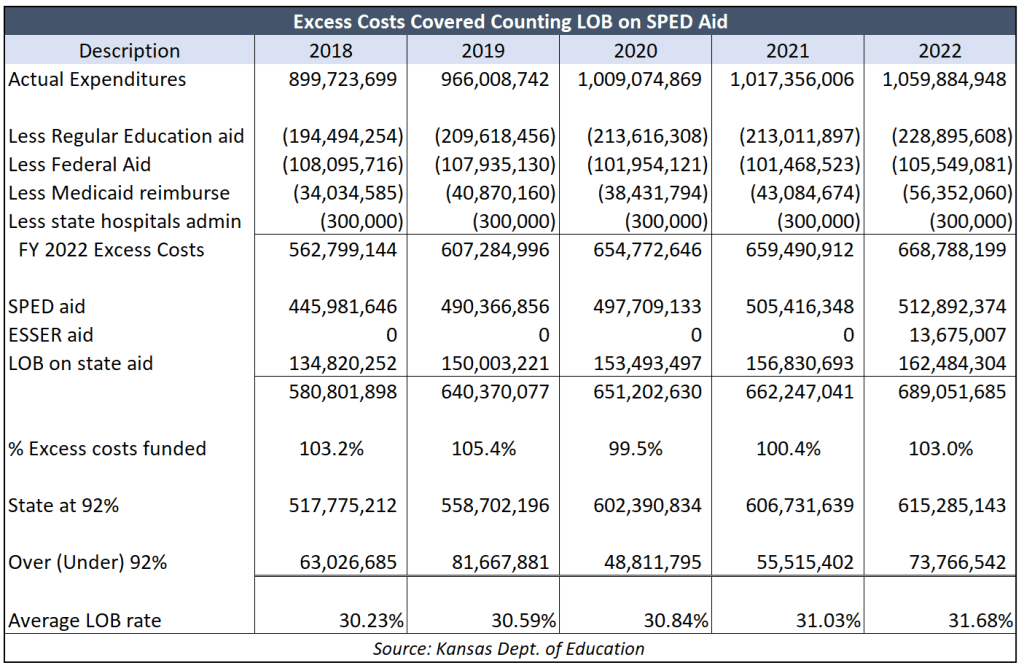

The format and the data used in the calculation below come from Neuenswander. We added a line for the LOB on special education aid, using the average LOB rates from the Department of Education. State statute sets special education funding at 92% of ‘excess costs.’ The formula deducts regular education aid for SPED students, two types of federal SPED aid, and $300,000 provided through state hospital administration from actual special education expenditures to arrive at excess costs.

For example, schools spent $1.060 billion on special education in 2022, with excess costs of $668.8 million remaining after allowance for other funding. State aid for special education was about $513 million, which generated $162 million in LOB money, and KSDE credits the state with $13.7 million in extra federal funding. (It is not clear why KSDE treated ESSER aid in this manner rather than include it with other federal aid, but this analysis follows the KSDE format.) That totals $689 million, which is 103% of schools’ excess costs and about $74 million higher than the 92% threshold.

The Legislature provided $323 million more than the 92% threshold on this basis over the last five years, and that does not include funding for the weightings excluded in the formula.

Excluding weightings and LOB money generated by special education funding was likely just an oversight, which happens from time to time. But not correcting that oversight could cost taxpayers billions in the coming years.

Kelly proposes a $973 million special education increase over five years

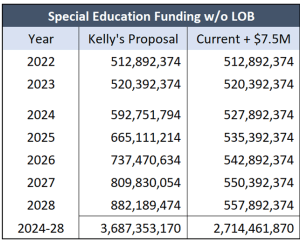

Governor Laura Kelly is proposing to increase special education funding by a little more than $72 million starting in 2024, and she would continue to increase by that amount for another four years through the 2028 school year. The compounding effect of Kelly’s proposal is much more than you might expect.

Governor Laura Kelly is proposing to increase special education funding by a little more than $72 million starting in 2024, and she would continue to increase by that amount for another four years through the 2028 school year. The compounding effect of Kelly’s proposal is much more than you might expect.

The Legislature has been increasing funding by $7.5 million per year. If that continues, taxpayers would provide $520.4 million in the 2023 school year, and that would rise to $557.9 million for the 2028 school year. So taxpayers would spend $2.7 billion between 2024 and 2028. Kelly’s proposal would cost taxpayers $973 million more.

Alternatively, adjusting the formula to count all of the money provided would save taxpayers hundreds of millions of dollars. And school districts collectively won’t be harmed because they have not been spending all of the money they’ve been getting.

Operating cash reserves jump by $227 million

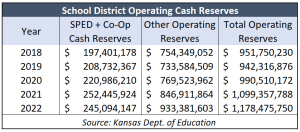

School districts had $952 million in operating cash reserves at the end of the 2018 school year; that doesn’t count money set aside for capital outlay, debt service, or federal funds. The total jumped by $227 million by the end of the 2022 school year to $1.178 billion.

Cash reserves function like your checkbook; the balance increases if you deposit more than you spend. That means most of the increase in cash reserves results from districts not spending all of the money given to them by taxpayers.

Cash reserves function like your checkbook; the balance increases if you deposit more than you spend. That means most of the increase in cash reserves results from districts not spending all of the money given to them by taxpayers.

Special education cash reserves are part of the operating total. Those balances increased by $48 million, and all other operating reserves increased by $179 million.

The evidence shows two things: the Legislature is more than meeting its obligation on school funding, and school districts don’t need more money. Total spending will exceed $17,000 per student this year.

But that won’t stop them from demanding another $1 billion from taxpayers.