Governor Sam Brownback announced this evening that he will veto legislation that would have imposed a $2.4 billion income tax increase on Kansans over a five-year period. The Governor’s announcement was made at the Kansas Chamber of Commerce annual dinner, prompting a standing ovation and thunderous applause.

Substitute for House Bill 2178, passed by the House and Senate last week, would significantly increase marginal rates, eliminate the gradual phase-out of income taxes and eliminate the exemption on pass-through income for small business. Adding insult to injury, legislators made it all retroactive to January 1, 2017. Most of the increase – $1.46 billion – would fall on individuals and the remaining $967 million comes from eliminating the pass-through exemption.

Marginal tax rates would increase on all taxpayers under the plan. The bottom bracket (up to $15,000 Single / $30,000 Married) is taxed at 2.7% in 2017 but was scheduled to drop to 2.6 percent next year. Current law taxes all income above those levels at 4.6 percent but the House measure adds a bracket. The rate on taxable income between $15,000 and $50,000 (Single) would jump 14 percent to 5.25 percent and the rate on taxable income above $50,000 would jump 18 percent to 5.45 percent. The same rate hikes apply to married filers at double the taxable income levels.

The legislation passed the House by a 76-48 margin last week and the Senate margin was 22-18. It will be sent back to the House first, where it will likely be subject to an override attempt later this week. Override in the House requires 84 votes, so 8 of those who voted against the tax increase would have to flip (or the one absent vote be cast to override) and join the 76 Representatives who voted for the tax increase to override the veto. If that were to happen, the Senate would then need 27 votes to override, which would require 5 of the 18 Senators who voted against the income tax increase to flip.

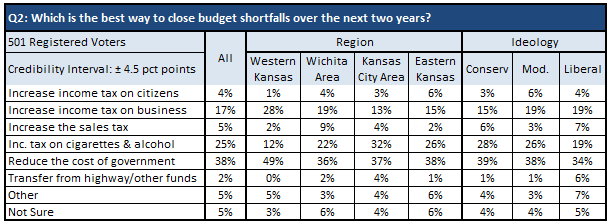

Most citizens are probably rooting for the promised veto to hold, given that only 4 percent of Kansans want a personal income tax increase to be the primary vehicle for balancing the budget over the next two years.