The KLRD’s recently released budget profile predicted a massive $3 billion ending surplus in FY 2024 even AFTER the potential tax relief from implementing a flat tax in Kansas. Even more, this doesn’t include an additional $1.6 billion in the state’s Budget Stabilization Fund. Yet, this bill and other commonsense tax reforms failed to get passed this session, leaving Kansas rolling in taxpayer cash – in particular, from higher than average state tax collections.

According to the recently released revenue numbers for April 2023, the cumulative taxes collected this far into the fiscal year is 4.9% greater than what it was at this time last year. Lower tax numbers in April 2023 were due to fewer tax processing days and the implementation of SALT Parity.

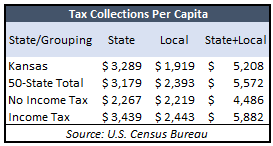

According to data from the U.S. Census Bureau and compiled in the 2023 Green Book, Kansas’s state taxes collected per capita was $3,289 in 2020. This is only tax levied by the state and doesn’t include taxes that people face at the local level. Kansas’s state tax collections per capita $110 higher than the 50-state total and a whopping $1,022 higher than the average in non-income taxing states of $2,267. In general, states that tax income had state tax collections per capita that was 52% higher than that of income taxing states like Kansas.

According to data from the U.S. Census Bureau and compiled in the 2023 Green Book, Kansas’s state taxes collected per capita was $3,289 in 2020. This is only tax levied by the state and doesn’t include taxes that people face at the local level. Kansas’s state tax collections per capita $110 higher than the 50-state total and a whopping $1,022 higher than the average in non-income taxing states of $2,267. In general, states that tax income had state tax collections per capita that was 52% higher than that of income taxing states like Kansas.

States that tax less, spend less too. Kansas spent $4,932 per resident in 2021 – $326 higher than the 50-state average of $4,606 and $2,096 higher than the non-income taxing states average of $2,836. States that taxed income spent 80% more per resident than states that don’t.

The difference is how governments chose to spend, which is in turn determined by the amount taxed. Kansas has the 12th lowest rate of government employees per capita nationwide. Not filling positions after employees naturally leave and continually evaluating the size of government are ways to start saving money.

Mitch Daniels, the former Governor of Indiana and current President of Purdue University, compared budgeting to approaching a marbled steak: there’s fat everywhere inside it, and any trimming of it makes a difference. As a result of this philosophy, under Daniels’s leadership, Purdue has maintained an 11-year freeze on tuition, making education more affordable to thousands of families. A similar approach in budgets across Kansas would save taxpayers millions over time and help keep families in the Sunflower State.

The longer real, fundamental tax reform is fumbled in the Kansas Legislature, the more Kansas continues to fall behind states like Utah, North Carolina, Tennessee, Florida, Idaho, and dozens of other states that gave back to their citizens and are seeing record growth.