This week, members of the Kansas House and Senate were in conference committees debating appropriations for the next fiscal years. Those committees involve relevant members of both chambers consolidating differences on similar bills they passed separately. The bills involved include the House substitutions for SB 169, SB 8, and HB 2184. Legislators are adjourned until the end of the month, it’s a break they take every year, and here is where things stand on the larger fiscal picture.

But, before we get there a few definitions are in order. A conference committee is where the different versions of a given bill or policy from each chamber are hashed out by members of both parties from each chamber. Once they agree to the specifics it goes back to each chamber for an up or down vote. Paying close attention, you’ll see bills listed as the “House Substitute for SB 1234,” or vice versa. This is where one chamber takes the guts out of one bill and inserts something else. Essentially creating a substitute bill that may be very similar or wildly different.

SB 169: The Big Tax Bill

Multiple different tax bills were folded into SB 169 in conference. The largest is a flat tax proposal that would apply a 5.15% flat tax starting at income above $6,150 for individual filers and $12,300 for married joint filers, replacing Kansas’s bracket tax system whose top bracket is 5.7%. The corporate rate would also decrease to 3% from a rate that varies from 4% to 7%. The cost of these combined changes would save taxpayers a total of $372.3 million by FY 2025.

Governor Kelly’s flagship proposal of eliminating the food sales tax by January 1st, 2024 also made it into the bill; current law has food sales tax being phased out over the next two years. Accelerating this policy will save taxpayers $115.5 million by FY 2024 and $122.7 million by FY 2025.

Another big piece of the bill is a phaseout of the taxation “cliff” on Social Security benefits. Kansas is ranked as the third least tax-friendly state for retirees across the entire country. Private retirement plans like IRAs, 401ks, certain Social Security benefits, and out-of-state public pensions are all fully taxed. According to IRS migration data, between 2012 and 2020, 16% of adults 26 years and older who left Kansas were 55 or older, but they accounted for 32% of the adjusted gross income loss. A complete elimination of the retirement tax would be more to keep Kansas affordable for seniors, but the cliff certainly helps for now.

In total, SB 169 tax savings would equal $302.7 million in FY 2024 and $569.3 million in FY 2025. That’s meaningful reform letting Kansans keep more of what they earn.

SB 8: Property Tax

Compared to SB 169, SB 8 totals $82.5 million in tax relief for FY 2024 and contains considerably smaller or more specific policies.

The largest section of the bill includes various adjustments to personal property tax filings, including reduced penalties for late filing, extensions of time to file in case “good cause and excusable neglect” with regard to classification and valuation, and the repeal of a prohibition of paying under protest against a valuation. These changes were likely influenced by valuation spikes this year that resulted in an average property tax increase of 6.4% despite about 57% of taxing authorities across the state not exceeding their revenue-neutral rate.

Changes to SALT Parity got folded into SB 8 as well. These would help residents who receive credits save money, however, the federal SALT limitation pressures states to reduce or not increase taxes, so SALT Parity weakens that effort.

One additional property tax bill worth mentioning out of conference is SCR 1611. This bill would limit property tax valuations to no more than 4% per annum. The bill passed the Senate and is now ready for House consideration.

HB 2184: Appropriations

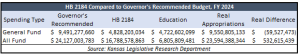

The appropriations bill that is now making its way to Governor Kelly’s desk has an FY 2024 General Fund budget that is $4.7 billion below the Governor’s Recommendation and an All Funds budget $7.3 billion below her original asks.

However, this is largely due to one component moving the Department of Education budget into a separate bill; a pretty regular occurrence in conference. So, in actuality, HB 2184’s General Fund appropriations are $59.5 million higher than the Governor’s Recommended Budget and All Funds appropriations are $532 million lower. These numbers are not set in stone and likely to change as legislators continue to go back and forth. Indeed, the final FINAL spending package will only come together after the Consensus Revenue Estimating Group gives a final revenue number to the legislature after Tax Day.

Since Kansas’s approved 2023 All Funds budget was $22.9 billion, HB 2184’s appropriations including their deferred Education numbers would total $23.6 billion, a 3% increase in spending. While this doesn’t seem like much at first, according to the Congressional Joint Economic Committee, Kansas families are still losing $718 a month from high inflation – calculated from the Bureau of Labor Statistics’ Consumer Expenditure Survey, state income, and other measures since 2021. The last thing they need is even more spending that makes its way into taxes.

Since Kansas’s approved 2023 All Funds budget was $22.9 billion, HB 2184’s appropriations including their deferred Education numbers would total $23.6 billion, a 3% increase in spending. While this doesn’t seem like much at first, according to the Congressional Joint Economic Committee, Kansas families are still losing $718 a month from high inflation – calculated from the Bureau of Labor Statistics’ Consumer Expenditure Survey, state income, and other measures since 2021. The last thing they need is even more spending that makes its way into taxes.

Kansas is swimming in taxpayer cash: in March, the state exceeded its revenue expectations by a whopping 9.4%, continuing a ridiculously long trend of high revenue returns. Only once in the last 32 months have collections NOT exceeded estimates. Meaning that the estimating process likely need some serious revision let alone that state coffers really are (excessively) full. But that isn’t a reason to keep spending more and more at the expense of families struggling to purchase the same goods as they did before. Instead, tax relief is well within the range of the budget.