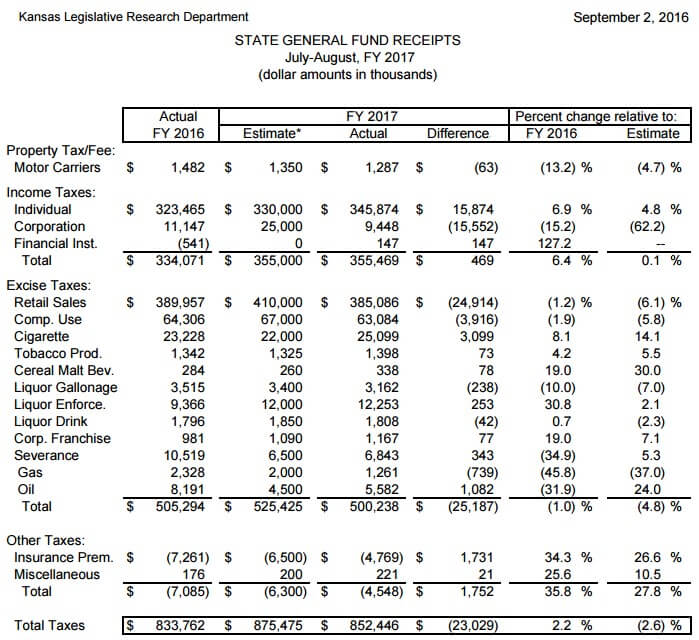

Media and special interests tend to take a tabloid headline approach to state revenues that de-emphasize or even ignores a lot of important information. For starters, individual income tax receipts are 6.9 percent higher for the first two months of this fiscal year and almost $16 million above the estimate.

Yes, total tax revenue is $23 million below the estimate but it’s still 2.2 percent higher than last year despite declining severance tax on oil and gas, which have no relationship to state tax policy. Corporate income taxes (not LLC or sub-S…just regular C-Corporations) are down 15 percent over last year and that’s not uncommon across the country, but why would anyone predict that corporate taxes would increase by 124 percent ($11.1 million to $25 million)?

The other major estimate shortfall is with retail sales tax and compensating use tax (sales tax paid on out-of-state purchases). There’s no specific action that conclusively explains the cause, but it’s not uncommon for businesses and individuals to pull back on spending when media, special interests and some legislative candidates are constantly calling for tax increases.

Citizens interested in continuing to track receipts on both a current and historic basis can do so via KansasOpenGov.org. Year-to-date general fund tax receipt data by tax type is available here. Historical data by tax type is available here. A trend line of general fund tax revenue relative to inflation each year since 1995 is available here.