Not surprisingly, 2020 is one of the worst economic-performing years in Kansas history. With massive fraudulent unemployment claims and little public communication, the Kansas Department of Labor (KDOL) seems unable to serve Kansans. Making matters worse, the latest business reports reveal the agency likely overestimated the already abysmal job growth.

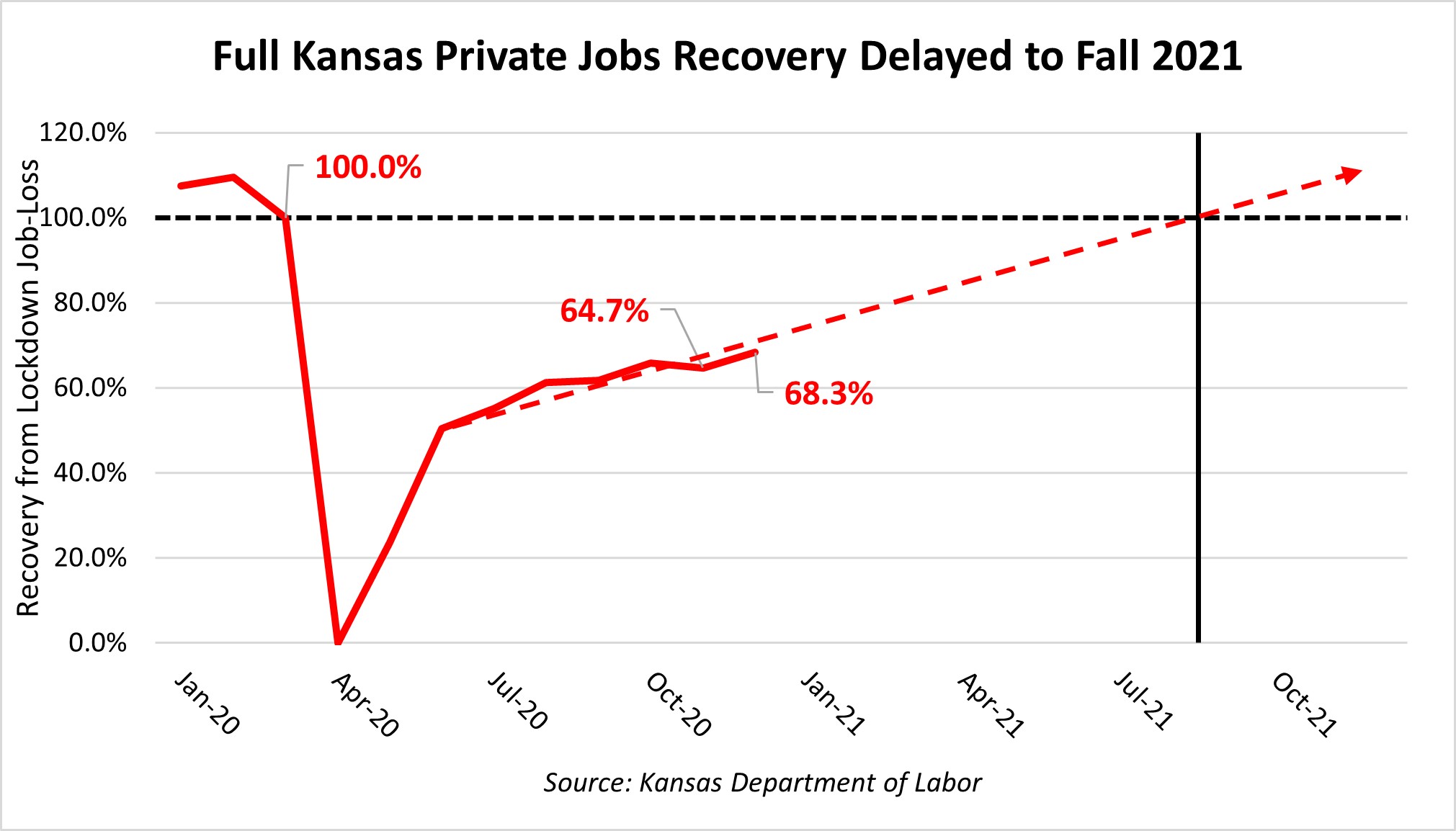

With the December labor report, Kansas is 40,000 jobs away from pre-COVID levels. However, few Kansans outside of KDOL know these job counts are, in fact, estimates. The Kansas Department of Labor predicts the job counts from the Multiple Worksite Report, a quarterly report of employment and wage data sent by roughly 95% of all Kansas businesses. As the quarterly actual jobs reports come in, KDOL will revise the initial media-reported job counts. For 2020, it seems initial job figures are rosier than what business reports provide.

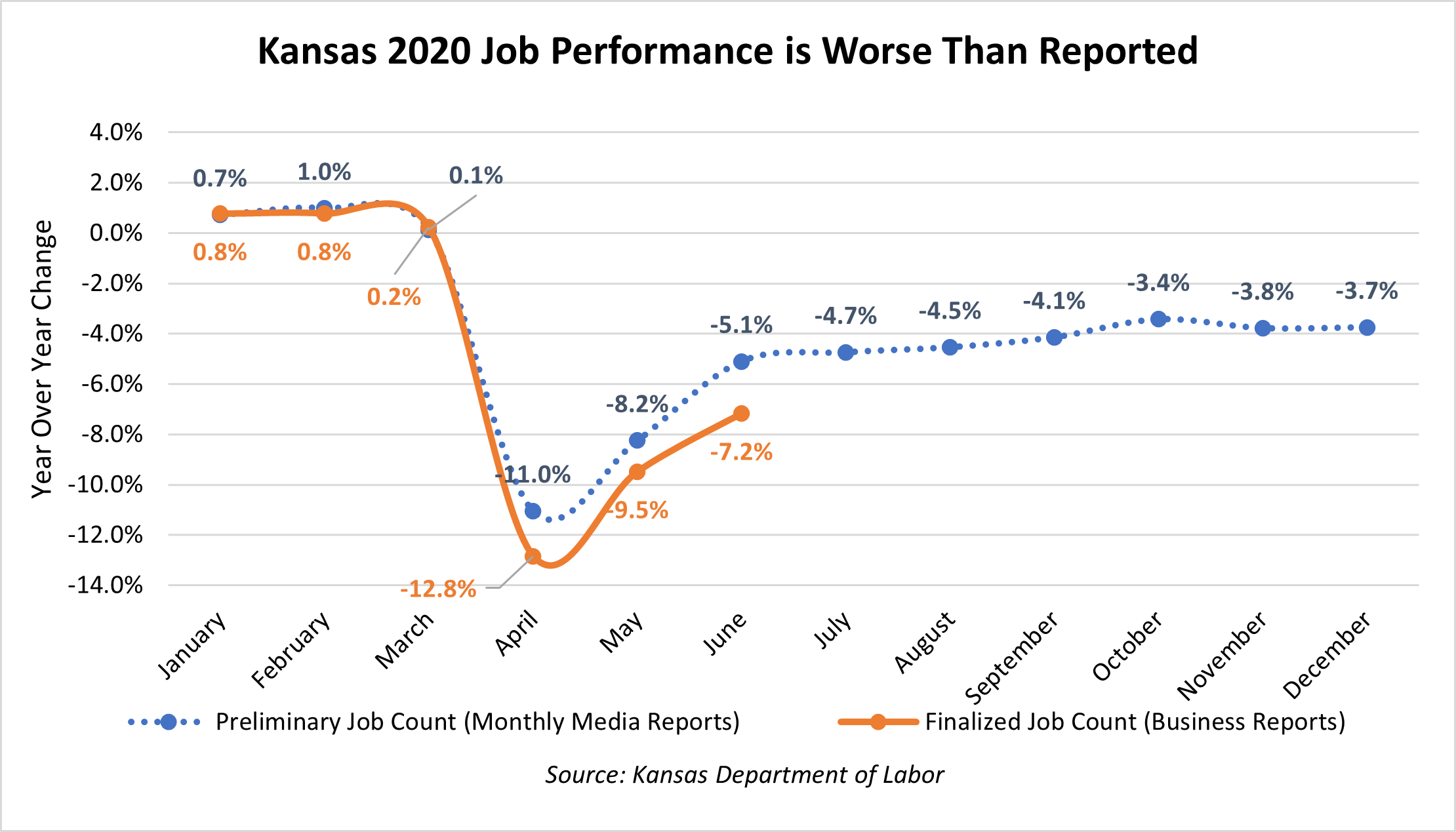

The chart below compares KDOL’s report of preliminary jobs (blue), with the finalized count of jobs from Kansas businesses (orange). For example, in the month of June, the media reported a 5.1% contraction in estimated private-sector jobs. However, when actual business employees and wage reports came in, the June contraction revealed a 7.2% decline. The final actual numbers will be available in March and we’ll know how the estimates squared with reality.

However, KDOL overestimating job growth wouldn’t be the first time it happened. In fact, this same downward revision also occurred in 2019. Gov. Kelly claimed, in her 2019 State of the State address, that Kansas gained roughly 13,000 private jobs. The truth is Kansas gained less than half that amount – the slowest job growth since 2011. If that revision happens again, the Kansas COVID recovery will take longer than initially thought. Using the preliminary estimates, Kansas will not fully recover to pre-COVID job levels until Fall 2021. The final numbers next month will show if this prediction holds true.

It’s a sad truth about the Kansas labor market. It’s also why Kansas needs a budget that prioritizes economic growth and COVID protection. Under the Balanced Budget Plan, the Kansas government can shift resources away from special interests and personal favors and more towards helping Kansans prosper. It allows roughly $85 million in income and sales tax relief. The Balanced Budget Plan also spends taxpayer funds on publicly beneficial endeavors. It is a path towards a more sustainable economy, where job growth is far more likely to meet expectations.