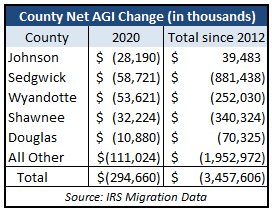

In 2020, Kansas saw nearly $295 million in Adjusted Gross Income (AGI) leave the state. This latest AGI data is from the IRS and reflects changes in their measure of gross income minus deductions, which is the basis for calculating taxes. It’s a tool to track people and their income moving from one state to another. All five of the largest counties by population in the state had net AGI losses, and in total since 2012, Kansas has had a net loss of $3.5 billion AGI because of domestic migration.

Though it had barely positive AGI migration in 2019, Johnson County lost $28.2 million due to net migration in 2020 and lost $132 million over the last five years. Of the biggest counties, Sedgwick County had both the largest AGI loss this year at $58.7 million and the largest cumulative AGI loss at $881.4 million since 2012. All other counties outside of the big five lost $110 million. Since 2012, Kansas has had a total net loss of $3.5 billion in AGI leaving the state.

Though it had barely positive AGI migration in 2019, Johnson County lost $28.2 million due to net migration in 2020 and lost $132 million over the last five years. Of the biggest counties, Sedgwick County had both the largest AGI loss this year at $58.7 million and the largest cumulative AGI loss at $881.4 million since 2012. All other counties outside of the big five lost $110 million. Since 2012, Kansas has had a total net loss of $3.5 billion in AGI leaving the state.

Kansas’s high outbound migration rates reflect decades of not being economically competitive, largely because of tax policy. A quarter of Kansas’s AGI loss is going to the nine states that don’t have an income tax compared to the 11% going to the nine states with the highest tax burdens according to the Tax Foundation. Between 2012 and 2020, 16% of the adults 26 years and older who left Kansas were 55 or older, but accounted for 32% of AGI loss: this is likely tied to Kansas being ranked the third worst state for retirees by Kiplinger and fully taxing private retirement plans like IRAs, 401ks, and certain Social Security benefits, as well as out-of-state public pensions.

The net migration problem isn’t being stopped by government subsidies. For example, between 2019 and 2021, Shawnee County’s Choose Topeka Program provided $900,000 to have 70 workers relocate to the area. This is an inconsequential dent in the net loss of 1,182 residents from Shawnee County over the same time period. The program’s projected $3.9 million alleged return on investment (no justification is provided by Shawnee County) over its three-year existence is dwarfed by the IRS migration data, which shows Shawnee County lost $32.2 million in total adjusted gross income due to net migration out of the county in 2020 alone. Not only is the migration subsidy failing to offset negative net migration of people, but the even limited economic benefits are being paid for by working-class families and are offset by those leaving the county altogether.

Two crucial push-and-pull factors for migration – cost of living and economic opportunity – are entwined with tax and spending. For instance, a $150,000 home in the Topeka School District pays $2,403.32 in property taxes each year. A home of the same value in Salt Lake City pays only $975 in property taxes, and in Nashville, $1,035. Between 1997 and 2021, property taxes in Shawnee County increased by 164.8% while the population grew by only 3.5% and inflation was 61%. High taxation is caused by high spending too: according to a 2018 KPI study of county budgets, Shawnee County spent $833 per resident while nearby Douglas County only spent $655. More efficient operations and budgeting is key to lowering the burden of the government on people and businesses. Things like zoning reform for affordable housing or petitioning state legislators to make tax agreements for remote workers easier are two ways to approach the same issues as Choose Topeka without wasting thousands of dollars.

Kansas is falling farther behind by “staying in the same place” with taxation and its economy relative to other, more competitive states. Taking a serious stance towards reducing the burden of government and the cost of living could help keep families in Kansas in the long run.