With just 12 days to go before the revenue-neutral rate property tax hearings will begin, over half of the taxing entities that have responded to KORA requests from Kansas Policy Institute are not raising property taxes this year. But as of today, 61 counties have not provided information in response to our Open Records requests filed last month. While most of those who responded contained all of a country’s taxing entities, some counties didn’t provide the information for all of its entities.

According to the Truth in Taxation law passed in 2021, taxing entities that want to collect more property tax next year than is budgeted this year must notify taxpayers of their intent to do so, including the percentage increase above revenue-neutral, and the time, date, and location of a public. Reports were to be filed with the county clerk by July 20th, and all hearings must occur between August 20th and September 20th.

Many large counties haven’t reported

Just over half of the 1,499 entities reporting thus far are not exceeding the revenue-neutral rate. That leaves about 2,173, or just under 60%, taxing authorities outstanding.

A few of the largest counties, like Johnson, Douglas, Reno, and Leavenworth have provided the RNR hearing information but many have not. Large counties not reporting include Sedgwick, Wyandotte, Shawnee, and Riley.

Information on the counties that have responded is posted to KansasOpenGov.org and will be updated as more counties report.

Don’t be fooled by claims of cutting a mill rate

Many local officials try to fool citizens into believing they are cutting property tax by directing attention to changes in the mill rate, while valuation increases still give them a big property tax hike. For example, the City of Shawnee announced a property tax “cut” of two mills, but taxes are still going up by 2.6% on average because of valuation changes.

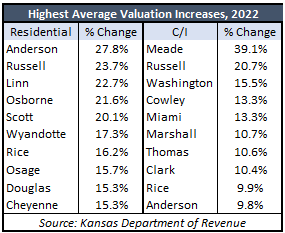

According to data from the Kansas Department of Revenue, the average residential value for existing properties jumped 11% this year and it is significantly higher in many counties. Anderson County home values jumped 28%; others with large increases include Scott (20%), Osborne (21%), Wyandotte (17%), Douglas (15%), Linn (23%), Russell (23%), and Miami (15%). The nearby table shows the counties with the ten highest percentage increases in average residential value and average commercial and industrial value for existing buildings.

According to data from the Kansas Department of Revenue, the average residential value for existing properties jumped 11% this year and it is significantly higher in many counties. Anderson County home values jumped 28%; others with large increases include Scott (20%), Osborne (21%), Wyandotte (17%), Douglas (15%), Linn (23%), Russell (23%), and Miami (15%). The nearby table shows the counties with the ten highest percentage increases in average residential value and average commercial and industrial value for existing buildings.

Truth in Taxation has the potential to save citizens hundreds of millions of dollars through the simple tool of honesty. But it also depends on communication between citizens and their communities about spending and the “why” behind tax hikes.