The annual ritual of universities making sad-faced announcements of tuition increases and blaming them on state funding cuts took place last week. And in keeping with tradition, media abandoned basic journalistic principles and basically functioned as the Regent’s press office.

Media didn’t question whether university tuition increases could be partially or fully avoided (they can) or attempt to put anything in context that would upset the narrative – perhaps because doing so would (a) require a bit of investigative work and (b) undermine the media collective opinion that state tax policy and/or stingy legislators (one hoot of an oxymoron) are to blame.

University Tuition Increases Can Be Avoided

The Governor’s Budget Report as amended by the Conference Committee Report budget summary from Legislative Research shows funding for the six state universities is flat over the next two years; it declines by 0.9 percent in FY 2018 and increases by 0.9 percent in FY 2019. If inflation continues at its current pace (1.4 percent for the current fiscal year), universities could conceivably have to deal with a 2.3 percent differential next year (small state funding decline plus inflation) but the tuition hikes are notably between 2.5 percent and 2.9 percent.

The first question media should ask is simple: “Taxpayers and employers routinely have to find ways to operate about 2 percent more efficiently, so why can’t universities do that?” Doing so would prompt a mix of indignation and pearl-clutching so it’s just not done in polite government company, but universities have been known to waste a buck or two.

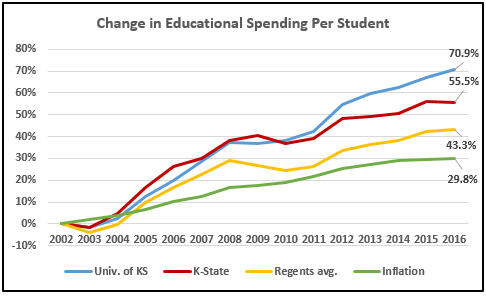

Data from the Regents annual reports certainly shows per-student spending has exceeded inflation over recent years. The University of Kansas increased spending by 71 percent between 2002 and 2016 while inflation was just 30 percent. K-State also spent well in excess of inflation, with a 55 percent jump. Wichita State and Pittsburg State were just above inflation at 31 percent, Emporia State was 29 percent and Fort Hays State actually reduced costs by 20 percent) but collectively, the six universities’ costs went up by 43 percent.

Educational spending as defined by the Regents does not include scholarships, research, maintenance, public service and other costs; inflation is the Consumer Price Index for Midwest Urban Cities on a fiscal year basis.

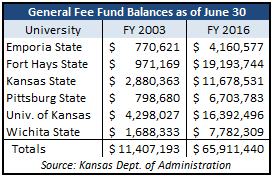

Here’s another good question media ignored: “Why not use excess tuition collected in prior years that’s still sitting in the bank?”

Tuition is deposited in a special fund that can be  tracked annually and KPI publishes the balances each year on KansasOpenGov.org. Government funds operate just like a checkbook, so increasing annual balances means more money has been collected than spent. The six universities collectively had $11.4 million of unspent tuition money on June 30, 2003 but the total ballooned to $65.9 million by June 30, 2016. It would only require $5.6 million to cover an inflationary increase in state funding so universities could easily avoid tuition increases by using just a little bit of money students already paid.

tracked annually and KPI publishes the balances each year on KansasOpenGov.org. Government funds operate just like a checkbook, so increasing annual balances means more money has been collected than spent. The six universities collectively had $11.4 million of unspent tuition money on June 30, 2003 but the total ballooned to $65.9 million by June 30, 2016. It would only require $5.6 million to cover an inflationary increase in state funding so universities could easily avoid tuition increases by using just a little bit of money students already paid.

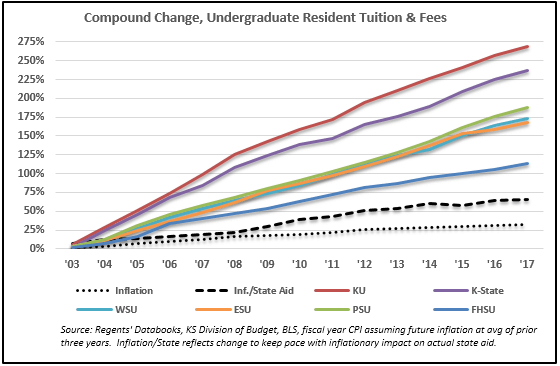

Excessive Tuition Hikes

University of Kansas Chancellor Bernadette Gray-Little told the Board of Regents, “We don’t want to keep students away because of the tuition” but her actions say otherwise. Adjusting tuition and fees for inflation and a small decline in state funding since 2002 would have produced a 65 percent increase through the current year, but KU went up more than four times that amount, hiking tuition and fees by 268 percent! K-State was almost as unfriendly to students and parents, with a 236 percent increase. The smallest increase, 114 percent at Fort Hays State, was still far more than necessary to keep up with inflation.

Unnecessary and excessive university tuition hikes is just another sad example of government putting its own interests ahead of citizens and students, with the full support of a sympathetic media.

Unnecessary and excessive university tuition hikes is just another sad example of government putting its own interests ahead of citizens and students, with the full support of a sympathetic media.