Articles Filtered By:

State Budget

Tax Expenditure Limits Prevent Government’s Balancing Act

September 17, 2021KDOR Misleads Lawmakers to Justify Kelly Tax Relief Veto

April 19, 2021

The real cost of Government “free stuff”

February 25, 2021

Kansas RELIEF Act can spur COVID Recovery

February 15, 2021

2021 Legislator Briefing Book

January 14, 2021

Kelly’s budget raises taxes during recession

January 14, 2021A Kansas Budget for Economic Growth & COVID Protection

January 4, 2021

Legislature could turn incoming fiscal shortfall into savings

November 18, 2020Reversing years of Kansas fiscal mismanagement

November 9, 2020

In one month, 25,000 Kansans quit job hunting

October 21, 2020

Federal bailouts of state budgets hasten fiscal disaster

September 16, 2020Gov. Kelly plays politics with federal unemployment relief

August 24, 2020

Unemployed Kansans surpass no-lockdown states

July 28, 2020Lawmakers can serve Kansans without Medicaid Expansion

February 10, 2020

Gov. Kelly’s 2020 budget: Five things you should know

January 20, 2020Gov. Kelly promotes flawed “Three-Legged Stool” tax policy

December 10, 2019Kansas economy ranks 49th as government grows

November 26, 2019

Kansas deficit-spends into a billion dollar hole

October 10, 2019

Kansas out-migration creates U-Haul shortages

October 2, 2019

The truth about county spending; there’s room to cut

September 23, 2019

Budget deficit remains as recession fears grow

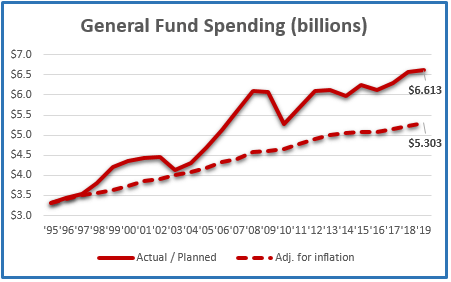

August 26, 2019Three Signs of Kansas Government Growth

July 11, 2019More State Funding Won’t Stop Tuition Hikes

May 28, 2019New county data underscores struggling Kansas economy

March 25, 2019Solving the Kansas Budget Crisis

March 7, 2019It’s Official: Governor’s Budget Sets Up A $1.3 Billion Tax Increase

February 19, 2019Are Kansans Preparing For More Tax Increases?

February 8, 2019No Oversight for Kansas Discretionary Spending

February 5, 2019Medicaid Expansion Attracts Tax & Spend Philosophy

February 4, 2019Governor’s Budget is Not Structurally Balanced

January 22, 20192019 Legislator’s Budget Guide: Reversing The Kansas Exodus

January 4, 20192019 Legislator’s Budget Guide: Economic Development Needs Reform

December 19, 2018November FY 2019: Sales Tax Stalls For Five Straight Months

December 3, 2018

2019 Legislator’s Budget Guide

November 28, 2018Reports of Budget Surplus Ignore Imbalance

November 15, 2018October 2018 Report Shows Trend of Sales Tax Struggling

November 1, 2018Kansas Ranked 15th in Economic Freedom

October 30, 2018

Kansas Freedom Index provides legislative transparency

October 22, 2018Reverse long-term economic stagnation

October 8, 2018Politicians are ignoring a $3.7 billion revenue shortfall

September 17, 2018

2018 Voter Issue Guide

September 10, 2018$2 billion 2017 Kansas payroll online

April 20, 2018School funding plan requires big tax hike

April 5, 2018Are you ready for another tax increase?

September 11, 2017

Kansas Legislature Broke a Lot of Promises

June 15, 2017$11 Billion School Debt Exceeds State Debt

June 5, 2017Fake news in Kansas promotes political agenda

March 28, 20172016 State Payroll 3% Above 2013 Level

March 27, 2017Kansas budget can be balanced without tax hikes

February 28, 2017Efficient, Effective Spending Keeps Taxes Low

February 26, 2017Kansas House passes $2.4 billion income tax increase

February 16, 2017Kansas income tax hike rejected by citizens

February 8, 2017Most Kansas legislators won’t declare their principles

January 30, 2017Kansas tax proposal endorses government favoritism

January 20, 2017Brownback’s budget proposal pretty good overall

January 12, 2017Coverage of proposed $820 million tax hike loaded with media bias

December 27, 2016$820 million tax hike not necessary

December 11, 2016Legislative leadership moving Left in Kansas

December 6, 2016Move Revenue Estimates from April to May

November 15, 2016States That Spend Less Tax Less

November 4, 2016$1.45 Billion tax hike or broken promises coming in January

September 12, 2016Duane Goossen: Do as I say, not as I did

May 25, 2016Option 4: Soak the Poor

May 7, 2016

2016 Green Book

March 7, 2016

Houston, we have a spending problem

February 20, 2016Scare tactics and false choices: just another Tuesday at KCEG

February 17, 2016Supreme Court ruling on equity creates challenges and opportunity

February 12, 2016

2015 Kansas Budget Wrap-up

June 22, 2015

Kansas Budget Documentary Short on Facts

April 16, 2015Major Structural Deficits Looming in Kansas

December 1, 2011