Kansas is seeing a significant outmigration of families and businesses for destinations with more friendly tax climates, and the Adjusted Gross Income loss is even worse. As documented in our 2022 Green Book, U.S. Census data shows that Kansas is the 39th worst in total domestic migration since 2000, with a net loss of 185,509 residents out of the state over the last two decades. Retirees and those approaching retirement have been leaving for low-tax states in increasing numbers, too.

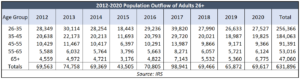

IRS annual migration data has an even more alarming trend. Between 2012 and 2020, 16% of adults 26 years and older who left Kansas were 55 or older, but they accounted for 32% of the adjusted gross income loss.

The income loss trend is also getting worse. The average loss over the period is 32%, but the losses for 2019 and 2020 were above the average, at 36% and 34%, respectively. Also, the average AGI loss in dollars for adults 55+ since 2016 is 37% higher than the 2012-2015 average ($785 million vs. $571 million).

The income loss trend is also getting worse. The average loss over the period is 32%, but the losses for 2019 and 2020 were above the average, at 36% and 34%, respectively. Also, the average AGI loss in dollars for adults 55+ since 2016 is 37% higher than the 2012-2015 average ($785 million vs. $571 million).

A big reason for this is Kansas’s unfriendly tax code, especially for retirees. According to Kiplinger, Kansas is ranked as the third least tax-friendly state for retirees across the entire country. Private retirement plans like IRAs, 401ks, certain Social Security benefits, and out-of-state public pensions are all fully taxed, though public sector pensions are not.

A big reason for this is Kansas’s unfriendly tax code, especially for retirees. According to Kiplinger, Kansas is ranked as the third least tax-friendly state for retirees across the entire country. Private retirement plans like IRAs, 401ks, certain Social Security benefits, and out-of-state public pensions are all fully taxed, though public sector pensions are not.

The IRS data also shows that only 11% of the AGI loss is going to the nine states deemed to have the highest state and local tax burden by the Tax Foundation, but a quarter of the loss goes to the nine states that don’t have an income tax; seven other low-tax states account for 34% of the total AGI loss.

This data underscores the need to reduce the tax burden on retirees. Recent proposals to phase out this tax would help, which is why KPI requested the introduction of legislation to exempt retirement income in January 2021. Reducing the tax burden will help keep people and their families in the Sunflower State.