“Where the Buffaloed Roam – An Ode to the Kansas Budget,” a film by Louisburg High School student Carson Tappan, is being featured at the Kansas City Film Festival. It is billed as a ‘documentary’ but in reality, it merely presents a political viewpoint that doesn’t let facts get in the way of the story it wants to tell.

Mr. Tappan is to be commended for tackling the project and it is heartening to see a high school student take an interest in state budget issues. He deserves an “A” for initiative and creativity but he fails in his goal to “make the problem clean and simple.” I agreed to be interviewed for the film and provided Mr. Tappan with a great deal of data, some of which contradicts claims made by other participants but he chose not to use it.

I recently asked Mr. Tappan why he excluded pertinent facts I provided and he wrote back saying, “I did not exclude any facts that you provided, the interview was too long to keep it in its entirety.” But as explained later in this piece, he did indeed exclude facts that contradict one of his own contentions.

Mr. Tappan and other participants in the film are certainly entitled to their opinion, and healthy discussions of alternate views are productive. Different opinions can be evenly presented in a documentary format but “Where the Buffaloed Roam” goes out of its way to ridicule those who don’t agree with its premise that reducing taxes is a bad idea.

The film takes the position that states like Texas and Florida can manage without an income tax because they have oil and tourism revenue, but that is not the reason. Texas, for example, could have all of the oil revenue in the nation and still have a high tax burden if it spent more. Every state provides the same basket of basic services (education, social service, etc.) but some states do so at a much lower cost and pass the savings on in the form of lower taxes.

The film takes the position that states like Texas and Florida can manage without an income tax because they have oil and tourism revenue, but that is not the reason. Texas, for example, could have all of the oil revenue in the nation and still have a high tax burden if it spent more. Every state provides the same basket of basic services (education, social service, etc.) but some states do so at a much lower cost and pass the savings on in the form of lower taxes.

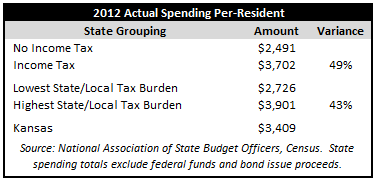

In 2012, the states that tax income spent 49 percent more per-resident providing services than the states without an income tax, and they don’t do it by pushing spending to local government; the ten states with the highest combined state and local tax burden spent 43 percent more per resident than the ten states with the lowest burdens. Kansas, by the way, spent 37 percent more per resident than the states without an income tax.

While Kansas spent $3,409 per resident, Texas only spent $2,293 and Florida spent just $1,862 per resident. Small states also spent less; New Hampshire (which doesn’t have an income tax or a state sales tax) spent just $2,455 per resident. States that spend less, tax less.

The ‘oil and tourism’ objection is common so I gave this information to Mr. Tappan and discussed it in the interview. He didn’t just ignore those facts…he actually made the ‘oil and tourism’ argument.

The ‘clean and simple’ explanation of the Kansas budget is that spending wasn’t adjusted when taxes were reduced. Regardless of whether legislators agreed with tax reform, they and Governor Brownback should have reduced the cost of government. Instead, they succumbed to pressure from the bureaucracy and special interests and continue to increase spending. General Fund spending will set a new record this year and is proposed to rise even higher over the next two years.

Let’s put that in perspective. Kansas’ 2012 spending of $6.098 billion was 37 percent higher than the per-resident spending of states without an income tax. This year Kansas is expected to spend $191.5 million more than in 2012 and the budgets under consideration in the Legislature will add another $210.1 million in the next two years.

Kansas doesn’t need to be as efficient as states with low taxes to balance the budget…the state just needs to operate a few percentage points better. Ask legislators or Governor Brownback if government operates efficiently and they will say, “of course not.” Then ask what they are going to do about it. This year, as in the past, the majority would rather raise taxes unnecessarily than stand up to the bureaucracy and special interests that profit from excess government spending. That is the clean and simple explanation of what is wrong with the Kansas budget.

Former state budget director Duane Goossen tells a different story (but still won’t debate us in public where he can be called out). He said revenue dropped three straight years during the recent recession and it appeared that revenue would decline for a fourth year, which prompted a sales tax increase that he attributes for the revenue turnaround. But that’s not exactly true. Mr. Goossen talked about tax revenue declines before carefully shifting to a discussion of revenue declines. Most people, and probably Mr. Tappan, wouldn’t catch that nuance but Mr. Goossen knows exactly what he was doing.

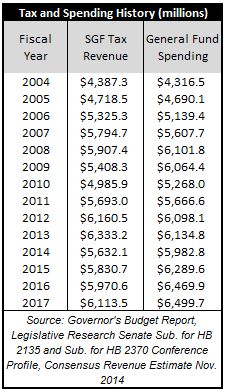

As shown in the above table, tax revenue only declined two years during the recession, in 2009 and 2010. Total revenue did decline a third year and was projected down a fourth year but that was because of conscious decisions made by legislators to transfer tax money out of the General Fund. The November 2009 Consensus Revenue Estimate predicted that tax revenues would increase for 2011, from $5.192 billion to $5.324 billion, and that estimate did not consider any sales tax increase. Mr. Gossen is simply pushing a notion that tax increases are necessary. Or, maybe tax increases are Mr. Gossen’s preference but he would rather distract his interlocutor with obfuscation than simply state his true goal.

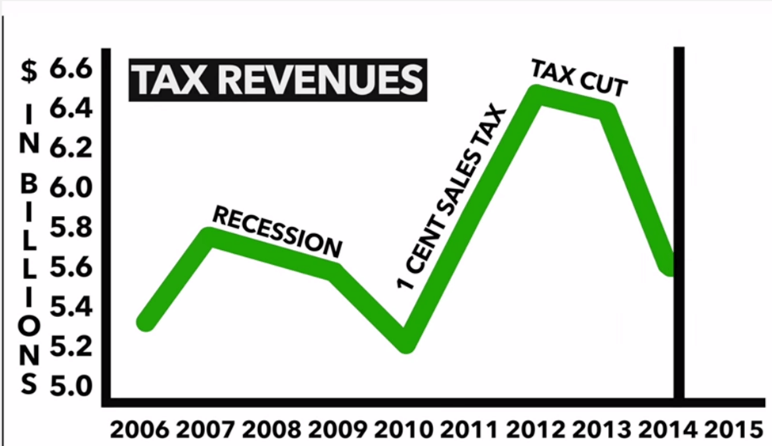

This tax revenue chart that appears in the film clearly attributes tax revenue growth between 2010 and 2012 to the 1 cent sales tax that began July 1, 2010 (it’s unknown whether Mr. Goossen or Mr. Tappan prepared it because there is no sourcing). But this chart is yet another misrepresentation of the facts.

This tax revenue chart that appears in the film clearly attributes tax revenue growth between 2010 and 2012 to the 1 cent sales tax that began July 1, 2010 (it’s unknown whether Mr. Goossen or Mr. Tappan prepared it because there is no sourcing). But this chart is yet another misrepresentation of the facts.

Data readily available from the Kansas Legislative Research Department shows that income taxes and other tax sources also increased in 2011 and 2012. Income tax revenue increased by $560 million over the two years while retail sales taxes grew by $490 million and all other General Fund taxes increased by $125 million.

Kansas certainly has a spending problem but tax revenue is actually running well ahead of inflation…even after income taxes were reduced. General Fund tax revenue increased 28 percent between 2004 and 2014 while inflation was only 24 percent. The November 2014 Consensus Revenue Estimate shows that tax revenue will continue to stay well ahead of inflation (assuming inflation continues at its current pace. Tax revenue in 2017 would be 39 percent higher than 2004 but inflation would be 29 percent higher (again, assuming inflation maintains its current pace.)

The film also contains a number of false claims about school funding. Heather Ousley, who is a member of an organization that actively campaigns for the defeat of legislative candidates who do not subscribe to the ‘just spend more’ philosophy of school funding, repeatedly claimed that schools are being defunded. She also repeats the mantra that schools are being defunded so that public education can be privatized; she may believe that but having spent a lot of time working with legislators, I know that to be a false assumption. Defenders of the status quo are fond of repeating the mantra, but it is nothing more than a scare tactic.

Schools are not being defunded and Mr. Tappan was provided with data from the Kansas Department of Revenue that contradicts claims made in the film. Again, he chose not to use that information. In reality, school funding will set a fourth consecutive record this year at $6.145 billion. On a per-pupil basis, it’s $13,343 and will be the third consecutive record. The facts are explained in greater detail in another blog post, which also shows that state funding is increasing this year under the new block grants.

There are other examples of factual inaccuracy in the film, but hopefully those set forth here sufficiently demonstrate that “Where the Buffaloed Roam” is not the documentary it purports to be but an artfully designed political statement.

Those who agree with the film’s position are certainly entitled to their view. They should just be honest and say that they prefer higher taxes and the high spending that goes with it.

Note: KPI staff members Patrick Parkes and David Dorsey deserve credit for much of the research in this blog post.