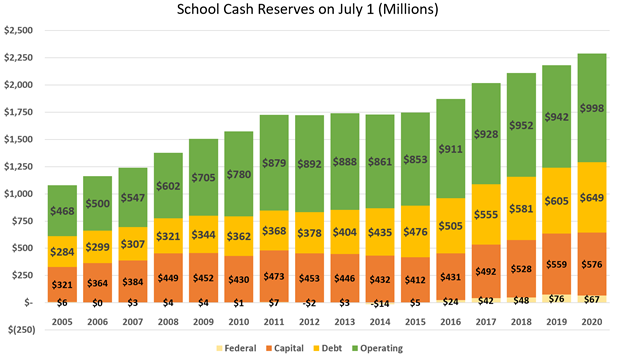

[vc_row][vc_column][vc_column_text]In yet another affront to students and taxpayers, school districts increased cash reserves by $107 million last year, setting a new record of $2.3 billion. The largest portion, operating cash reserves, increased from $942 million to $998 million. Cash set aside for debt payments went from $605 million to $649 million, capital outlay reserves increased from $559 million to $576 million, and federal cash declined slightly from $76 million to $67 million.

The majority of school districts – 172 out of 286 – increased their operating cash reserves last year.

It’s become an annual ritual akin to The Emperor’s New Clothes fable. School districts plead poverty and get funding increases but use some of the tax money they receive to increase cash reserves; media is well aware of the sham but, just like the adults pretending to see fabulous new clothes on the naked emperor, they ignore the affront to taxpayers and students.

It’s become an annual ritual akin to The Emperor’s New Clothes fable. School districts plead poverty and get funding increases but use some of the tax money they receive to increase cash reserves; media is well aware of the sham but, just like the adults pretending to see fabulous new clothes on the naked emperor, they ignore the affront to taxpayers and students.

Districts’ operating cash reserves more than doubled since 2005, going from $468 million to $998 million, and most of the $530 million increase represents unspent state and local tax dollars. And while districts were padding their bank accounts, they told parents they didn’t have enough money to educate students. They told teachers they lacked the money to properly compensate them or reimburse them for classroom supplies. And they tearfully told courts they were woefully underfunded.

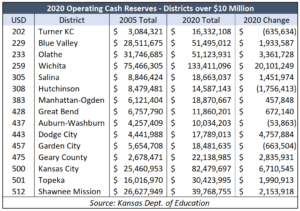

Even in the affluent Blue Valley school district, students have been denied services for dyslexia on the pretense of lack of funding while the district almost doubled operating cash reserves, going from $28.5 million in 2005 to $51.1 million last year.

Fifteen districts have more than $10 million in reserve. USD 259 Wichita has the most, at $133.4 million; they boosted reserves by $20.1 million last year. Wichita was one of the lead plaintiffs that sued for additional funding, and two of the other three plaintiffs also padded reserves last year.

Fifteen districts have more than $10 million in reserve. USD 259 Wichita has the most, at $133.4 million; they boosted reserves by $20.1 million last year. Wichita was one of the lead plaintiffs that sued for additional funding, and two of the other three plaintiffs also padded reserves last year.

USD 500 Kansas City increased cash reserves by $6.7 million, boosting their total to $82.5 million. USD 443 Dodge City finished the year with $17.8 million in operating reserves, up $4.8 million from the prior year. USD 308 Hutchinson reduced operating reserves by $1.8 million but still has $14.6 million left over.

Complete lists of districts’ cash reserves are on KansasOpenGov.org, by fund, by major category, and charts showing trends since 2005.

School officials should reduce property taxes

School districts with excess cash reserves could choose to reduce their Local Option Budget property tax and give taxpayers some much-needed relief.

They could also reduce the local property tax collected for Capital Outlay, which was budgeted to bring in about $329 million last year. Eliminating the Capital Outlay tax, even for just one year, would take as much as eight mills off property tax bills.

They could also reduce the local property tax collected for Capital Outlay, which was budgeted to bring in about $329 million last year. Eliminating the Capital Outlay tax, even for just one year, would take as much as eight mills off property tax bills.

Property tax for education, which includes community colleges, increased by 142% between 1997 and 2019. That’s almost three times the rate of inflation, which was 52%.

With many businesses and individuals struggling in reaction to government-imposed COVID shutdowns, a little property tax relief from cash-rich school districts is in order.[/vc_column_text][/vc_column][/vc_row]