The Kansas Supreme Court’s recent Gannon school funding ruling, if endorsed by legislators, would cause devastating tax hikes on top of record-setting tax increases just passed. The Court cited vast differences between the new money appropriated by the Legislature ($293 million more in FY 2019) and the amount demanded by school districts (at least $1.7 billion) and the State Board of Education ($893 million).[i] While the Court’s own March 2014 opinion said adequacy is measured not by the total amount spent but whether funding is reasonably calculated so that students can meet specific (Rose) standards, it now seems focused on going back to hitting some arbitrary dollar amount demanded by the education lobby.

One way of doing so would be to cut other General Fund expenditures. The FY 2019 General Fund budget of $6.609 billion includes $3.82 billion for public education and $3.198 billion for everything else.[ii] Giving schools another $600 million as demanded by the State Board of Education (SBOE) would require an 18 percent funding reduction for non-K-12 expenditures or a 43 percent reduction to meet school districts’ incremental demand of another $1.4 billion.

Paying the Court’s ransom (i.e., give them what they want or they will close schools and deprive every child of their constitutional right to education) with a tax increase would devastate citizens and the economy. The state-mandated 20 mills of property tax would have to be increased to 39.5 mills to satisfy SBOE and district demands would require a jump to 66 mills. [iii] For perspective, a house valued at $200,000 would pay $449 more per year to meet the SBOE demand or $1,058 more to meet the schools’ demands; commercial property valued at $1 million would pay $4,875 more and $11,500 more, respectively.

Paying the Court’s ransom (i.e., give them what they want or they will close schools and deprive every child of their constitutional right to education) with a tax increase would devastate citizens and the economy. The state-mandated 20 mills of property tax would have to be increased to 39.5 mills to satisfy SBOE and district demands would require a jump to 66 mills. [iii] For perspective, a house valued at $200,000 would pay $449 more per year to meet the SBOE demand or $1,058 more to meet the schools’ demands; commercial property valued at $1 million would pay $4,875 more and $11,500 more, respectively.

The Kansas Department of Revenue says a 0.1 change in the state sales tax rate generates $44 million, so funding the SBOE demand with sales tax would take the rate from 6.5 percent to 7.9 percent; meeting district demands would require a rate of 9.6 percent. According to the Tax Foundation’s most recent rankings, Kansas would have the highest state and state/local combined sales tax rates in the nation in both scenarios.[iv]

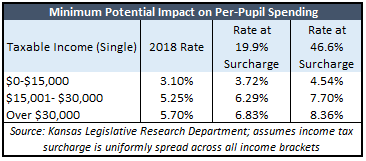

Kansas Legislative Research Department says a 19.9 percent personal income tax surcharge would be needed to produce $600 million more under the SBOE demand and the districts’ demand of an additional $1.4 billion would require a 46.6 percent surcharge.[v] The Legislature would have multiple options to distribute the surcharge but doing so uniformly to all tax rates in order to meet the SBOE demand would take the bottom rate from 3.1 percent to 3.72 percent for taxable income below $15,000 (Single); the rate on the next $15,000 would go from 5.25 percent to 6.29 percent and income over $30,000 would be taxed at 6.83 percent instead of 5.7 percent. Uniformly applying the surcharge to meet district demands would take the rates to 4.54 percent, 7.7 percent and 8.36 percent, respectively.

Kansas Legislative Research Department says a 19.9 percent personal income tax surcharge would be needed to produce $600 million more under the SBOE demand and the districts’ demand of an additional $1.4 billion would require a 46.6 percent surcharge.[v] The Legislature would have multiple options to distribute the surcharge but doing so uniformly to all tax rates in order to meet the SBOE demand would take the bottom rate from 3.1 percent to 3.72 percent for taxable income below $15,000 (Single); the rate on the next $15,000 would go from 5.25 percent to 6.29 percent and income over $30,000 would be taxed at 6.83 percent instead of 5.7 percent. Uniformly applying the surcharge to meet district demands would take the rates to 4.54 percent, 7.7 percent and 8.36 percent, respectively.

Marginal rates under both scenarios would be the highest in state history.

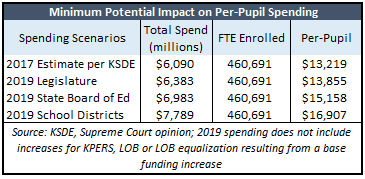

How this school funding ruling might  translate into per-pupil funding depends upon the degree to which districts raise local option budgets (as they did under Montoy) and the portion of new spending going to employee pay (which causes KPERS pension payments to increase). But just counting the new state money already identified and assuming no change in local or federal funding, the total would exceed $15,000 per-student under the SBOE demand and the districts’ demand would take funding to $16,907.

translate into per-pupil funding depends upon the degree to which districts raise local option budgets (as they did under Montoy) and the portion of new spending going to employee pay (which causes KPERS pension payments to increase). But just counting the new state money already identified and assuming no change in local or federal funding, the total would exceed $15,000 per-student under the SBOE demand and the districts’ demand would take funding to $16,907.

Of course, neither scenario would do anything to help students. Despite billions more spent over the years in Kansas, proficiency levels remain relatively low and unchanged; only about a quarter of low income students are proficient in Reading and Math (NAEP) and just about half of all other students. Even researchers who believe there is some degree of correlation between spending more and improving outcomes admit that spending more doesn’t cause anything to change; it’s how money is spent that can make a difference rather than the amount spent.

The Court’s school funding ruling and the position of the education lobby is all about money and demonstrates no real interest in improving outcomes. They just want a big bag of money with no strings attached.

_________________________________________________________

[i] Gannon v. State of Kansas, October 2, 2017 Supreme Court opinion, page 43.

[ii] July Comparison Report, Kansas Division of the Budget. Schedule 2.2

[iii] Per KSDE, 20 mills of property tax generated $613.9 million for FY 2017.

[iv] https://taxfoundation.org/state-and-local-sales-tax-rates-in-2017/

[v] KLRD says the revised estimate for Individual income tax for FY 2019 is $3.017 billion.