As Kansans collect smaller paychecks this month because of the massive income tax hike passed by the Legislature, school districts’ lobbying arm is defending it as an ‘investment.’ The Kansas Association of School Boards recently said the tax increase “…has been defended by many as necessary to stabilize the budget and comply with a Supreme Court decision on school funding.” Yes, some people defend the largest tax increase in Kansas history as such even though neither circumstance necessitated a tax increase. KASB then trots out it’s standard logical fallacy in support of higher taxes and more money for school districts, saying it is clear “…that improving state educational attainment requires higher levels of funding.” That’s about as true as the late Senator Daniel Patrick Moynihan once observing very tongue-in-cheek that northern states tend to have better outcomes, so proximity to the Canadian border must have something to do with it.

KASB uses similarly flawed logic in their defense of a huge tax increase. ‘People with higher education attainment earn more (true), and since (they falsely claim) that higher levels of adults having college degrees requires higher funding of K-12 schools, so that giant tax increase is really promoting stronger economic results.’ They point to what they believe is a “strong correlation” between states spending more on K-12 and adults in those states having higher educational attainment but a bivariate analysis (two variables), doesn’t allow for meaningful conclusions. Dr. Benjamin Scafidi, Director of the Education Economics Center at Kennesaw State University, says, “…they do not control for the many other factors that impact student achievement. Social scientists do not put much stock into bivariate relationships like the KASB [example] below.” Dr. Scafidi’s remarks were specifically directed at a KASB report that also only looked at changes in spending and achievement.

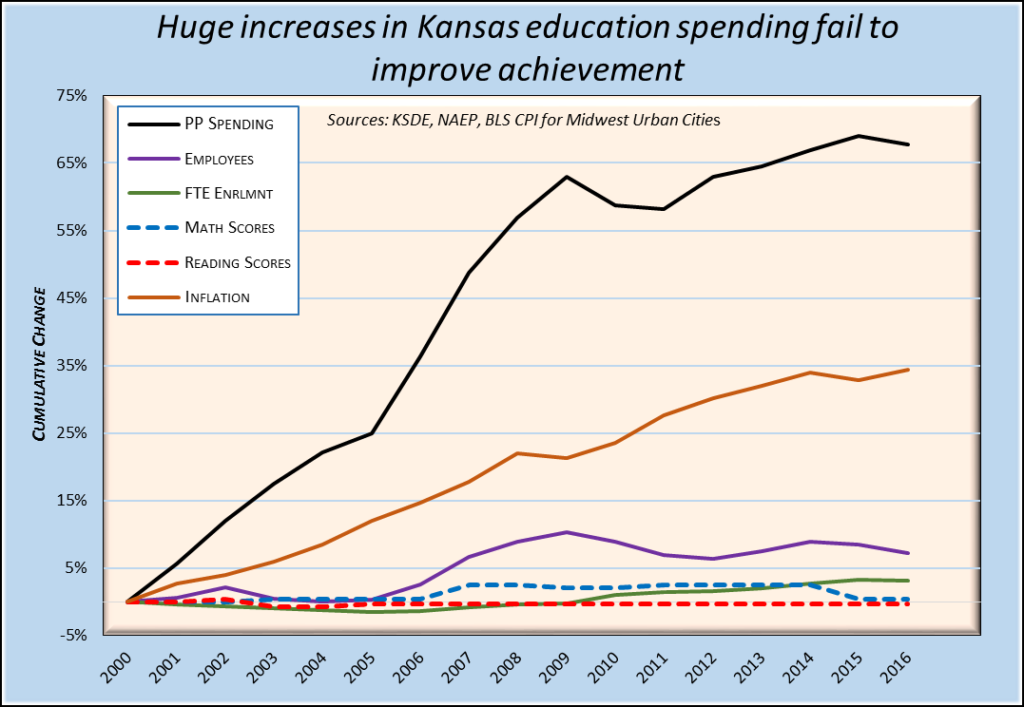

KPI scholar David Dorsey most recently addressed the disconnect between spending more and achieving more with this chart comparing changes in both over the last sixteen years. Spending increased at almost twice the rate of inflation but outcomes remain relatively flat.

This statistical analysis of state spending and student achievement also found no causal relationship. The R-squared value of 0.09 is considered ‘weak’ correlation and the R-squared value drops to 0.04 when adjusted for cost of living. Of course, correlation and causation are two entirely different subjects despite what the school lobbyists would like you to infer.

The largest tax hike in Kansas will produce stronger economic results for the adults in the education system but just hiking taxes won’t change student outcomes or produce economic gains for citizens.