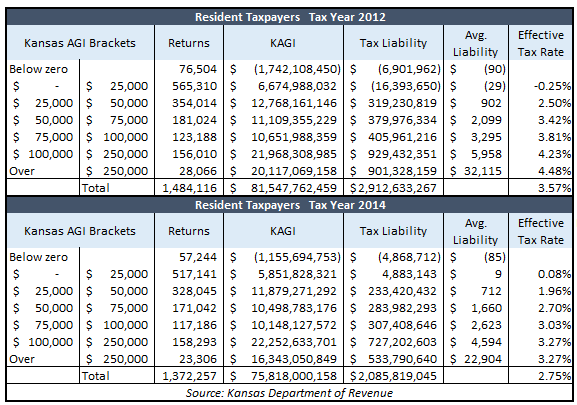

Critics of tax reform in Kansas continue trying to paint it as only benefiting businesses and those with higher incomes. Data from the Kansas Department of Revenue (KDOR) proves otherwise and shows that the majority of Kansans—those earning anywhere from $25,000 to $250,000—have enjoyed reduced tax burdens. The table below shows this in the form of total group tax liability, average liability per taxpayer, and effective tax rate.

It is true that Kansans earning up to $25,000 have moved from a negative to a positive tax liability. The impact of this is mitigated though by (KDOR)’s finding that personal exemption increases removed thousands of low-income tax filers from the tax rolls completely. Additionally, the repeal of the refundable food sales tax credit meant that other low-income Kansans stopped filing income tax returns altogether. Finally, looking at the change in terms of average liability per taxpayer helps to put it into perspective. As the table above shows, filers in this tax bracket went from receiving a $29 tax rebate to paying $9 in taxes on average.

Still, the change comes as an unfortunate consequence of too many legislators from all sides of the political spectrum refusing to get serious about reducing the cost of government. The question of whether any taxpayer should receive a tax refund greater than the tax amount he or she owes in the first place is also a legitimate policy consideration, however.

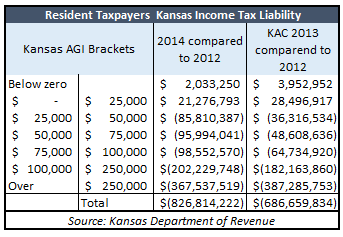

Duane Goossen of Kansas Action for Children (KAC) tries to seize on the change in tax liability for those earning up to $25,000 in his latest piece, arguing that tax reform in Kansas benefited businesses and higher-income individuals at the expense of lower-income individuals. His analysis is flawed from the start because it fails to use the latest available, 2014 tax filing data from KDOR.

Secondly, Goossen’s use of total group tax liability as opposed to average tax liability per taxpayer fails to capture the drops in the number of tax filers noted above as well as the movement of some filers between tax brackets.

Continued declines in marginal rates make for greater net changes in liability in the tax brackets from $25,000-$250,000, but taxpayers earning 25,000 and up still carry the bulk of the tax burden in Kansas.

Goossen distorts this fact by just looking at net tax liability changes within the tax brackets below $25,000 instead of looking at what individuals in these brackets actually pay in taxes compared to those in higher tax brackets (shown in this blog’s first table).

As we have proven on numerous other occasions, analytical gimmicks such as these are commonplace and mark just another day at the office for Goossen and KAC.