This week, the Kansas House’s Committee on Taxation will hold the first hearings on HB 2061, a bill that would usher in a flat tax on individual and corporate income. This reform would be a simple and fair change that saves taxpayers cash and boosts the Kansas economy by promoting investment and keeping the cost of business and living low. However, there are still many questions about what a flat tax is and that can be quickly answered.

Kansas taxes individual personal income. The tax rate increases based on different incomes, or brackets. A flat tax would be one single tax rate applied to all incomes. Under the proposed flat tax, all current deductions and exemptions still exist. But the rate of taxable income is just the same for everybody.

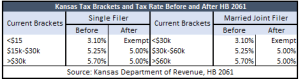

The below table compares Kansas’s current tax brackets to how much they would be taxed under HB 2061.

Contrary to concerns that a flat tax shifts more burden to people with lower incomes, everyone saves money with the current Kansas proposal because the lowest tax bracket becomes exempted. For instance, a single filer making $30,000 in taxes today and taking advantage of the standard deduction and personal exemption pays $951 in income taxes currently, but because of the exemption, will pay $463 in income taxes – that’s $488 saved.

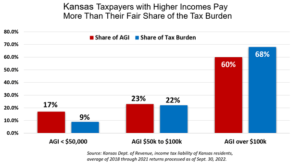

A larger share of the tax relief goes to people in the higher income brackets because they are paying the majority of the tax burden today. According to a four-year average of 2018 through 2021 tax returns from the Kansas Department of Revenue, people with incomes less than $50,000 made up 17% of adjusted gross income (AGI) in the state, yet paid 9% of the tax. On the other hand, people with incomes more than $100,000 made up 60% of AGI and paid 68% of the tax.

A larger share of the tax relief goes to people in the higher income brackets because they are paying the majority of the tax burden today. According to a four-year average of 2018 through 2021 tax returns from the Kansas Department of Revenue, people with incomes less than $50,000 made up 17% of adjusted gross income (AGI) in the state, yet paid 9% of the tax. On the other hand, people with incomes more than $100,000 made up 60% of AGI and paid 68% of the tax.

24 states from around the country achieved income tax cuts since the 2012 Brownback tax cuts, which should serve as a sign of caution but not a deterrent to tax reform. KPI Analysis showed that small spending reductions (2% to 3%) over three years would have balanced the budget and allowed spending to increase as revenues grew, and that could have been accomplished by enacting multiple efficiency opportunities. An 8.5% reduction in spending over several years would have worked. But General Fund spending increased from about $6.1 billion in FY 2012 to $6.3 billion in FY 2017, when the Legislature imposed the largest tax increase in state history. Similarly, Brownback’s original tax cut proposal was about $350 million over five years, but it ballooned to $3.5 billion by the time it left the Senate.

KPI has done recent research on why a flat tax is effective as well as myths about it that can easily be dispelled.