Job growth throughout the country may be slow, but positive, longer-term job growth trends in Kansas are getting ignored in favor of preliminary, month-to-month comparisons of how many private-sector jobs exist or existed in the state at two single points in time. These comparisons give  disproportionate weight to short-term, potentially anomalous industry-level spikes or declines when arriving at Kansas’ overall jobs number and growth rate.

disproportionate weight to short-term, potentially anomalous industry-level spikes or declines when arriving at Kansas’ overall jobs number and growth rate.

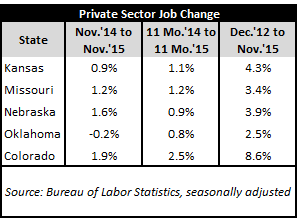

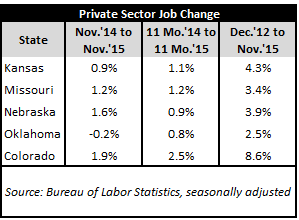

Taking a longer-term look at November jobs numbers from the U.S. Bureau of Labor Statistics (BLS) shows Kansas continuing to add private-sector jobs at a growth rate—4.3% since December 2012—that trails only Colorado (8.6%) in the region.

Kansas achieves a similar 4.5% growth rate when comparing its annual average number of private-sector jobs in 2012 to its average thus far in 2015. This ranks 29th nationally, a marked improvement in only three years after ranking 38th in average annual job growth during the fourteen-year period from 1998 to 2012.

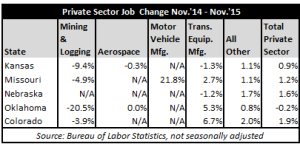

The adjacent table shows why cursory examinations of average state jobs numbers can be misleading. It looks at November 2014 to No vember 2015 job growth in Kansas and its regional peer states for four industries that together comprise less than 7% of each state’s private-sector economy but exert an outsized influence on each state’s jobs numbers due to largely global factors beyond the control of any particular state and its policy choices.

vember 2015 job growth in Kansas and its regional peer states for four industries that together comprise less than 7% of each state’s private-sector economy but exert an outsized influence on each state’s jobs numbers due to largely global factors beyond the control of any particular state and its policy choices.

The outsized influence is evident in the differences between “total private-sector” job growth and “all other” private-sector job growth (with the four industries removed) in the table. For example, Kansas’ “all other” private-sector job growth—representing more than 93% of the state’s private-sector economy—ties Missouri in the region. Yet, its total private-sector job growth trails Missouri because Kansas is weighed down by developments in the four relatively small industries highlighted.

The mining & logging industry (which includes oil and gas extraction) is an industry that factors into jobs numbers for Kansas and all of its regional peer states except Nebraska. Yet, the industry is one of the most highly sensitive to global supply and pricing fluctuations that have little to do with particular policy choices made in Kansas or elsewhere in the region.

The aerospace industry is also a highly global one, but it is only large enough per BLS minimum reporting requirements to influence jobs numbers in Kansas and Oklahoma and no other states in the region.

Transportation equipment manufacturing is a large enough industry to influence jobs numbers for all states in the region. However, job growth within this industry can be tied to demand for a specific product that may be heavily produced in one or more regional states but not others.

Fourthly, job growth or decline in the motor vehicle manufacturing industry only influences jobs numbers for Missouri given that the industry is too small in every other regional peer state to meet aforementioned minimum reporting requirements.

In short, the industries above prove that preliminary monthly changes in the number of private-sector jobs within Kansas and any other state are inadequate measures of current economic vitality and future outlook in those states. Kansas’ longer term job growth in the three years post-tax reform is far more telling.

Check back for next month’s update.