Articles Filtered By:

Job Growth

Economic growth is a marathon, not a sprint

May 28, 2024Kansas ranks 41st for private-sector jobs since 1998

April 1, 2024

New flat tax bill offers relief across all incomes

March 15, 2024

Kansas flounders as other states shore up their tax climate

October 30, 2023

Kansas continues to see more out migration than in

February 20, 2023

Kelly administration has $1.2 billion in unspent ARPA COVID-relief funds

September 12, 2022Kansas still 19,500 jobs below pre-pandemic levels

August 19, 2022

Excess tax collections are not good for taxpayers

August 4, 2022

2022 Green Book: Spend Less, Tax Less, Grow More

May 31, 2022

March 2022 Kansas Job Stagnation

April 15, 2022Simple Tax Reform Goes a Long Way

March 24, 2022

SB 347: The Mother of All Subsidies

January 25, 2022

Reforming Zoning Laws Reduces Housing Costs

December 15, 2021

Cutting Red Tape in Kansas

November 23, 2021

October 2021 Jobs: Slow Growth Amidst High Inflation

November 19, 2021

August Jobs Numbers Show Slow Growth for Kansas

September 30, 2021

Lockdown effect means 57,000 fewer private jobs

March 15, 2021

Kansas RELIEF Act can spur COVID Recovery

February 15, 2021

2021 Legislator Briefing Book also has good value for taxpayers

January 14, 2021Reversing years of Kansas fiscal mismanagement

November 9, 2020

In one month, 25,000 Kansans quit job hunting

October 21, 2020August jobs report says no Kansas full recovery until 2021

September 22, 2020Small businesses re-plummet despite state economic planning

September 8, 2020

Kansas recovery stalls three months after lockdown

September 1, 2020

STAR Bonds redirect jobs, not create them

August 28, 2020Gov. Kelly plays politics with federal unemployment relief

August 24, 2020

Unemployed Kansans surpass no-lockdown states

July 28, 2020Kansas 2019 Private Jobs Grows Slower Than Expected

March 16, 2020Kansas media spins job growth

March 2, 2020Kansas economy ranks 49th as government grows

November 26, 2019Three Signs of Kansas Government Growth

July 11, 2019“Hope” Leads to Work & Opportunity

June 24, 20192019 Legislator’s Budget Guide: Reversing The Kansas Exodus

January 4, 2019

Kansas Freedom Index provides legislative transparency

October 22, 2018Reverse long-term economic stagnation

October 8, 2018

KPI publishes 2018 Voter Issue Guide

September 10, 2018

2018 Voter Issue Guide

September 10, 2018Kansas Job Growth Rank Improves Post-Tax-Relief

September 28, 2017

Pass-Through Exemption Helped Add 18,000 jobs in 2015

April 23, 2017PEAK subsidy costs Kansas $48.5 million annually

April 19, 2017States that Spend Less, Tax Less…and Grow More

April 7, 2017Fake news in Kansas promotes political agenda

March 28, 2017Kansas Private Sector Jobs Grew in 2016

March 13, 2017

2017 Greenbook

March 13, 2017Kansas budget can be balanced without tax hikes

February 28, 2017New business filings sets another record in Kansas

February 15, 2017Kansas job rank improves after tax reform

January 23, 2017Kansas tax proposal endorses government favoritism

January 20, 2017Media’s hypocritical tizzy over fake news

November 29, 2016

Pass-through entities drive job growth in Kansas

October 31, 2016Media Ignores Some Good News in August Jobs Numbers

September 23, 2016Media and highway contractors mislead again

August 31, 2016

December Jobs Update

February 1, 2016

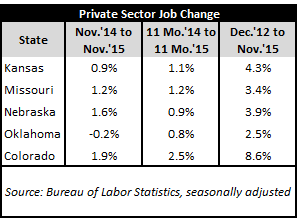

November Jobs Update

January 6, 2016

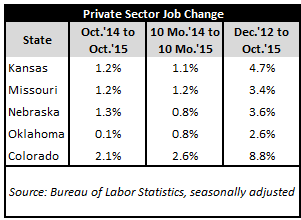

October Jobs Update

November 25, 2015

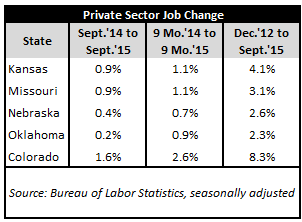

September Jobs Update

October 29, 2015

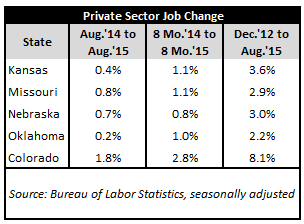

August Jobs Update

September 24, 2015

July Jobs Update

August 31, 2015

June Jobs Update

July 31, 2015April Jobs Update

May 29, 2015KCEG misleads on job growth – again

May 20, 2015Q1 2015 Jobs Update

May 11, 2015KC Star misleads again on Kansas economic growth

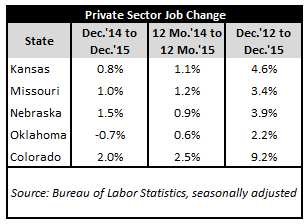

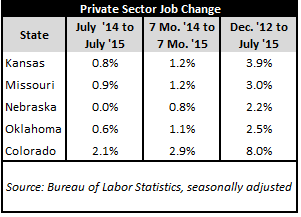

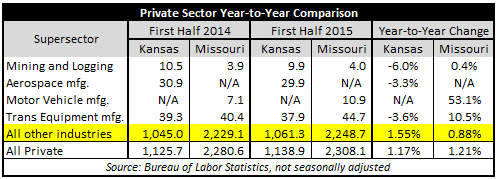

April 26, 2015Kansas beats Missouri in private sector job growth

March 30, 2015December Jobs Update

February 12, 2015November Jobs Update

January 2, 2015