The Kansas Center for Economic Growth (KCEG) is once again using specious methodology—this time on personal income—to advance its “higher-tax, higher-spending” agenda by saying personal income growth slowed after tax reform. True to form, KCEG would not respond to our request to see their data. We attempted to reconstruct their schedule, but the data they purportedly used does not produce their published results.

Where KCEG Gets It Wrong

Most fundamentally, KCEG’s focus on non-farm personal income to highlight changes from “Before Tax Reform” to “After Tax Reform” is flawed from the start. Non-farm personal income includes the government sector. The purpose of tax reform was to grow the private sector—not government, so any attempt to determine whether tax reform is ‘working’ should focus on its target. Further, the KCEG approach could mask critical information about private sector vitality. Government can grow by raising taxes, which negatively impacts the private sector; alternatively, tax reduction could boost private sector activity but be masked by the related impact on government spending.

Next, KCEG manipulates their pre and post-tax reform periods to artificially inflate their pre-tax reform growth. Their use of only Q1 2010 to Q4 2012 data to represent their “Before Tax Reform” period conveniently coincides with the country’s rebound from a prolonged recession and is further impacted by the fact that Kansas tends to enter and depart recessions later than most states. Any growth trend during such a period will be exaggerated simply by virtue of starting from a lower than average baseline. A much longer period stretching back to first-available 1998 data would be far more telling and appropriate.

Similarly, KCEG appears to start their “After Tax Reform” period with Q1 2013 (Note: They won’t share their data, but their report says they start with Q1 2013). Tax reform took effect in Q4 2012 on January 1, 2013 so growth post-tax reform must be measured against Q4 2012. (Note: Only quarterly data is available for 2015 but not for the entire year at this writing.)

A Fair, Accurate Measurement

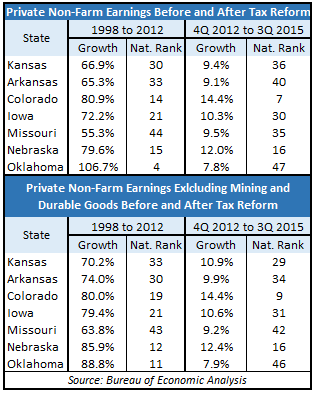

Private non-farm earnings for Kansas and five of the six regional states selected by KCEG show that Kansas and five of these aforementioned regional peers dropped in the national rankings post-tax reform, which is indicative of economic challenges across a broad region. But an economy is composed of many moving parts, and those parts vary  (sometimes quite significantly) from one state to the next. And some economic sectors may be growing while others decline, so judgements based on a single average can be deceptive.

(sometimes quite significantly) from one state to the next. And some economic sectors may be growing while others decline, so judgements based on a single average can be deceptive.

For example, Kansas is much more reliant on Mining (oil and gas) than most states and the same is true of aerospace. Quarterly data does not break out aerospace from the Durable Goods sector, but we can remove Mining and Durable Goods to see how the balance of the private sector economies performed in each state. (Private Non-Farm earnings less Mining and Durable Goods comprises 77% to 94% of the measured states’ private-sector economies.)

Now we see that Kansas improved its national ranking by four positions since tax reform was enacted. Colorado – which has benefited from its long-time low-tax and controlled-spending environment – moved up ten spots and Missouri moved up one spot but lost competitive ground to Kansas since tax reform was enacted.

We also see why Duane Goossen and Kansas Center for Economic Growth refuse to discuss these issues with us in public – they won’t go where they can be held accountable.