The latest misleading claim on job growth from the Kansas Center for Economic Growth is loaded with misleading and irrelevant information; they don’t fully disclose their methodology and at this writing they have ignored our request to explain it. Sadly, this is not the first, second or even third time that KCEG has published misleading information and declined to produce documentation.

Here are the questions we posed to Annie McKay, executive director at KCEG:

We received a ‘read’ receipt but no reply, so we attempted to replicate their methodology to arrive at what they call “private sector job growth since tax changes” which they measure between January 2013 and March 2015. Based on tests of Kansas and national data, it appears that KCEG is using seasonally adjusted jobs but we couldn’t find a 6-state region including all of Kansas’ neighbors to match their number.

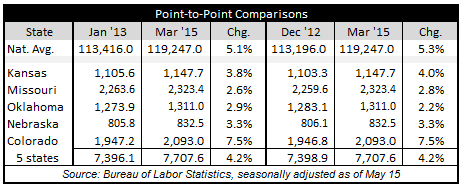

KCEG has the national average increasing 5.2% and Kansas 3.8%, so we assume they are comparing January 2013 to March 2015. This is not a true measure of post-tax reform activity, however; the base month of a point-to-point comparison should be the last month of the old tax system, which was December 2012. Comparing Kansas to the 5-state region does show that Kansas is slightly behind (4.0% vs. 4.2%) but by not showing the performance of individual states, KCEG hides the fact that Kansas beat three of its four neighbors.

KCEG has the national average increasing 5.2% and Kansas 3.8%, so we assume they are comparing January 2013 to March 2015. This is not a true measure of post-tax reform activity, however; the base month of a point-to-point comparison should be the last month of the old tax system, which was December 2012. Comparing Kansas to the 5-state region does show that Kansas is slightly behind (4.0% vs. 4.2%) but by not showing the performance of individual states, KCEG hides the fact that Kansas beat three of its four neighbors.

While Kansas is outperforming three of its neighboring states on this measurement, point-to-point comparisons are problematic; one or both points can be unusual spikes or declines, making the data less reliable. The Bureau of Labor Statistics also publishes average annual employment, which minimizes the impact of any single data point.

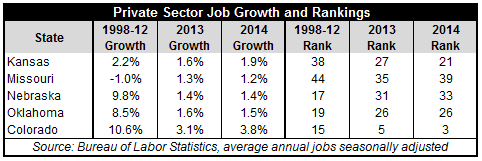

The more stable comparisons of average annual employment show job growth trends for Kansas to be much more competitive since tax reform. Private sector jobs grew just 2.2% between 1998 and 2012, which ranked Kansas at #38, but Kansas moved up to #27 in 2013 and last year moved up again to #21. That’s still not good enough and it will take perhaps another decade to fully understand the impact of tax reform, but the early trend is very encouraging. Kansas still trails Colorado, but has improved its competitive position. The table below shows Kansas trailed Colorado by a factor of five (2.2% vs. 10.6%) between 1998 and 2012 but has since closed the gap to a factor of two.

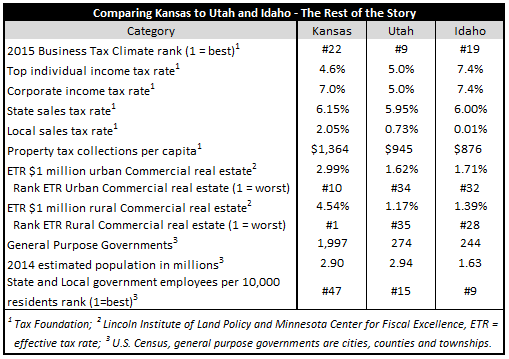

KCEG noted that Utah and Idaho have higher taxes on “the wealthy” and better job growth than Kansas, but of course they don’t tell the whole story. Kansas does have a lower marginal rate than both states but that is a recent development; Kansas was higher than Utah until 2013 and much closer to Idaho when the marginal was 6.45%. Kansas’ lower rates are helping to reverse trends but it will take much more time to catch up to states that historically grew much faster – like Utah and Idaho.

Here’s the rest of the story that KCEG doesn’t want you to know. According to the Tax Foundation, the corporate income tax rate in Kansas is 40% higher than Utah’s and just slightly below Idaho’s. State sales tax rates are comparable but Kansas has much higher local sales tax rates.

Utah and Idaho also have much lower property taxes on commercial and industrial real estate. Kansas has the 10thhighest effective tax rate on urban property and the worst in the nation on rural property! Part of the reason that Kansas has very high effective tax rates is baked into the State Constitution, where Commercial and Industrial property is assessed at 25% of appraised value but Residential is assessed at 11.5%.

The other major factor driving up property taxes is that Kansas has too much government. Kansas and Utah have about the same population but Kansas has 1,997 cities, counties and townships whereas Utah has only 274. Idaho has just 244. Extra government means extra government employees (and higher taxes to pay for all of that government); Kansas is ranked #47 in government employees per 10,000 residents (i.e., the 3rd worst in the nation) but Utah is ranked #15 and Idaho is #9.

These truths about private sector job growth and relevant competitive issues with Utah and Idaho are typical of KCEG efforts to mislead citizens and legislators – and probably explain why they refuse to engage KPI in public debates on tax, spending and education issues.