Governor Laura Kelly knows it would be political suicide to propose an income tax hike ahead of her re-election effort, so her Council on Tax Reform is paving the way for her to do it if she’s re-elected.

It’s all been carefully choreographed over the last two years, and the latest report from the Council on Tax Reform puts the justification out for media to unquestioningly distribute.

The report says Kelly convened the Council to create “a shared vision of increased prosperity and well-being for all Kansans.” However, it’s crystal clear that the real purpose is to justify more revenue for state and local government. To wit:

- Council members currently or previously working for taxpayer-funded entities outnumber private-sector members 14-2.

- The report is littered with concern for the public sector. The only real sop to taxpayers is a smallish ($55 million) recommendation for a refundable food sales tax credit for low- and moderate-income taxpayers.

- The Tax Council recommends gifting $54 million to cities and counties under the pretense of property tax relief.

- There are two new sales taxes on marketplace facilitators and on digital products like Netflix and Disney subscriptions (that’s on top of taxing all online purchases from online vendors in violation of the U.S. Supreme Court’s Wayfair decision).

- It recommends against reversing the income tax increases resulting from federal tax reduction in 2019 (not itemizing deductions if using the federal standard deduction, disallowed business interest, and global intangible low-taxed income). The Kansas Department of Revenue says these items are collectively costing taxpayers $166 million this year.

A major contradiction in the report is concern about the regressivity of sales taxes. They express concern about regressivity on food sales taxes but not on online vendors or streaming services.

Now, here’s their head nod to a future tax increase.

“Our collective notion of adequacy now may have changed significantly given the impact the pandemic has had not just on tax receipts, but also demand for additional public-sector aid and support for individuals and businesses.”

Translation – current tax revenues, from some of the highest rates in the nation, are not adequate…or certainly won’t be once the full effects of the pandemic are felt, safely after Gov. Kelly’s re-election is secured.

The myth of the three-legged stool

Governor Kelly and most members of her Council on Tax Reform want most people to pay more tax, and here’s how they will justify an income tax increase on most Kansans.

One of the pushbacks against Governor Brownback’s proposal to eventually phase out the state income tax was that the state was better off with a folksy sounding “three-legged stool” of income, sales, and property tax. The complaint was that the state’s revenue model would be unbalanced with just two revenue sources. The ‘stool’ has never been balanced for state government or local governments, but the Tax Council ignored that detail.[i]

One of the pushbacks against Governor Brownback’s proposal to eventually phase out the state income tax was that the state was better off with a folksy sounding “three-legged stool” of income, sales, and property tax. The complaint was that the state’s revenue model would be unbalanced with just two revenue sources. The ‘stool’ has never been balanced for state government or local governments, but the Tax Council ignored that detail.[i]

They make a big deal about the combined state and local three-legged tax stool being out of balance, and income tax happens to be the shortest leg.

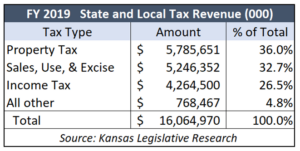

Income tax accounted for 26.5% of all state and local taxes in FY 2019; sales, use, and excise tax was 32.7%, and property tax was 36% of the total.[ii]

Their ‘adequacy’ signal calling for more tax revenue combined with income tax being the shortest leg of the mythical stool will be the basis for raising income taxes.

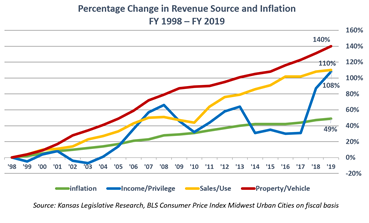

Not to give merit to the three-legged myth, but the reason that combined state and local taxes are allegedly out of balance is that property tax grew much faster than the other two sources.

In 1998, income tax accounted for 28% of total revenue, sales tax was 34%, and property tax was 33%. Since then, property tax shot up 140% while income and sales tax increased 108% and 110%, respectively.

Instead of calling for the longest leg to be planed down, the Tax Council and Governor Kelly want to bolt another tax hike on the short leg because they want to spend more.

Instead of calling for the longest leg to be planed down, the Tax Council and Governor Kelly want to bolt another tax hike on the short leg because they want to spend more.

No state ever taxed its citizens into prosperity

Never mind that Kansas already has higher marginal income tax rates than many states or that Kelly’s next hike would be the fourth increase since 2017. Most Tax Council members apparently aren’t concerned that another tax increase will worsen the state economy, which is in its fifth straight decade of economic stagnation.

The majority of Kansans know the state has a spending problem, not a tax problem.

But with 88% of members of the Council on Tax Reform rooted in government interests, look for them (and Kelly if re-elected) to propose yet another income tax hike.

(The Wichita Eagle published a condensed version of this column.)

[i] Kelly’s Tax Council looks at combined state and local taxes in noting the ‘imbalance’ but there is a huge disparity between state and local tax schemes. State revenues are almost all from sales and income tax, with only about 1% from property tax, whereas local tax revenues are virtually all property tax and sales tax. Balancing the stool for state and local governments would therefore require a complete overhaul of how they each impose taxes.

[ii] We include sales tax on motor fuels, alcohol, and beer in our sales tax total, and we include motor carrier property tax and vehicle registration in our property tax total. The Tax Council list all those items in All Other taxes.