The Wyandotte County Land Bank is a government body established in 2018 to confiscate homes from delinquent taxpayers, refurbish them, and then sell them back to the community. Currently, the Land Bank holds around 3,500 properties that they then can sell. This process has not been without controversy. Sen. David Haley (D -Wyandotte) cited the practice as “reverse redlining” and as a process that disproportionately affects the county’s 60 percent minority population. In any case, evicting families and confiscating their properties is not a desirable situation, as it puts those families at additional economic risk. The root of some of these evictions is with Wyandotte County’s policies itself, which with proper change, could be altered to promote growth and stable housing instead of threatening it.

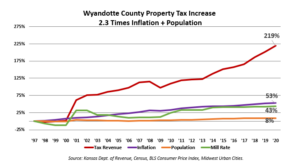

An unhealthy tax environment is for the large part causing the issues that Wyandotte County is seeing. Between 1997 and 2020, Wyandotte County increased its property taxes by 219 percent, yet the county mill rate has only increased by 43 percent, creating a 176 percentage point gap between the increases in property value and the taxes on the property. These increases far outpace Wyandotte’s steady population increase and the rate of inflation, meaning that taxes are far outpacing growth and pricing people out of their homes, thus leading to the situation that brought about the land bank in the first place. Property taxes in Kansas have been pushing people to move elsewhere for a while. The below graph illustrates the changes in Wyandotte County’s property taxes, population, inflation, and mill rate.

The county should avoid pushing people out of their homes with property taxes. According to the Land Bank, 88 of the 124 properties sold in 2018 were vacant lot sales with no rehab. Considering that the Land Bank estimates that 43 percent of the properties were vacant already, there has to be a better way to redistribute this property to available buyers instead of through a system that punishes families who aren’t able to pay the county’s growing taxes. In fact, the county’s rehabilitation program could make properties even more expensive in the area, giving government officials the push to raise property taxes even more, thus pushing out more families. It’s a destructive path that could harm the county’s long-term growth.

Owning a home is one of the primary investments that a family makes. On top of the increasing value of housing and property over time, having a permanent home gives families security and shelter. At the same time, paying a fixed mortgage is safer than often predatory and inflation-vulnerable rent. Nationwide, the average homeowner’s wealth was $231,420, whereas the average renter’s wealth was $5,200. If Wyandotte County wants to see a healthier living and business environment, they should make their community more accessible for the average family by halting their property tax hikes.

Instead of trying to predict and guide housing policy, the government needs to focus on removing barriers and assisting in the natural process of real estate development of affordable housing. Across every sector, government involvement in business policy can lead to hit-or-miss outcomes, which isn’t ideal effectiveness when running programs on a taxpayer’s dime. Consider the infamous Little Pink House case, in which a Connecticut homeowner unsuccessfully attempted to defend her home from an eminent domain case as part of plans to turn a former industrial zone into new projects. The homeowner lost her house, and the government project went belly-up after her home and neighborhood were destroyed. The often-ambiguous nature of land bank policy opens the door for government creep into housing policy. Consider Wichita’s Places for People Plan, which gave the government more authority over redeveloping, rezoning, and other responsibilities which citizens complained about due to limited transparency. If not managed properly, land banks can cost taxpayers millions of dollars in maintenance waiting for development projects which never come to fruition.

The government shouldn’t hog the reins over housing. In fact, local boards need to cooperate with homeowners and developers on reducing barriers such as high tax rates, strict zoning conditions, and substantial costs from liability rules, which push people out of their homes in the first place and make it difficult to develop neighborhoods. The government should avoid making costly investment blunders similar to STAR Bonds or TIF’s, which haven’t shown their promised economic progress across the state of Kansas (once again, at the cost of the taxpayer). Pursing often ineffective housing mandates can drive up prices even more and threaten the same people they set out to protect.