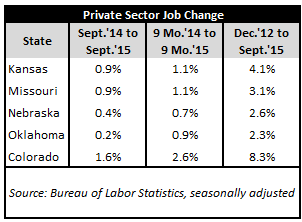

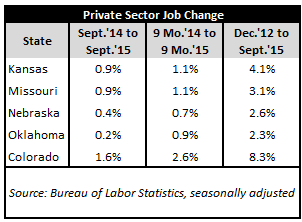

Kansas remains tied with Missouri for the second highest seasonally-adjusted private-sector job growth rate (1.1%) among regional peer states when comparing the first nine months of 2015 to those same nine months in 2014. Only Colorado performs better—at a 2.6% growth rate—in the region over the period according to the latest, September 2015 Bureau of Labor Statistics (BLS) releases.

Kansas overtakes Missouri for sole possession of second place in the region though when tracking private-sector job growth from December 2012—when Kansas implemented tax reform—to today’s September 2015 numbers. As the table above shows, Kansas’ 4.1% growth rate over the period tops that of all regional peer states but Colorado (8.3%).

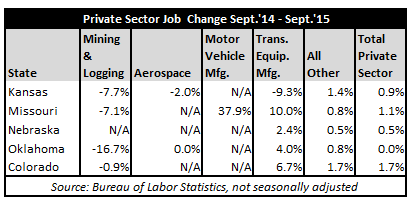

Kansas’ strong comparative performance in the region carries over to our customary shorter-term but deeper examination of regional job growth by industry sector. The adjacent table isolates four inordinately global industries that collectively make up less than 7% of the entire private sector in Kansas and in each of its regional peer states. This allows us to examine “All Other” private sector job growth, accounting for more than 93% of the private sector in Kansas and in each of its regional peer states. Kansas’ “All Other” private-sector job growth from September 2014 to September 2015 is 1.4%. This trails only Colorado’s 1.7% growth in the region.

Looking at “All Other” private-sector job growth in this fashion helps state-level jobs numbers from being disproportionately skewed by larger-scale global developments that are unrelated to state tax policy.

Looking at “All Other” private-sector job growth in this fashion helps state-level jobs numbers from being disproportionately skewed by larger-scale global developments that are unrelated to state tax policy.

For example, in the region, the aerospace industry is only large enough in Kansas and Missouri to be reported. Thus, global developments in the industry outside of Kansas’ or Missouri’s control directly affect jobs numbers for these two states but no others in the region.

The same holds true for the motor vehicle manufacturing industry, which is only large enough in Missouri to meet the BLS’ minimum reporting requirements.

With the exception of Nebraska, all of Kansas’ regional peer states have large enough mining and logging industries to show up on BLS reports. Yet, this industry includes oil and gas extraction, a sub-sector which is arguably one of the most sensitive to global supply, demand, and pricing fluctuations beyond state influence or control.

Lastly, the transportation equipment manufacturing industry meets minimum size requirements to be reported in Kansas and in all of its regional peer states. However, state-level growth or declines in this industry can be linked to global or national demand for specific types of equipment manufactured that may be more heavily concentrated in certain states.

These are just a few of the many reasons why preliminary monthly jobs numbers should never be the sole metric one uses in assessing a state’s economic vitality and outlook. Instead, one must examine many fluid factors within a state when making such an assessment. Check back for next month’s update.