In January 2022, the state of Kansas took in total tax revenue of $944 million, which was 14.5% greater than the estimates for this month. This includes $342 million in sales taxes and $574 million in income taxes. This is also 18.7% higher than what it was for the same month last year. In total, the tax revenues thus far in FY 2022 are approximately $5.2 billion – 4% greater than the latest predictions for FY 2022.

Kansas’ increased revenue collection over the past year isn’t unique as almost every state across the country is seeing an influx of cash. Missouri currently holds more than $4 billion in unappropriated funds from the past year. Colorado alone has $3.3 billion it can spend – not to mention $2.6 billion in COVID-19 relief funds on their plate too.

Consistently high revenue receipts over this past year are a sign of over-taxation. There are now competing legislative and gubernatorial plans to address this realization: from Gov. Laura Kelly’s one-time tax rebate and food sales tax reductions to different legislative proposals that provide a long-term reduction in income tax rates.

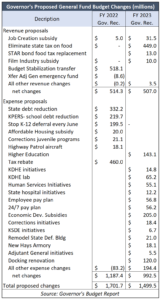

When faced with decisions on how to spend this money, Kansas has an opportunity to responsibly enshrine long-term relief. What the state should avoid is quickly creating new, inefficient subsidies with the money. In Governor Laura Kelly’s recommended budget, the current surplus would drop by $2.3 billion by the end of next year from new programs – which are outlined in the adjacent table. This money should be returned to taxpayers and not spent on new programs that will outlive the current surpluses.

When faced with decisions on how to spend this money, Kansas has an opportunity to responsibly enshrine long-term relief. What the state should avoid is quickly creating new, inefficient subsidies with the money. In Governor Laura Kelly’s recommended budget, the current surplus would drop by $2.3 billion by the end of next year from new programs – which are outlined in the adjacent table. This money should be returned to taxpayers and not spent on new programs that will outlive the current surpluses.

For instance, the massive subsidy bill of SB 347 alone could cost around $2 billion in subsidies for an unnamed company over the course of a decade. Likewise, inefficient subsidies such as those for affordable housing and a movie production subsidy (which has seen little return in other states) are not as good a use for the surplus cash compared to long-term tax relief.

Instead, this money should be returned to Kansas taxpayers and businesses. Reducing rates in the long run and in tandem with responsible spending is key to making the state a healthier tax environment and a more appealing state for business.