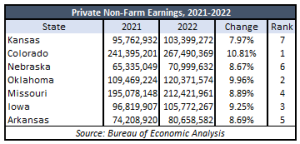

Kansas keeps slogging on through four decades of economic stagnation. According to the Bureau of Economic Analysis’s recently released data, Kansas ranked 38th in the country in private non-farm earnings growth between 2021 and 2022. Of Kansas’s neighbors and nearby states with similar economies like Iowa and Arkansas, Kansas ranks at the bottom of the group as well. From 2019 to 2022, Kansas’s rank falls further to 42nd.

But, and arguably most concerning, is that the writing has been on the wall for years. KPI’s Green Book makes that clear. Between 1998 and 2021, Kansas ranked 37th in private-sector wage and salary growth. Kansas’s 116% growth is dwarfed by Utah’s 257% growth at the number one spot. Kansas similarly lagged in job growth.

There was a sizable distinction in the earnings growth in states that tax income, like Kansas, and states that don’t like Texas, Florida, Nevada, and six others. Between 2021 and 2022, the wages across states that don’t tax income increased by 11.4% while in all other states, they increased by 7.86%. Similarly, Between 2019 and 2022, wages in non-income taxing states increased by 23.6% whereas that number for taxing states was 18.2%.

States that spend, tax less, and grow more. Kansas spends above the national average per resident, has high taxes, and is growing poorly. The combined state and average local tax rates are the 9th highest in the country. Kansas has the highest tax rates on mature businesses in the country, limiting the long-term gains of small business growth. Megasubsidies ineffective for promoting growth are doled out by the hundreds of millions from the taxes of families and their businesses.

Kansas has some of the highest local property taxes as well. A commercial property in a town the size of Iola pays the highest property tax compared to other towns in states across the country. Industrial and rural homesteads face similarly high rates.

The toll paid by families for 40 years of economic stagnation will not be overturned with any single policy. But the tide can be turned by enacting pro-growth policies that have worked well to bolster state economies. Enacting a flat tax would match successful reforms over the last five years across the country, and would put Kansas on the literal and figurative map when it came to growth. Critically reviewing performance-based budgeting in line with a limited budget keeps the burden of government low and more cash in taxpayers’ wallets.