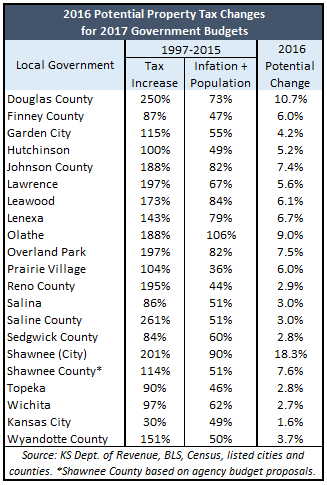

City Council members and County Commissioners across Kansas are deciding how much more to tax and spend next year, and the preliminary numbers are not encouraging across most of the larger population areas. With inflation at 1.4 percent (June 2016 compared to December 2015), the smallest increase we  found was 1.6 percent in Kansas City, which is part of the Unified Government of Wyandotte County; the county tax increase is 3.7 percent. The smallest increase among standalone local government is the City of Wichita (2.7 percent), followed closely by Sedgwick County and the City of Topeka at 2.8 percent. The City of Shawnee is considering a whopping 18.3 percent hike, and that’s on the heels of a 7 percent increase last year.

found was 1.6 percent in Kansas City, which is part of the Unified Government of Wyandotte County; the county tax increase is 3.7 percent. The smallest increase among standalone local government is the City of Wichita (2.7 percent), followed closely by Sedgwick County and the City of Topeka at 2.8 percent. The City of Shawnee is considering a whopping 18.3 percent hike, and that’s on the heels of a 7 percent increase last year.

Cities and counties set property taxes this year for their 2017 budgets. The potential increases include new construction as well as increases on existing property and in each case, property taxes in the adjacent table have far outpaced the combined change in inflation and population since 1997. (Historical comparisons are available for all 105 counties and the 25 largest cities). The proposed increases were mostly gathered from published budget proposals, updated as necessary with revised July 1 valuations. Shawnee County doesn’t publish a proposed budget but we did find agency budget requests; more information on that issue is available here.

Next year, local government will need voter approval to raise property tax by more than inflation (with lots of exceptions, including one for new construction), and the threat (as government sees it) of taxpayer accountability may be used as justification for larger-than-necessary hikes this year. Johnson County, for example, rammed a 21 percent tax hike through last year and this year is proposing another 7.4 percent. County Manager Hannes Zacharias showed his disdain for citizen input in his Budget Message, saying “…it is bittersweet knowing that this is the last year under local control.” He added, “The property tax lid was designed to limit the ability of duly elected Board of County Commissioners to levy the amount of property tax they deem necessary to adequately fund significant portions of the County’s operations.”

Mr. Zacharias obviously believes that government knows best and local control is about local government rather than citizens, but the framers of the Kansas Constitution had a different viewpoint. And the voter empowerment law passed by the state legislature granting citizens the right to approve above-inflation was prompted by citizen outrage over local government’s persistent dishonesty about large tax increases and ignoring citizen sentiment. Case in point: Johnson County’s own 2015 citizen survey asked four questions about property tax increases and in each case, the majority did not support a tax increase. But at the county manager’s urging, a 21% tax increase was rammed through on a 4-3 vote.

Final decisions will be made in early August, so get engaged now if want to have a say this year.