A property tax lid passed last year will allow Kansans to begin voting later this year on whether, with many exceptions, city and county property taxes should increase by more than the rate of inflation. Citizens overwhelming support the right to vote but local government doesn’t want citizens meddling in their business. Cities and counties are asking legislators to strip citizens of their right to vote when they return in May, and some are threatening residents with service cuts if they don’t get their way.

The Spring 2017 Newsletter from Mission Hills Mayor Rick Boeschaar is a good example. The Mayor says, “…consistently staying under the property tax lid allowances can only be accomplished by deferring needed maintenance, reducing the services you have come to expect, or taking the City deeper in debt….”

We asked Mayer Boeschaar if his statement meant that the City could not possibly operate more efficiently and he said, “…of course I do not believe that Mission Hills…could not find operational efficiencies….” Residents must wonder why the Mayor didn’t include cost reductions in his ‘either/or’ ultimatum. He didn’t provide any examples of how costs could be reduced, but said they routinely bid services to maintain the lowest possible prices. City spending records, however, indicate that other cities are providing services at better prices.

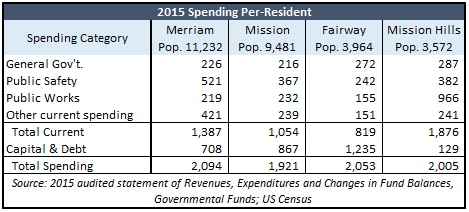

Compared to three other nearby cities in Johnson County, Mission Hills spends the most per-resident on General Government and Public Works; spending on Public Safety is also much greater similarly-sized Fairway – both of which are very safe places to live.

Compared to three other nearby cities in Johnson County, Mission Hills spends the most per-resident on General Government and Public Works; spending on Public Safety is also much greater similarly-sized Fairway – both of which are very safe places to live.

Fairway Keeps Costs Low

Asked how the City of Fairway is able to keep costs lower, City Administrator Nathan Nogelmeier gives most of the credit to his staff. He says staff is constantly looking for ways to be more efficient and carefully plans routine maintenance.

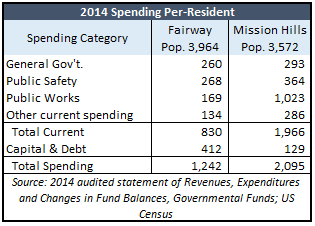

Nogelmeier also said their large capital outlay of $3.95 million in 2015 was an anomaly, and total spending per-resident is often lower. Their 2014 audit bears that out. Capital outlay was a little less than $1 million in 2014, so total spending per-resident was just $1,242; that was 41 percent less than similarly-sized Mission Hills.

Nogelmeier also said their large capital outlay of $3.95 million in 2015 was an anomaly, and total spending per-resident is often lower. Their 2014 audit bears that out. Capital outlay was a little less than $1 million in 2014, so total spending per-resident was just $1,242; that was 41 percent less than similarly-sized Mission Hills.

The 2016 audit is not complete but Nogelmeier said capital outlay was again about $1 million.

Strong Sense of Entitlement

Testimony from many city and county officials asking for citizens to be stripped of their right to vote demonstrated a strong sense of entitlement, and that also was made clear in Mayor Boeschaar’s newsletter: “Properties in Mission Hills appreciated by 5% in 2016, but the tax lid rules will not allow us to share in that appreciation.” We asked the Mayor if he believes government is entitled to a share of Kansans’ property. He said he doesn’t feel entitled to a share of appreciation, but “…appropriate increases in property taxes is a mutually agreeable way to pay for the increases in those costs.” ‘Appropriate’ is of course a subjective term and many citizens might disagree with characterizing their property tax increases in such manner.

The mayor didn’t explain what he means by ‘mutually agreeable’ but he may mean the guy in the mirror. After all, he opposes citizens having a right to ‘mutually agree’ via voting that their taxes should increase beyond inflation.

Technically, there isn’t a property tax lid; government is free to raise property taxes beyond the rate of inflation if citizens approve. A ‘lid’ would simply prevent taxes from increasing beyond a specific point with no possibility for override, and that may be what Kansans really need.

As explained here in greater detail, cities and counties have hiked property taxes far in excess of the combined rates of inflation and population. The state’s largest county – Johnson – increased property taxes by 210 percent since 1997 while inflation and population grew at a combined rate of 85 percent. The next largest county – Sedgwick – was much more conservative; property taxes increased 89 percent while inflation and population increased by 62 percent.

The ‘award’ for largest county property tax increase since 1997 goes to Osage County; the county increased its property tax by 382 percent with inflation at 44 percent and an 8 percent population decline.

Graphs of this nature for every Kansas county are in the County section of KansasOpenGov.org; additional reports of annual property tax charges and mill rates are also available in the Report drop-down section.

Five cities more than tripled property taxes since 1997 – Lawrence, Manhattan and three Johnson County cities of Olathe, Overland Park and Shawnee. Readers can find graphs, annual property tax charges and mill rates for the 25 largest cities in the City section of KansasOpenGov.org.

Hopefully, Legislators will reject the bully and extortion tactics of cities and counties regarding the property tax lid and support citizens’ right to vote when they return in May.