Yes, you read that headline correctly. The Kansas City Star published an editorial last week calling for the ‘pause’ button to be pressed on the battle over school funding. They said, “…it may be time for the state and the judges to pause for a year or two to see if the $488 million infusion, coupled with a new formula for disbursing the money, will work.”

The Star says it still believes “Years of underfunding and unfair income tax reductions have hurt a generation of students” but says “…legislators must consider school funding in the context of other state funding and the demand on taxpayers.” Whether tax reductions were ‘fair’ is a matter of personal opinion but it’s a fact that generations of students have been harmed for decades and billions more in funding hasn’t made a difference. And neither will the latest cash infusion because the Legislature refused to hold schools accountable for improving outcomes; the new formula just provides another big bag of money with no real strings attached.

The Star’s editorial board is under new leadership this year. Editorial Page Vice President Colleen Nelson pledged to bring more balance to the page and her efforts are gradually beginning to show, both with the thoughtful editorial on school funding and having more alternate views from guest columnists.

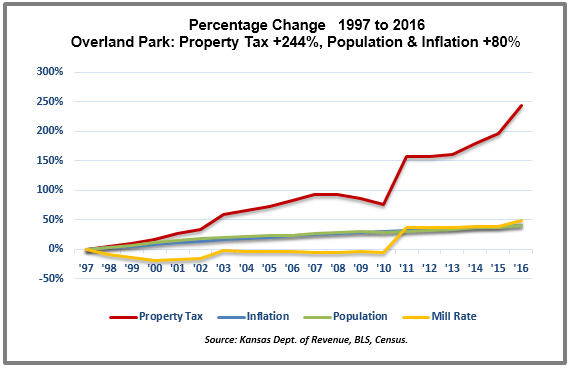

The Star also shared some good news last week on property taxes. The Overland Park City Council proposed a budget that will reduce the current property tax rate from 13.80 to 13.55 mills. A mill equals $1 dollar of tax for each $1,000 of taxable value and the proposed reduction would produce $3.7 million less in tax revenue than would be generated by the current rate. Council members reportedly said the rate cut won’t hurt services or the city’s bond rating but merely produces a slightly smaller reserve balance of $42.4 million. General Fund spending is still budgeted to increase by 6.4 percent next year and property tax is expected to rise by 7.3 percent.

Council member Paul Lyons, who asked for an even larger mill rate reduction, said “I’ve been on this council for 10 years and during that time we have increased the mill levy twice that I can remember and have not reduced it. I feel like now’s the time.” This fall will be citizens’ first opportunity to vote on whether property taxes should, with many exceptions, increase beyond the rate of inflation, and one must wonder how much this new citizen empowerment played into the decision to slightly limit the still-considerable increase most property owners will feel. City calculations show retaining the higher mill rate wouldn’t prompt an election but elected officials have to be sensitive to voter outrage over previous tax hikes that led to the new law, as well as city and county attempts to have voters’ right to vote rescinded by the 2017 Legislature (which fortunately failed.)

Kansas Department of Revenue records shows there were several small increases and decreases over the last ten years but there were two very large jumps; the mill rate spiked by 44 percent in 2011 and another 7 percent hike came in 2016. The following chart shows that City Council had plenty of opportunity give taxpayers breaks over the years, with property tax revenue leaping 244 percent since 1997 while inflation and population combined grew by just 80 percent.

Let’s keep the good news coming. Voters need all the relief they can get, especially after the Legislature stuck them with an unnecessary $3 billion income tax hike over five years.

Let’s keep the good news coming. Voters need all the relief they can get, especially after the Legislature stuck them with an unnecessary $3 billion income tax hike over five years.