A Hutchinson News report stating “Voters in Pretty Prairie soundly defeated a ballot question that would have authorized higher property taxes this fall to support the 2018 city budget” marks a significant victory for voter empowerment in Kansas. Legislation passed in 2016 allows citizens to begin voting this year on whether, with many exceptions, property taxes should be increased above inflation. The story says no counties triggered the voting requirement this year but two cities conducted mail ballots recently. Pretty Prairie voters rejected the proposal by a margin of 52-105 but Tescott voters approved a proposed increase by a 50-27 vote.

Both elections are important markers in voter empowerment because citizens are finally allowed a direct vote on runaway property tax increases and how their money is spent. According to the Hutchinson News story, the larger tax increase in Pretty Prairie would have generated money for street improvements and to boost cash reserves. Speaking of street spending, City Clerk Pattie Brace said, “They’ve been kind of scaling back in the last two or three years.” The story notes that the city golf course “…has proved a costly operation, affecting city expenditures…” which begs the question of whether residents believe a city-owned golf course is a proper use of taxpayer money.

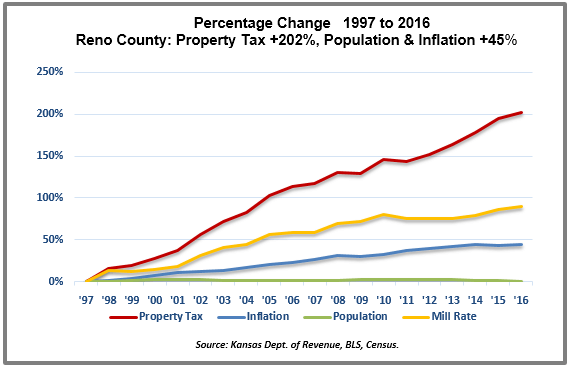

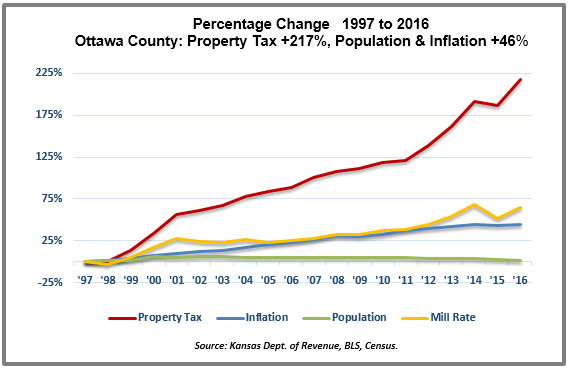

Tax history on the small cities of Pretty Prairie (680 residents in Reno County) and Tescott (318 residents in Ottawa County) are not readily available but those residents’ county taxes have certainly exploded over the years. Reno County residents have seen county taxes increase 202 percent between 1997 and 2016 while inflation and population combined was just 45 percent; county taxes in Ottawa County jumped 217 percent while inflation and population was a combined 46 percent increase.

The same history for all Kansas counties and the largest cities is available at KansasOpenGov.org.

The same history for all Kansas counties and the largest cities is available at KansasOpenGov.org.