The Kansas Association of School Boards falsely claims Kansas is in the top ten for student achievement, but Kansas does have some top ten rankings – and they’re in all the wrong categories. Newly released data from the U.S. Census Bureau for the 2016 school year shows:

- –Kansas has the 2nd highest growth rate in cash and securities since 2001 (284 percent)

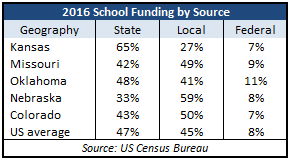

- –Kansas has the 6th highest share of total aid coming from the State (65 percent)

- –Kansas has the 7th highest per-pupil spending on Capital Outlay ($1,946)

- –Kansas has the 8th highest debt per-pupil ($11,238)

The current debt ranking could be even higher, since Kansas schools set a new record of $6.1 billion in bonded indebtedness last year. The cash and security totals in the Census data includes an unknown amount of construction funds for each state. The Kansas Department of Education doesn’t require school districts to report construction funds on hand but it could be nearly $800 million; Census data shows Kansas schools had $2.7 billion in cash and securities but the state-reported total for 2016 was $1.9 billion. Construction funds would be proceeds from the sale of bonds that haven’t been spent on construction projects.

Long before legislators added about $1 billion to school funding, school districts already received 65 percent of their funding from the State, while the national average was just 47 percent. The difference is made up in Local funding, where the national average is 45 percent, but local property taxes only cover 27 percent of the tab in Kansas.

Long before legislators added about $1 billion to school funding, school districts already received 65 percent of their funding from the State, while the national average was just 47 percent. The difference is made up in Local funding, where the national average is 45 percent, but local property taxes only cover 27 percent of the tab in Kansas.

Education officials prefer the higher State allocation because local property tax increases would prompt citizens to scrutinize school spending practices. (Legislators tend to look the other way because that’s the expedient way to get re-elected.)

Calculations from Kansas Legislative Research Department show a $3.7 billion revenue shortfall over the next four years. That’s what it would take to pay for approved and proposed school funding without taking money from the highway fund, making timely payments to the pension system and complying with state law on ending balances.

Whoever wins in November will have some critical decisions to make.

Do they pay for the massive school funding increase with another big state tax hike or raise local property taxes? Do they cut a lot of waste and (finally) tell the court to mind its own business and reject school funding increases? What about highway transfers and pension payment delays?

Legislators created a serious math problem trying to appease courts and the education lobby. Now they should be honest and tell citizens how then intend to resolve it.