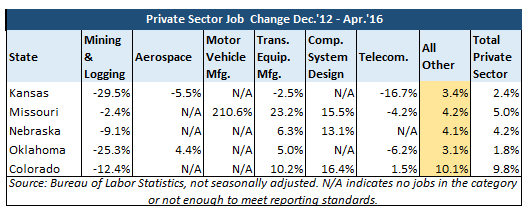

Opponents of tax reform in Kansas are quick to use simplistic monthly averages of newly-released Bureau of Labor Statistics (BLS) jobs numbers to argue that tax reform hasn’t worked for the Sunflower State. This approach is fundamentally flawed because it fails to account for one elementary but all-important fact: links between jobs changes and tax policy should obviously factor out jobs changes that are unrelated to tax policy.

As we have shown on numerous occasions, certain industry segments in Kansas and other states are disproportionately affected by global and national developments as well as product demand fluctuations that have little or nothing to do with Kansas’ tax policy decisions. And while these disproportionate effects collectively comprise a relatively small portion of the job market (no more than 7.6 percent in Kansas and neighboring states), they can mask what is really happening in the rest of the economy. In this analysis, the balance of jobs in Kansas and Oklahoma are a full percentage point better than the state average.

It must be noted that industry data is only available on a seasonally unadjusted basis, so state comparisons of different points in time (in this case, December and April) can be impacted by relative variances in seasonality.

It must be noted that industry data is only available on a seasonally unadjusted basis, so state comparisons of different points in time (in this case, December and April) can be impacted by relative variances in seasonality.

All regional states have jobs in the mining & logging industry (which includes oil and gas extraction) but Kansas and Oklahoma are much more oil and gas dependent. The industry is one of the most highly sensitive to global supply and pricing fluctuations that have little to do with particular policy choices made in Kansas or elsewhere in the region.

The aerospace industry is also a highly global one, but it only exists or is only large enough per BLS minimum reporting requirements to influence jobs numbers in Kansas and Oklahoma and no other states in the region.

Transportation equipment manufacturing is a large enough industry to influence jobs numbers for all states in the region. However, job growth within this industry can be tied to demand for a specific product that may be heavily produced in one or more regional states but not others.

With the exception of Missouri, motor vehicle manufacturing jobs either don’t exist or aren’t sufficient to meet minimum reporting standards. Increased demand for products that happen to be made in Missouri jumped almost 211% but are unrelated to state tax policy. Similarly, the computer systems design industry is either non-existent or too small in Kansas and Oklahoma to register on BLS reports. Yet, significant industry job growth in Colorado, Nebraska, and Missouri gives overall jobs numbers in these states a favorable bounce.

Finally, Kansas City Metro Area residents may have heard about large job losses in the telecommunications industry via the Sprint Corporation headquartered in Overland Park, Kansas. However, these losses had nothing to do with tax policy in Kansas; they were triggered by outside, industry-level changes that were not unique to Kansas.