Between late July and early August, Kansas residents have the best chance this year to let their voices be heard on their property taxes. Mailings are going out about local revenue-neutral rate hearings to be held between August 20th and September 20th this year. Understanding the revenue-neutral rates and attending hearings is key to keeping officials accountable and taxes low.

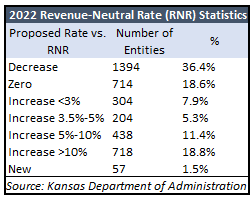

Truth-in-Taxation has already been a great success because of the public hearings. Of the 3,829 taxing authorities reporting no increases or changes in their revenue-neutral rates listed taxing authorities, 55% of them didn’t exceed their revenue-neutral rate in 2022; they held taxes flat rather than face questions from the public. Another 13% had less than a 5% increase, and 30% increased taxes by more than 5%.

Leavenworth USD 453 was considering an 8.6% tax hike, but instead voted to maintain the district’s revenue-neutral rate after testimony from constituents about their struggles with high prices.

Baldwin City USD 348 intended to raise property taxes by 18%, but the school board didn’t take the proper vote. A taxpayer who attended the hearing filed suit with the Board of Tax Appeals and with assistance from Kansas Justice Institute, BOTA ruled that the district could not increase property tax. That’s another good reason to attend revenue-neutral hearings.

How the process works

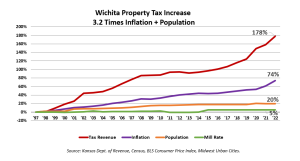

Understanding the revenue-neutral rate means understanding why the Truth-in-Taxation law that created it was enacted. Local property taxes are calculated based the assessed value of the property and the mill rate enacted by a taxing authority, which can be anything from a city, county, or school district to a fire or water district. For decades, authorities across the state had honesty problems with taxpayers: they would say they weren’t increasing the mill rate, yet taxes kept increasing annually. At Wichita’s revenue-neutral rate hearing last year, Mayor Brandon Whipple had this same rhetoric and said “for 28 years, we have held the line on our percentage of mill levy.”

But that’s not the full story. If appraisals go up and the mill rate isn’t changed, then the taxes that people pay are going to increase. Between 1997 and 2022, the total property tax collected in Wichita increased by 177.8% while the mill rate increased by 5.4%. At this same time, population only grew by 20% and inflation by 74%. So while the mill rate didn’t increase by much, the taxes that people are paying have vastly outpaced the growth of the city. The honesty gap – that is, the difference between the growth in the mill rate that officials would praise versus the growth in the actual tax collections – is 172.4%. The same information on other cities and every county can be found on KansasOpenGov.org.

The revenue-neutral rate is a mill rate that would keep the dollar revenue a taxing authority collects the same as it was in the previous. For instance, let’s say that a city has a mill rate of 20.0 and collected $2 million in property tax revenue for 2022. If the assessed value of property in the city increased between 2022 and 2023, then the revenue-neutral rate would be something below 20.0 – say, 19.0, so that the city still generates $2 million. If the city stayed at a mill rate of 20.0, with the increased assessments, then it would collect more than $2 million. With this revenue-neutral rate calculated, the city has two options: it can either choose to have a mill rate equal to the revenue neutral-rate, which means a hearing is optional, or it can propose a rate that is higher than the revenue-neutral rate, which means it must host a hearing and then having a public vote to approve the proposed rate.

This is especially relevant seeing as how valuation spikes caused big tax increases across the state in 2022. The statewide average property tax increase is 6.4%. Real estate tax collections increased by 6% and the tax on other types of property jumped 8.6%. The tax on mineral leaseholds spiked by 98% and motor vehicles taxes jumped 46%.

KPI will be posting information about revenue-neutral rate hearings to kansasopengov.org, but taxpayers should keep an eye out for their notice in the mail.