The Truth in Taxation revenue-neutral law continues to save taxpayers money in some counties, but elected officials elsewhere took advantage of valuation spikes to impose large property tax increases last year.

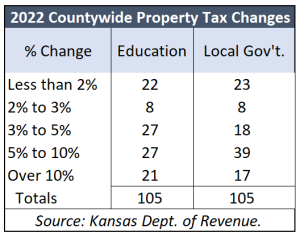

Actions taken last year by education entities (local school boards, community colleges, etc.) for 2023 budgets resulted in increases below 3% in 30 counties; elected officials in 27 counties imposed property tax increases between 3% and 5%. But elected officials in 21 counties imposed more than a 10% tax hike. Elected officials in all other local government entities (cities, counties, townships, etc.) took similar action, with increases below 3% in 31 counties. Eighteen counties have increases between 3% and 5%, but elected officials in 54 counties hiked taxes by more than 5%.

Actions taken last year by education entities (local school boards, community colleges, etc.) for 2023 budgets resulted in increases below 3% in 30 counties; elected officials in 27 counties imposed property tax increases between 3% and 5%. But elected officials in 21 counties imposed more than a 10% tax hike. Elected officials in all other local government entities (cities, counties, townships, etc.) took similar action, with increases below 3% in 31 counties. Eighteen counties have increases between 3% and 5%, but elected officials in 54 counties hiked taxes by more than 5%.

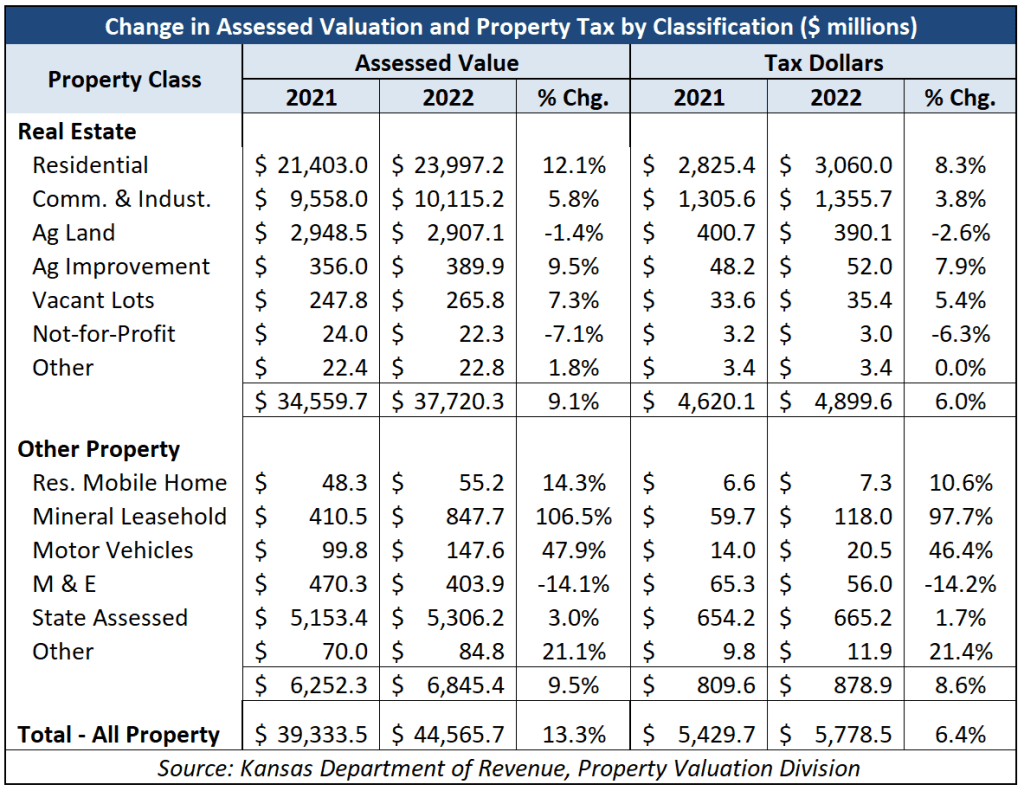

The statewide average property tax increase is 6.4%. Real estate tax increased by 6% and the tax on other types of property jumped 8.6%. The tax on mineral leaseholds spiked by 98% and motor vehicles taxes jumped 46%.

Homeowners bore the brunt of the real estate tax increase because county appraisers increased assessed valuations by 12% and elected officials in many counties used that to raise taxes.

The percentage change in property tax for local government, education, state, and overall for each county in 2022 is here on KansasOpenGov.org. The percentage change by county since 1997 is here.

Constitutional change needed to limit valuation and tax increases

The Truth in Taxation revenue-neutral law is encouraging a lot of elected officials to not increase property tax. In 2021, 52% of all taxing authorities did not exceed the revenue neutral rate and increase taxes, and 57% in the 101 counties reporting last year’s actions did not raise taxes. (Each county clerk is required to send a summary to the state for publication by the end of the year, but Phillips and Rooks counties have not done so as of today. Gove and Osage counties filed incomplete reports.)

Unfortunately, many elected officials ignore public pleas to not raise taxes and they will likely do it again this year with record-high valuation changes on residential property.

Unfortunately, many elected officials ignore public pleas to not raise taxes and they will likely do it again this year with record-high valuation changes on residential property.

Homeowners in many urban and rural counties just received notice of double-digit increases. The average increase on existing homes (not counting new construction) in Anderson County was 27.8%. Other counties with increases above 20% on existing homes are Linn, Osborne, Russell, and Scott. Urban counties with double-digit hikes include Douglas (15%), Johnson (11.5%), Shawnee (13%), and Wyandotte (17%). The average increase in Sedgwick County was ‘only’ 7.8%, but that is still a hardship on many residents.

Kansans need relief from these exorbitant valuation spikes, and that requires a change to the state constitution. And to stop local officials from making up for it with mill rate increases, there should also be a limit on the dollar amount of tax increase on each property.