As states across America sharpen their competitive edges with tax cuts and simpler tax codes, Kansas has a unique opportunity to foster prosperity and economic resilience. The tax reform bill with about $635 million in personal income tax relief in the first year awaits Governor Laura Kelly’s signature. While this bill is not as good as the one with a flat 5.25% tax rate passed earlier this year but vetoed by Governor Kelly, the latest bill would help better align the state with successful tax reforms nationwide that have spurred growth and investment. Governor Kelly would be wise to sign it or risk losing the opportunity for people to flourish across the state. But her recent equivocations do not suggest she’s likely to side with Kansas families.

The Urgency of Tax Reform

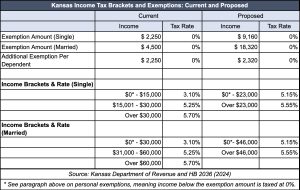

Earlier this month, HB 2036 overwhelmingly passed the House and Senate. The bill seeks to overhaul the state’s current tax structure by simplifying the brackets and reducing financial burdens on Kansans. The essence of the reform is to streamline the number of tax brackets from three to two, simplifying the tax filing process and reducing administrative costs. This reform is not just a fiscal adjustment; it’s a strategic move toward making Kansas more competitive and prosperous.

The proposed changes in tax brackets will make the tax system easier to navigate and less burdensome. But the legislation doesn’t stop at restructuring brackets; it also includes several key features designed to benefit Kansas residents directly:

- Increased Personal Exemptions: The bill raises the personal exemption significantly—from $2,250 to $9,160 for single filers and $4,500 to $18,320 for married filers–thereby taxing the first dollars earned up these amounts at 0%.

- Social Security Income Tax Elimination: It removes the state tax on Social Security benefits, offering relief to retirees.

- Property and Sales Tax Reductions: The reform slightly lowers the school property tax rate–while keeping K12 spending at the same levels–and speeds up the removal of the sales tax on food.

This restructuring will leave more money in Kansans’ pockets, fostering increased consumer spending and investment that will help support sustained increases in economic growth and new hires.

National Trends in Tax Reform

Kansas is not alone in its move toward income tax simplification and reduction. In 2024, fourteen other states thus far, had income tax cuts, enhancing their economic landscapes and making them more attractive for business investments and skilled workers. Here’s a map highlighting the states that have implemented income tax cuts this year:

This national movement underscores the importance of Kansas keeping pace with these trends. Failing to do so could deter potential investment and encourage businesses and talent to move to more tax-friendly states. This is especially true given how neighboring states are cutting taxes.

The Vision of Fiscal Responsibility and Economic Freedom

In an unpredictable economy, Kansas can improve the fiscal landscape through tax reform and sustainable budgeting. Adhering to a “Responsible Kansas Budget,” which changes the budget every year by no more than the rate of population growth plus inflation, and using resulting surpluses to reduce income tax rates annually would help flatten and eventually eliminate these taxes. This strategic approach promises a robust economic future, minimizing the need for burdensome taxation.

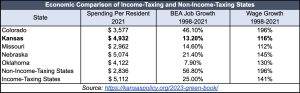

Economic Context: Kansas vs. Other States

The contrast in economic performance is stark when comparing Kansas with nearby states and those with and without income taxes. Here’s a snapshot of economic performance among these states.

This data proves that those states without income taxes perform better economically regarding job growth and wage growth, two key ingredients for reducing poverty and encouraging prosperity. Moreover, those states without personal income taxes have substantially less government spending, which helps reduce the burden of government on residents. Kansas will substantially improve its current trajectory by following the path of those states that are flattening, lowering, and eliminating personal income taxes.

Not Perfect, But Good Step Forward

It’s time for sustainable tax reform after the issues during the last decade of overspending, which resulted in higher taxes later. The Legislature’s passed tax reform is crucial for Kansas to provide the following:

- Economic Competitiveness: Lower and simpler tax rates attract businesses and skilled labor. These benefits will support more economic activity, drive faster economic growth, and give more reasons for people and businesses to move to the state.

- Prosperity for Residents: More disposable income for Kansans means higher consumer spending and savings and more opportunities for businesses to invest and hire more workers. This will contribute to more economic growth over time.

- Fiscal Health: Simplified taxes with much-needed sustainable budgeting promise long-term fiscal stability without jeopardizing limited government provisions. This will help avoid the fiscal issues during the last decade and set the state up for success.

The proposed tax relief of more than $600 million is needed in Kansas today. A recent economic analysis by the Economic Research Center at the Buckeye Institute of a $500 million income tax relief package. Their findings show that Kansas could have a $430 million (2012 dollars) increase in GDP, $240 million more in business investment, $200 million more in consumption, and 1,000 more jobs in the first year and more growth after that.

Gov. Kelly and the legislature should learn the key lesson from the Brownback years – you cannot cut taxes and increase spending. The plan on Gov. Kelly’s desk is eminently affordable if all parties involved learn from this lesson and have the discipline to act on it.

Governor Kelly’s signature would mark a significant step forward, positioning Kansas among the leading states with proactive fiscal policies that spur growth and enhance quality of life. This tax reform and responsible spending will help ensure that Kansas does not fall behind its peers but moves forward as a leader in economic health and resident well-being. It would also set the stage for a flat income tax and eventually eliminate it by returning surplus dollars to taxpayers where it is most productive.