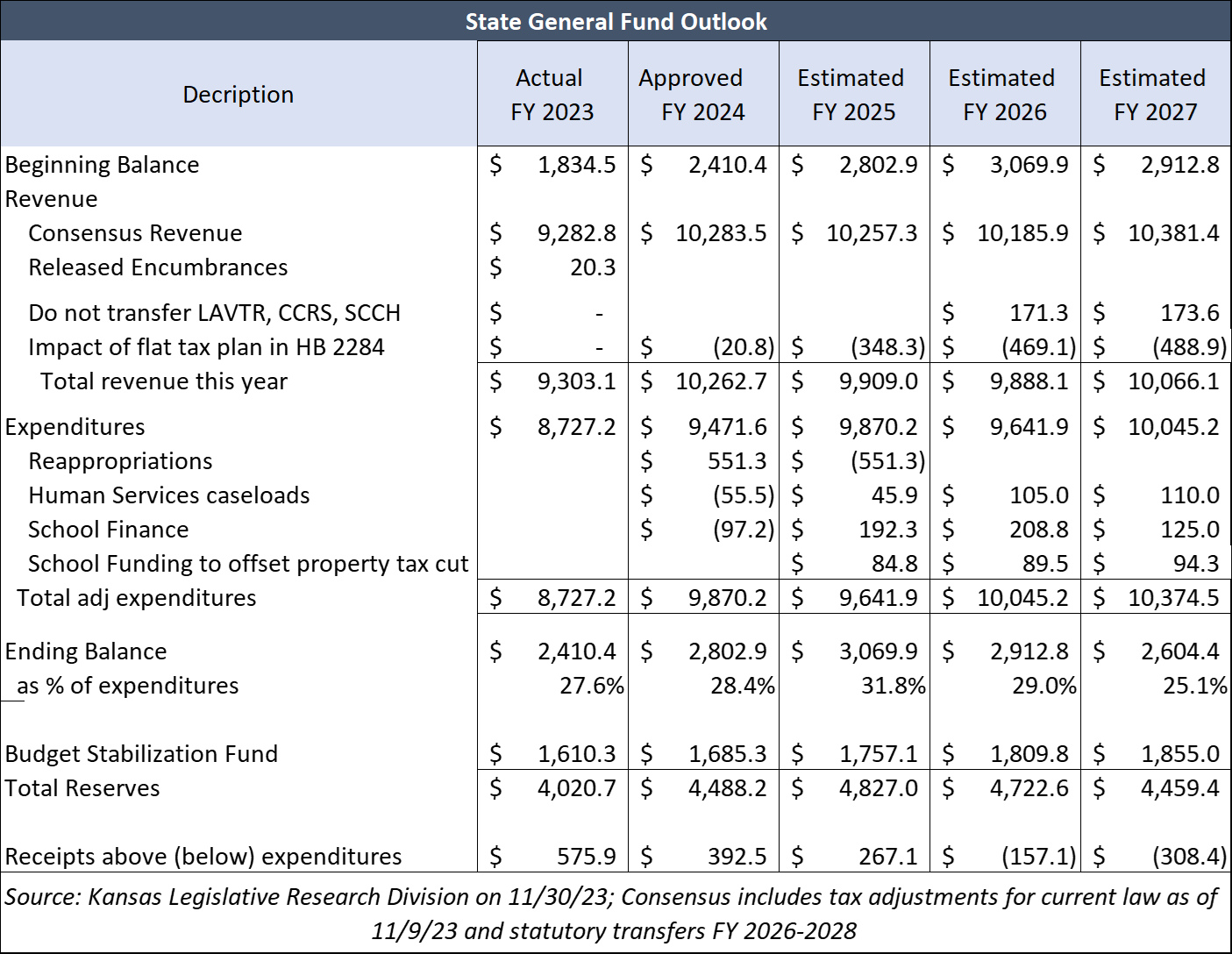

If the flat tax bill passed by the Legislature becomes law, the state will still have $4.5 billion in reserves after three years. That is after spending over $1 billion more on school funding, human service caseloads, and property tax relief.

The flat tax legislation will not take Kansas back to the Brownback deficits, crumbling roads, or any other outrageous claims from Governor Kelly. She knows she is misstating the truth because these numbers and everything in the table below come from the Kansas Legislative Research Department.

Governor Kelly and her supporters must think Kansans can’t do simple math. She proposed a $1 billion tax cut over three years with more than $4 billion in the bank. The three-year price tag on the flat tax is $1.6 billion, according to KLRD. She wants us to believe that $600 million more in tax relief wipes out a $4 billion surplus.

Even if the Legislature approves other spending increases, the state will still have billions in cash reserves. And it’s not as though the Legislature has been skimping on spending in recent years and needs to play catch-up.

General Fund spending was $6.3 billion in FY 2017, which was an all-time high. Last year, spending was $8.7 billion, and the approved budget this year is $9.9 billion. The chart below shows that spending has been growing much faster than inflation.

This is nothing like the Brownback days. When the 2012 tax cut legislation was signed, KLRD projected deficits within two years unless spending was reduced. Everyone knew that, but most legislators and Governor Brownback wouldn’t take action.

Low-income families are better off with the flat tax

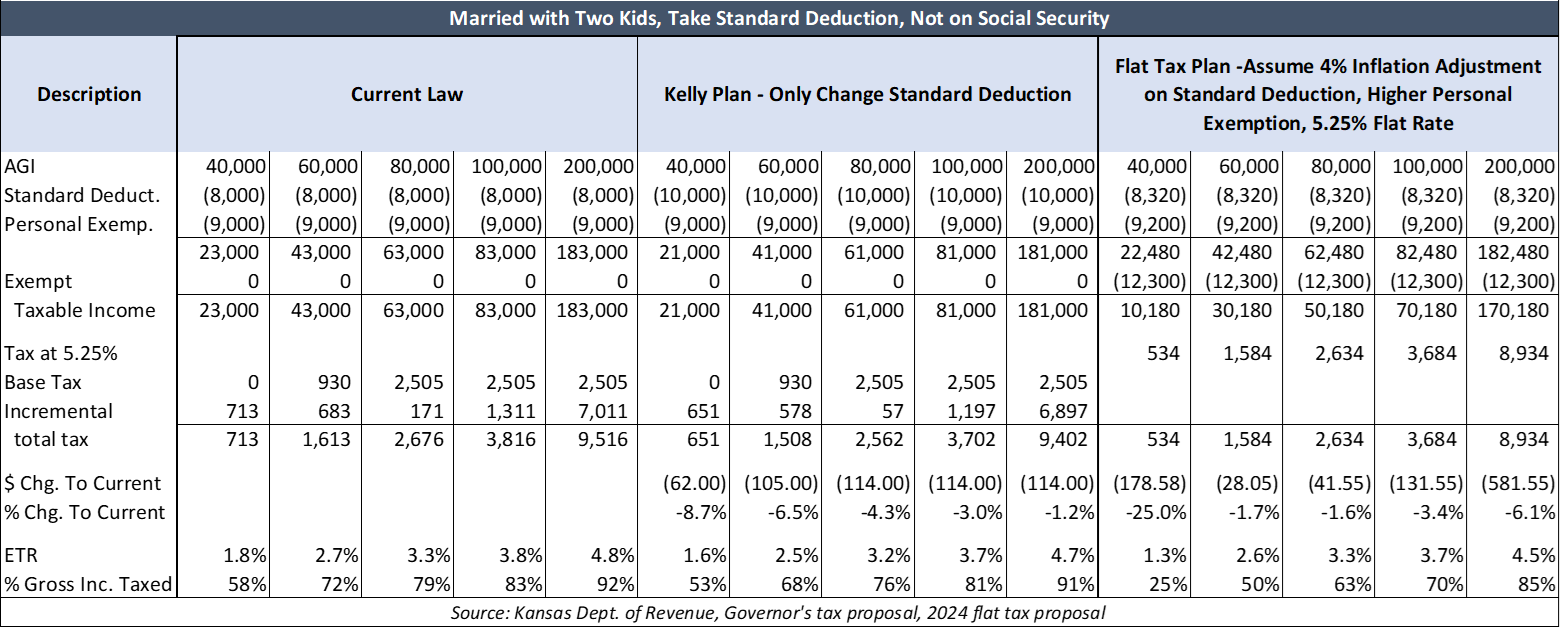

Low-income families fare much better under the flat tax approved by the Legislature this week than under Governor Kelly’s plan.

The table below models a married couple with two kids taking the standard deduction and not on Social Security at several income levels. Under current law, a couple with an adjusted gross income (AGI) of $40,000 has a taxable income of $23,000 and pays $713 in income taxes. Kelly’s proposal with the standard deduction would save this couple $62, but that family saves $179 with the flat tax proposal, however.

The biggest difference comes from exempting the first $12,300 from taxation. That change also means a family of four with AGI of $29,820 would pay no tax, but they would pay $335 under Kelly’s plan.

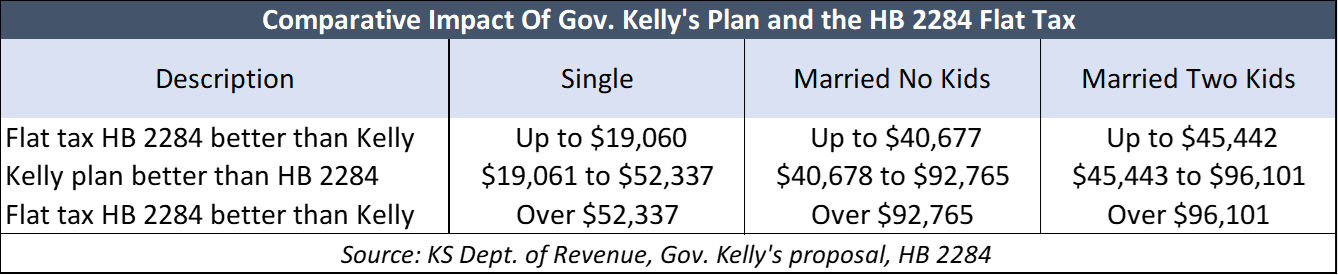

Most people fare better with the flat tax plan compared to Gov. Kelly’s proposal.

Single taxpayers who take the standard deduction, are not on Social Security, and with adjusted gross income up to $19,060 and over $52,337 are better off with the flat tax. On the same basis, a couple with no children and adjusted gross income up to $40,677 and over $92,765 are better off with the flat tax; a couple with two children and adjusted gross income up to $45,442 and over $96,101 are also better off.

Everyone gets a tax cut with the flat tax, contrary to what Senate Majority Leader Dinah Sykes said in an email to constituents last week. She writes, “Unlike the Republican flat tax scheme, Governor Kelly’s bipartisan tax package will cut taxes for ALL Kansans – not just the super wealthy.”

The plan that Gov. Kelly and Senator Sykes want does not reduce rates; they want to keep the high rate of 5.7% on taxable income over $60,000 (like a teacher and a firefighter, whose combined income is likely north of $100,000 and have most of their income taxed at 5.7%.

Like Gov. Kelly, Sen. Sykes knows she isn’t being honest, but that doesn’t stop the fearmongering.

Kansas is more competitive with a 5.25% flat tax

According to the Tax Foundation, fourteen states have individual income tax rate reductions taking effect in 2024: Arkansas, Connecticut, Georgia, Indiana, Iowa, Kentucky, Mississippi, Missouri, Montana, Nebraska, New Hampshire (interest and dividends income only), North Carolina, Ohio, and South Carolina. Two states—Ohio and Montana—will consolidate some tax brackets, and one state, Georgia, will move to a flat tax.

States with lower income taxes have superior economic growth, and that is desperately needed in Kansas. Private-sector job growth in Kansas was ranked #44 between 1998 and 2022. Last year, jobs grew by just 0.6% through November, which is only one-third of the national average.

A veto rejects income, property tax, and sales tax relief

If Kelly follows through with her veto threat, she will be saying ‘no’ to significant tax relief, and not just the money related to the flat tax proposal:

- Property tax – raising the exemption from the 20 mills of property tax for schools from $40,000 to $100,000.

- Social Security income tax – all Social Security income would be exempt from income tax

- Sales tax on food – the flat tax bill eliminates the state sales tax on food on April 1, 2024 rather than January 1, 2025.

Gov. Kelly’s plan adopts a few good items that were originally proposed by the Legislature, but Kansas also needs to reduce the high tax rate to grow the economy.

Having higher rates on teachers, firefighters, and other families with incomes above $60,000 is Governor Kelly’s political philosophy, and she should just be honest about that being the reason she opposes a flat tax.

Kansans need the relief in the flat tax bill, and the state can easily afford it. The economy will fare better with the flat tax, those who earn the least are considerably better off than with Kelly’s plan, and everyone gets an income tax cut.

Governor Kelly could at least be honest and say she is willing to deny more tax relief to the lowest earners so she can make families that earn more than $60,000 pay a higher tax rate.